The Daily Breakdown takes a look at the week ahead, including a look at AbbVie is it approaching a potential key support area.

Monday’s TLDR

- AbbVie stock pulls back into potential support.

- Ethereum continues higher after the SEC’s decision.

- Apple jumps on renewed iPhone demand in China.

What’s happening?

As if the recent trading volume wasn’t low enough, now we kick off the trading week on Tuesday due to the Memorial Day holiday on Monday.

Stocks are tip-toeing into the week after the S&P 500 ended about flat last week and as investors focus on the remaining trading sessions in May.

The big focus this week will be the revised GDP report on Thursday and the PCE report on Friday. Remember, the Q1 GDP report surprisingly missed estimates when it was initially released in April, while Friday’s PCE report is the Fed’s preferred inflation gauge.

On the earnings front, we have a few notable names in retail and tech reporting this week.

Some of the interesting retailers include: Abercrombie & Fitch, Chewy, Dick’s Sporting Goods, Kohl’s, Costco, and Best Buy.

Some of the interesting tech earnings include: Box, Salesforce, C3.ai, Okta, Dell, Zscaler, Marvell, and MongoDB.

Want to receive these insights straight to your inbox?

The setup — ABBV

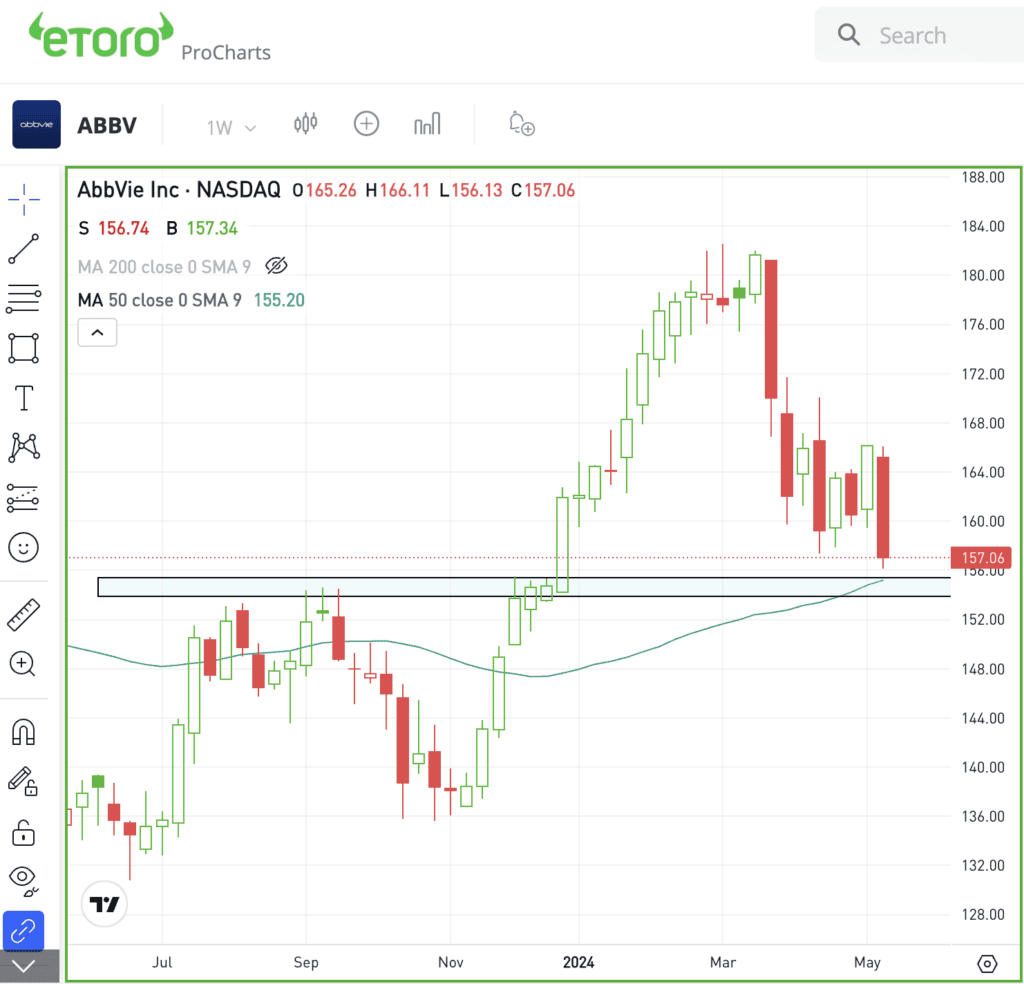

AbbVie hit new all-time highs earlier this year, but has been struggling lately as it’s fallen in five of the last eight weeks. Currently down about 14% from the highs, shares are approaching an interesting level on the charts.

That’s as the stock nears the 50-week moving average and a key prior support/resistance area. The mid-$150 zone was once stiff resistance, but the stock was able to break out over this area in December.

Will it hold as support?

If support holds, bulls can look for a potential bounce back into the $160s — and perhaps even higher if momentum remains strong. If support fails, active investors can cut their losses with minimal damage.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to make sure they have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

AAPL — According to reports, Apple’s iPhone shipments in China jumped more than 50% in April. Shares are trading slightly higher this morning on the news, as investors hope that the recent price cuts have helped renew demand in this struggling market.

WDAY — Workday shares plunged more than 15% on Friday after management lowered its full-year subscription revenue guidance, raising questions about future growth. As for the most recent quarter, the company delivered an earnings and revenue beat, with the latter growing 18.5% year over year.

ETH — Ethereum prices continue to drift higher after last week’s favorable ruling from the SEC. ETH roared into Thursday (May 23) ahead of the SEC’s verdict, which ultimately gave the green-light for spot ETFs to launch in the US. It’s worth noting that Bitcoin gained SEC approval for its ETFs in January, although it’s unclear when the Ethereum ETFs will launch.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.