The Fed’s once-a-year Jackson Hole event is in focus later this week, as The Daily Breakdown looks at this week’s key events.

Monday’s TLDR

- It’s a busy week of retail earnings.

- The week ends with a pivotal speech from the Fed.

- AMD makes a key acquisition in AI.

Weekly Outlook

A few weeks ago, we were looking at a very painful Monday as volatility soared. This Monday, the scene looks quite different as the S&P 500 is up a whopping 8.5% from the low a few weeks ago.

Earnings will remain in the spotlight this week, particularly with software companies and retailers. And while it’s a quiet week for economic reports, the Fed has a big event on Friday morning.

On Monday after the close, we’ll get earnings from Palo Alto Networks, a leading cybersecurity firm.

On Tuesday, Lowe’s and Toll Brothers will report earnings, while the Eurozone will report its inflation figures via the CPI report. It will be interesting to see if the Eurozone — which has already lowered interest rates — is seeing a steady decline in inflation or if prices are heating back up.

Wednesday features earnings from Target, Macy’s, TJX Companies, and Snowflake, among others, while Peloton, Baidu, and Workday will report on Thursday.

As it pertains to the Fed, the committee will kick off its Jackson Hole symposium on Thursday as well, with Chair Powell giving a speech at 10:00 a.m. ET on Friday. In that speech, investors are looking for the Fed to signal a coming rate cut, which would be the first cut of the current interest rate cycle.

Want to receive these insights straight to your inbox?

The setup — JNJ

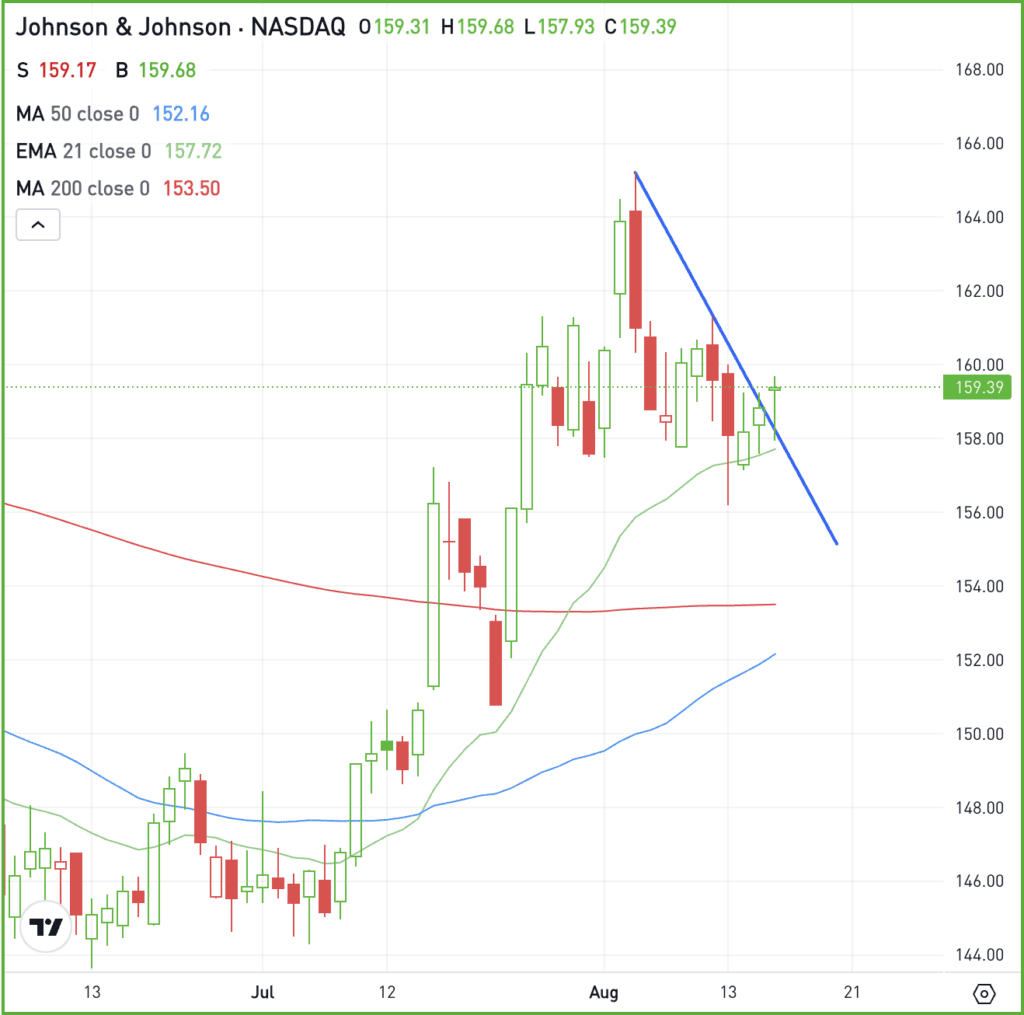

Known as a consistent long-term performer with an excellent dividend streak, Johnson & Johnson has not made a new all-time high since April 2022.

Lately though, shares have been trading well. The stock has consistently rallied from the lows in early July and is now back above all of its key daily moving averages.

The recent pullback to the 21-day moving average held as support, while shares broke out over recent downtrend resistance on Friday.

If JNJ can continue higher, perhaps the stock can make a push back into the mid-$160s, where it topped out earlier this month. On the flip side, a close below the recent low near $156 could open the door to a larger pullback, potentially down to the 50-day and 200-day moving averages.

Options

For some investors, options could be one alternative to speculate on JNJ. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and JNJ rolling over.

For those looking to learn more about options, consider visiting the eToro Academy — and remember to join our eToro Academy Learn & Earn Challenge, where you can take courses, pass quizzes, and earn up to $18 in rewards. Terms and conditions apply.

What Wall Street is watching

GLD — Gold prices hit new highs as expectations for Fed rate cuts fueled demand, while safe-haven buying has been on the rise due to Middle East tensions. Copper also saw gains despite Friday’s dip, driven by supply concerns from a major mining strike.

AMD — Shares of Advanced Micro Devices are in focus on Monday morning, rising slightly in pre-market trading after the firm announced the acquisition of ZT Systems for $4.9 billion in a cash and stock deal. ZT Systems is a data center firm with a focus on AI infrastructure.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.