The Daily Breakdown takes a look at the big rally on Wall Street and the recent breakout in Bitcoin. Can BTC continue to run?

Wednesday’s TLDR

- Stocks set for more gains

- Tesla jumps on earnings

- Bitcoin clears key technical area

What’s Happening?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

I was going to use this section to talk about Tesla’s earnings reaction. But with the S&P 500, Nasdaq 100 and other key indices boasting powerful gains yesterday and this morning, the narrative must be expanded (we’ll touch on Tesla’s earnings in the lower section).

The SPY and QQQ ETFs closed higher by 2.6% yesterday. This morning, they’re up another 2.2% and 2.7% in pre-market trading, respectively.

What a difference a day can make — and that saying is particularly true on Wall Street. On Monday, stocks had a wipe out. A day later, those gains were erased and now we’re looking at another potentially strong day in the markets.

Tuesday’s rally was kickstarted by comments made by Treasury Secretary Scott Bessent in a closed-door investor summit that the trade path with China is unsustainable and will have to de-escalate. Separately, President Trump made constructive comments toward a deal with China, and despite prior comments suggesting otherwise, said he didn’t want to fire Fed Chair Powell.

Put them all together and it’s not hard to see why stocks are popping this morning. The question is, can this rally sustain itself? For the SPY, I am still keeping a close eye on the 21-day moving average and the $545 to $550 zone. Here’s why.

Want to receive these insights straight to your inbox?

The Setup — Bitcoin

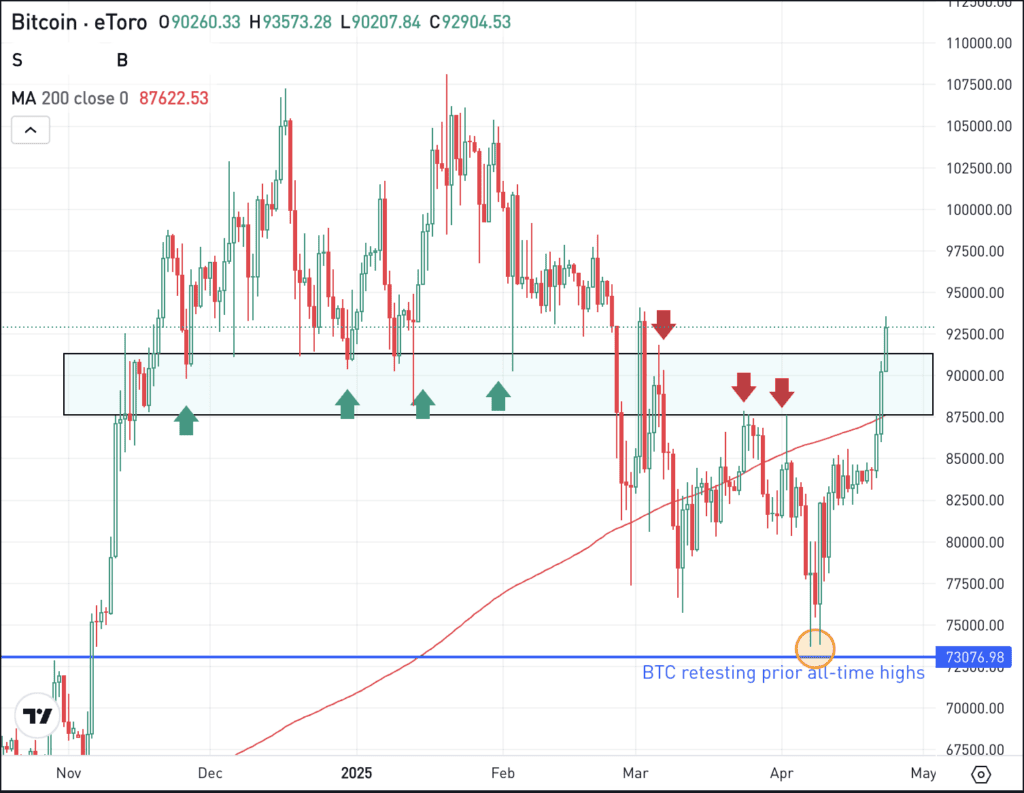

Bitcoin has been impressive lately, as it now sports a 10% gain for the week and has been ahead of the recent rally in stocks. Bitcoin hasn’t been immune to the pullback this year, but it’s been decoupling from its correlation to tech stocks, which is exactly what investors want to see.

The recent rally has been enough to thrust Bitcoin above some key levels, including the 200-day moving average, as well as a major support/resistance zone (blue box):

From here, it’s pretty simple. Bulls want to see BTC hold up within or above these major areas. If it can do, more upside momentum can continue. However, if BTC breaks below these levels, the selling pressure could re-accelerate.

The rally in BTC has given life to other cryptocurrencies as well, including Ethereum and Bitcoin Cash. It’s also given a lift to the IBIT ETF — which investors can trade options on — as well as crypto-related stocks like MicroStrategy, MARA Holdings, and Riot Platforms, among others.

What Wall Street is Watching

TSLA – Tesla shares are up about 7% in pre-market trading despite the company badly missing earnings and revenue expectations. Revenue of $19.3 billion missed estimates of $21.4 billion, while earnings of 27 cents a share missed expectations of 43 cents a share. Both figures were down year over year as well.

However, Musk said he would be committing more time back to Tesla, which is something investors badly wanted to hear. Further, he spoke promisingly about future technologies and products. This is a great reminder to investors that it’s the reaction to the news that often matters more than the news itself. Check out the chart for TSLA.

T – Shares of AT&T are rising in pre-market trading after the firm delivered a top- and bottom-line earnings beat. Further, the company reported better-than-expected postpaid net phone subscribers. T stock still pays a 4.1% dividend yield.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.