The Daily Breakdown digs into a busy week on tap, loaded with earnings reports from the Magnificent 7, and key economic reports like the GDP.

Monday’s TLDR

- Inflation, jobs and GDP in focus

- A big week of earnings

- BTC searches for more gains

What’s Happening?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

This week is full of big events. Today’s earnings include Domino’s Pizza, MGM Resorts, and Waste Management, among others. But the big events start tomorrow.

On Tuesday at 10 a.m. ET, we’ll get the JOLTS reports (the monthly job openings report) and the consumer confidence report. The latter will provide the latest “vibe check” on the consumer.

We’ll also get earnings from Visa, PayPal, SoFi, UPS, Starbucks, Snap, Coca-Cola, First Solar, and JetBlue, among others.

On Wednesday, we’ll get the initial Q1 GDP report at 8:30 a.m. ET, followed by the all-important PCE inflation report at 10 a.m. ET. Bulls want to see lower inflation to shake the worries that we’re heading for a “low growth, elevated inflation” situation — AKA stagflation.

After the close, we’ll get earnings from Microsoft, Meta, Robinhood, and Qualcomm.

On Thursday, McDonald’s, Eli Lilly and MasterCard will report before the open, then after the close, Amazon, Apple, Airbnb, Reddit and Riot Platforms will report earnings.

Friday’s earnings schedule include energy giants Exxon Mobil and Chevron. We’ll also get the monthly jobs report on Friday morning, which will give us the latest unemployment rate and show how many jobs were added to the economy (right now, economists estimate that 129K jobs were added last month).

Want to receive these insights straight to your inbox?

The Setup — Snowflake

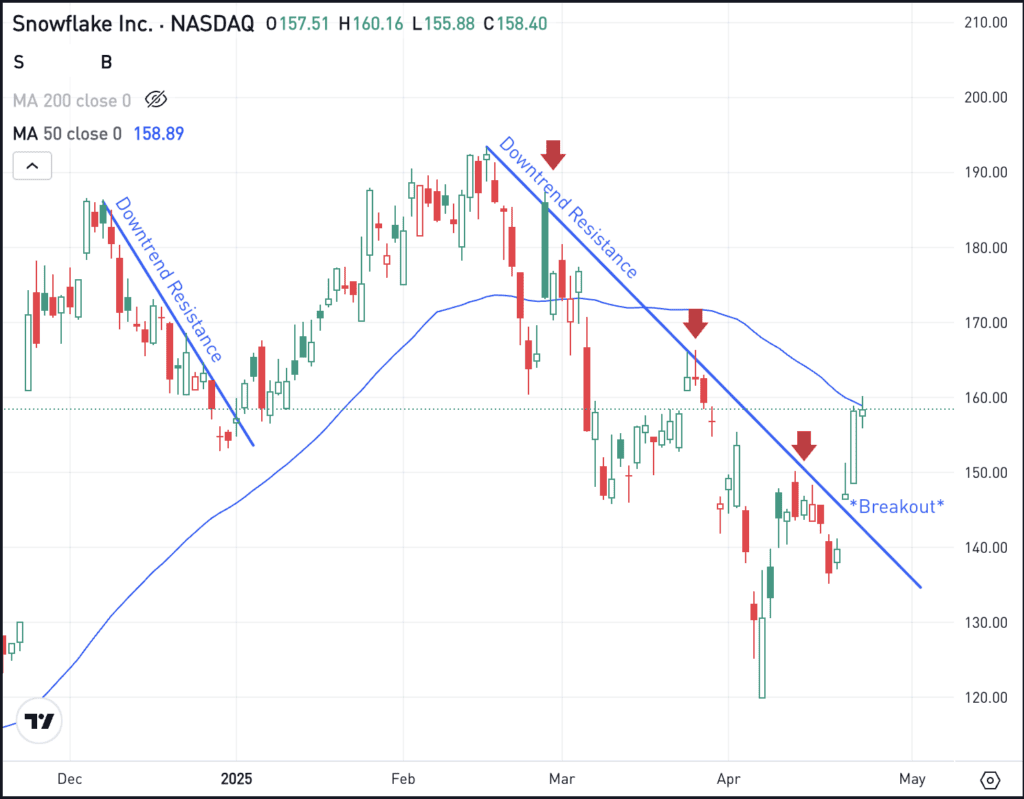

Following the strong earnings results from ServiceNow last week, bulls are feeling optimistic about enterprise tech stocks. Snowflake had been showing momentum in its business, with shares rallying after its last two earnings reports. However, it has struggled over the last few months, with SNOW down almost 18% from its mid-February highs.

While the company won’t report earnings for a few more weeks, technical investors are taking a closer look at the charts.

SNOW stock recently broke out over downtrend resistance, charging higher by more than 10% last week. However, it’s running into the 50-day moving average, which could act as potential resistance.

If shares can hold up over the $135 to $140 area, bulls could stay in control, and if shares can clear $160, Snowflake could gain even more bullish momentum. However, if shares do break back below $135, then more selling pressure could ensue.

Options

For some investors, options could be one alternative to speculate on SNOW. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and SNOW rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

BTC – Bitcoin did well last week, climbing just over 10%. It was BTC’s third straight weekly gain, which has seemingly helped lead the charge higher for “risk-on” assets. Now trading in the mid-$90K range, bulls are hoping Bitcoin can stay above recent resistance levels and make a run toward $100K.

TMUS – T-Mobile tumbled more than 11% on Friday, falling hard despite reporting a top- and bottom-line earnings beat. The company even raised its core EBITDA outlook for the year. However, postpaid phone additions missed analysts’ expectations, weighing on the stock. Shares are now approaching the 200-day moving average. Check out the chart for TMUS.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.