Investing in real estate has long been a popular way for Australians to build their portfolio and get exposure to a potentially lucrative asset class. But with soaring property prices and other financial barriers to entry, many investors are looking at alternative ways to get their foot onto the property ladder.

To better appreciate the current landscape, let us explore four alternative approaches to investing in real estate in Australia. Whether you are a first-time investor or simply looking to diversify your portfolio, these alternatives allow you to participate in the property market without needing the large outlay of traditional real estate ownership.

What has happened in Australia’s property market in recent years?

In most parts of the country, Australia’s property market has seen a price uptick in recent years. Several factors have contributed to the challenges facing aspiring property investors, such as:

- Record property prices: Property prices in most major Australian cities, especially Sydney and Melbourne, have reached – and continue to exceed – record highs. This has made it increasingly difficult for many Australians, especially young buyers, to enter the market.

- Cost of living: Rising living expenses, including higher energy costs and the general increase in the cost of living – especially in the face of stagnant wage rises – have put additional pressure on people’s finances, making it near-impossible for many to save for a property.

- Increasing interest rates: After months of back-to-back interest rate hikes, the Reserve Bank of Australia’s attempts to control inflation have resulted in stricter borrowing conditions for everyday Australians.

Why are people looking for alternatives to investing in real estate?

In light of these challenges, it is no wonder investors are actively seeking alternatives to conventional real estate ownership. But there are other reasons why investors are turning away from traditional strategies.

For experienced investors who recognise the importance of portfolio diversification, it’s clear that placing all their capital into real estate will leave them vulnerable to market fluctuations. Diversification helps distribute risk and shields them from over-reliance on a single asset class.

Property investments also demand substantial upfront capital and are inherently less liquid than other asset classes. This lack of liquidity can deter investors who prefer assets they can convert to cash faster – such as shares – whenever opportunities arise.

Then, there is the simple allure of alternative investments and their lower barriers to entry. These options are typically more accessible to a broader pool of investors, allowing for more widespread market participation.

What are some different ways to invest in real estate?

1. Invest in real estate ETFs

Real estate exchange-traded funds (ETFs) are investment funds that track the performance of real estate indices.

Pros:

- Diversification across multiple real estate assets.

- Liquidity, as ETFs are traded on stock exchanges.

- Lower minimum investment compared to buying physical properties outright.

Cons:

- There are management fees associated with ETFs.

- Dividends may be inconsistent based on the ETF’s performance.

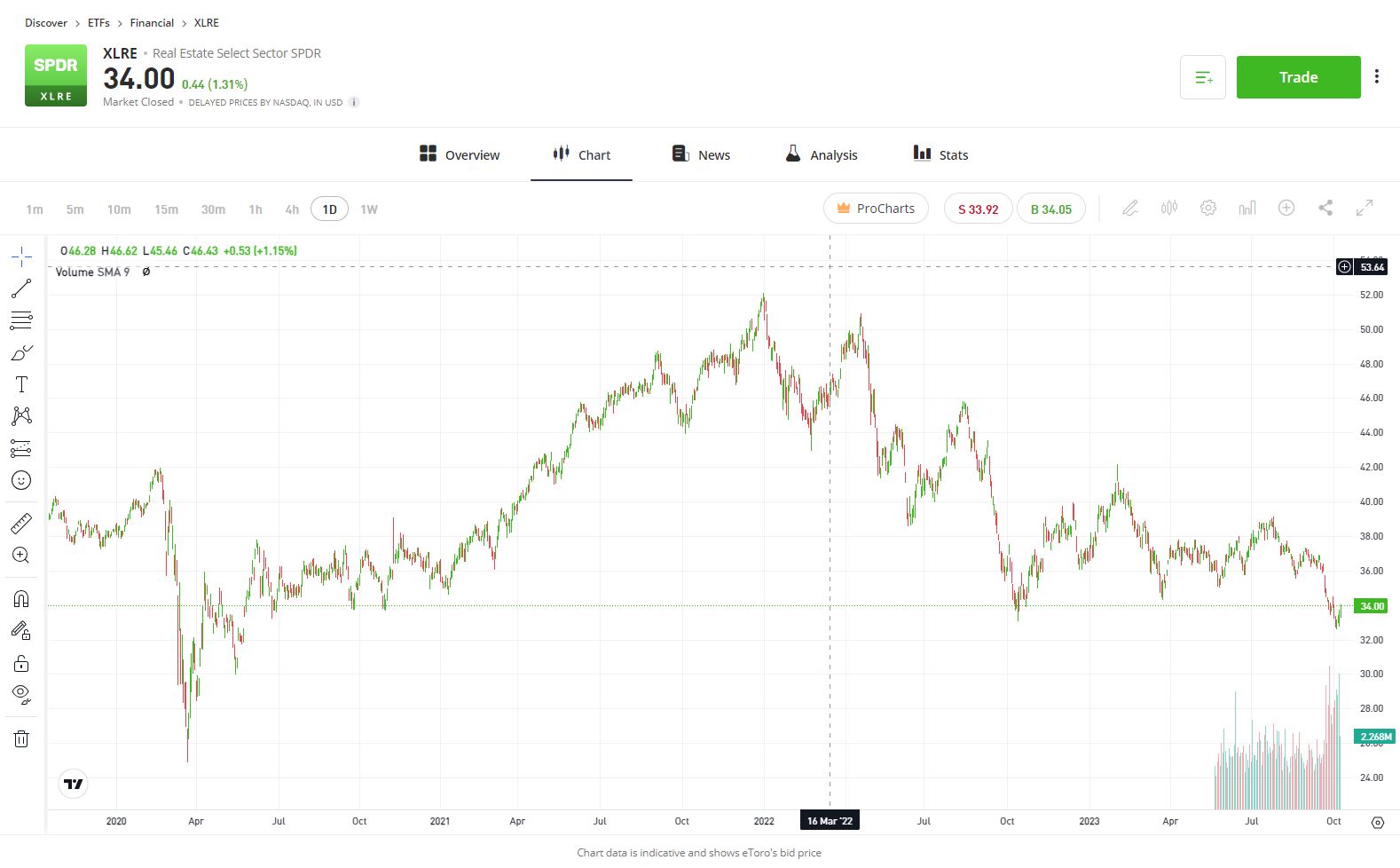

Some real estate ETFs available on eToro include Vanguard Real Estate ETF (VNQ), Real Estate Select Sector SPDR (XLRE), iShares U.S. Real Estate ETF (IYR), iShares Global REIT ETF (REET), iShares Core U.S. REIT ETF (USRT) and SPDR Dow Jones REIT ETF (RWR).

2. Invest in REITs

Real estate investment trusts (REITs) are companies that own, operate or finance income-producing real estate.

Pros:

- Exposure to diverse real-estate portfolios.

- Potential for regular income through dividends.

- A relatively liquid asset.

Cons:

- Like ETFs, REITs can charge management fees.

- Dividend yields can fluctuate based on market conditions.

Some REITs available on eToro include Charter Hall Long WALE REIT (CLW.ASX) and RealEstateTrusts Smart Portfolio.

3. Invest in real estate-focused companies

Investing in real estate-focused companies allows you to get indirect exposure to the property market. These companies might engage in property development or management, for example.

Pros:

- Potential for capital appreciation through stock-price increases.

- Potential for dividend income from profitable companies.

Cons:

- Stock prices can be volatile.

- Performance depends on the company’s financial health and broader market conditions.

Several real estate-focused companies are available on eToro, including REA Group Limited (REA.ASX), GPT Group (GPT.ASX), Scentre Group (SCG.ASX), Stockland (SGP.ASX), Vicinity Centres (VCX.ASX), Lendlease (LLC.ASX) and Mirvac (MGR.ASX).

4. Invest in construction companies and suppliers

Another indirect route to real estate investment is through construction companies and suppliers.

Pros:

- Exposure to real estate through companies that support the market’s growth.

- Potentially lucrative profits when the market is ripe for busy construction and supply periods.

Cons:

- Stock prices are sometimes affected by factors beyond real estate trends.

- Risks associated with the construction industry, such as economic downturns and recessions.

You might want to investigate construction stocks such as D.R. Horton Inc. (DHI), Lennar Corp (LEN), NVR Inc. (NVR) and PulteGroup Inc. (PHM), as well as construction suppliers like James Hardie Industries (JHX.ASX), CRH (CRH.L), Vulcan Materials Co. (VMC) and Martin Marietta Materials Inc (MLM).

While buying a property in the current climate can be difficult – if not impossible – for many Australians, the good news is there are alternative ways to get exposure to the real estate market. Just remember that before diving into any new investment, it is vital to conduct thorough research, understand the associated risks and consider how each of these alternatives aligns with your long-term goals.

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no