The Daily Breakdown looks at the week ahead, with a focus on Nvidia’s earnings. Energy stocks are trying to regain some momentum, too.

Monday’s TLDR

- Bulls stormed higher last week.

- Earnings are back in focus this week.

- Energy stocks are trying to break out. Again.

What’s happening?

A lot happened last week.

Investors cheered the results from the retail sales and CPI reports, which spurred the S&P 500 and Nasdaq 100 to new all-time highs. The Dow eclipsed 40,000 and Bitcoin hit its highest level in a month.

As we turn our attention to this week, earnings are back in focus. Specifically, investors will be watching retail and tech.

We’ll hear from Lowe’s, Macy’s, Target, TJX Companies, and Deckers, among others. Zoom Video, Palo Alto Networks, and Snowflake will also report earnings this week.

However, Nvidia will be the big one to watch when it reports earnings after the close on Wednesday.

With its $2.3 trillion market cap, Nvidia has become the third-largest company in the S&P 500. While it has a large weighting in various indices, it’s also become a key psychological stock for investors as it leads the AI revolution.

The stock’s reaction to its earnings report has the potential to reverberate throughout the market. That’s as the options market is currently pricing in a move of roughly 8.2% by the end of the week, equating to a swing of almost $200 billion in market cap!

Want to receive these insights straight to your inbox?

The setup — XLE

It’s been a little while since we talked about energy stocks, and that’s because this group has been consolidating over the past month after a monstrous rally.

However, it’s still the third best performing sector in the S&P 500 so far in 2024. And now, it’s trying to make another push to the upside.

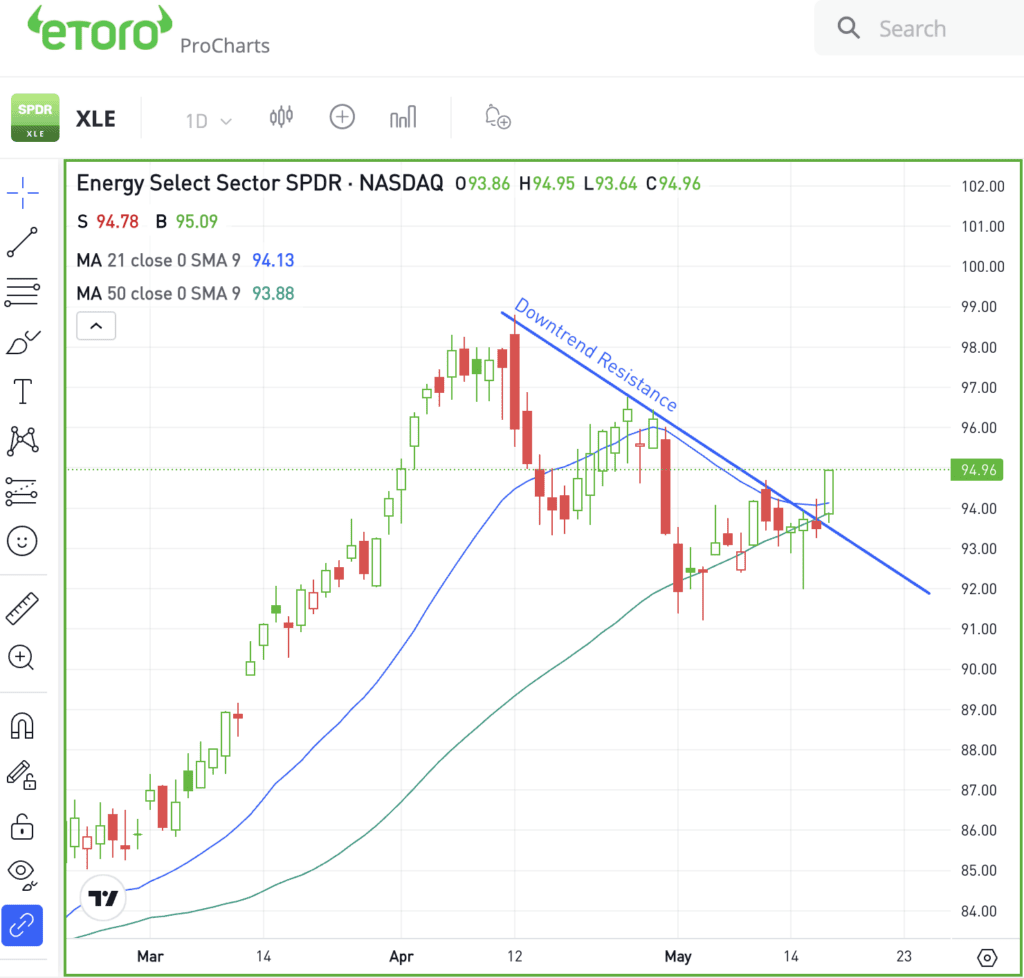

When it comes to the SPDR Energy Select Sector ETF — the XLE — we can see that it’s clearing downtrend resistance.

If the ETF can stay above the $93 level and its short-term moving averages, bulls can remain in control. However, if it breaks back below this level, it will lose momentum, while potentially putting the recent lows near $91 to $92 back in play.

Look, I get it. Energy stocks aren’t the most exciting group. But we’re not here for excitement; we’re here to find the best setups that we can. This doesn’t guarantee that we’ll be right, but looking for high-probability — rather than high-excitement — setups is the focus.

Options

For some investors, options could be one way to trade XLE. Remember the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on shares trading lower.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

BTC — Last week, Bitcoin experienced its best day since March, climbing over 7% to $66,923 following a cooler April inflation reading. This also comes as Morgan Stanley revealed a $270 million stake in US Bitcoin ETF holdings. The recent upswing marks Bitcoin’s recovery from a six-week decline, aligning it with a broader stock market rally.

Gold — Renewed geopolitical tensions in the Middle East are drawing increased attention to the commodity market. Gold and copper have hit new record highs due to anticipated supply shortages, while silver has been on the rise too, up about 30% so far in 2024.

BA — Boeing’s Starliner spacecraft encountered another delay due to technical issues, pushing its crewed spaceflight to no earlier than May 25th. The stock has struggled immensely so far this year, down about 29% so far in 2024.

O — On Friday, Realty Income — also known as “The Monthly Dividend Company” — increased its dividend 2.1% to $0.2625 per share. The dividend increase is the firm’s 107th consecutive quarterly increase, a stretch that spans more than 26 years.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.