The Daily Breakdown looks at the week as earnings continue to dominate the headlines. Can financial stocks continue to break out?

Wednesday’s TLDR

- A bond auction is in focus today.

- Uber, Shopify, Arm, and others report earnings.

- The financial sector is trading better.

What’s happening?

We expected it to be a quiet week with a focus on earnings, and so far, that’s what Monday and Tuesday have given us.

Outside of a few big earnings-related moves, stocks eked out a gain on Tuesday, as the S&P 500 strung together its fourth straight daily gain. Bitcoin and Ethereum continued to stagnate, falling 1.3% and 1.9%, respectively.

Bulls are waiting to see if these two cryptocurrencies can regain some of the recent momentum they displayed into the weekend.

As we look ahead, today’s action includes earnings reports from Uber and Shopify before the open. After the close, we’ll hear from Robinhood, Arm Holdings, Airbnb, The Trade Desk, and AMC Entertainment, among others.

There’s also a 10-year note action at 1 p.m. ET. Remember how we were talking about how key the 10-year yield has been lately?

That’s potentially a market-moving event tomorrow. If the bond auction goes well and yields continue lower — the 10-year yield has fallen for five straight days — stocks may continue to march higher.

If it goes bad though — meaning the bonds fall and yields rise — it could be a headwind for stocks.

Want to receive these insights straight to your inbox?

The setup — XLF

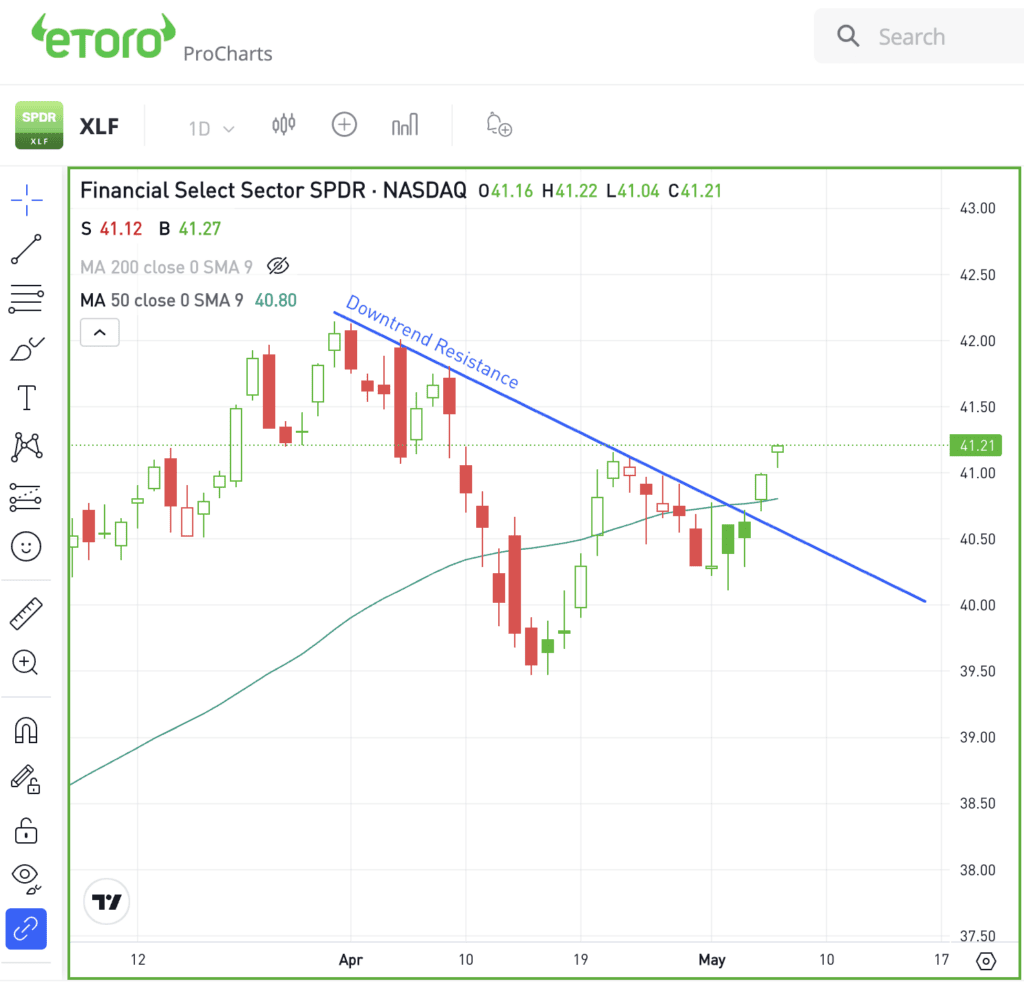

A number of banks have been trading pretty well and that’s reflected in the Financial Select Sector SPDR Fund — the XLF.

I like when semiconductors and financials are trading well. It telegraphs a constructive environment for stocks. Yesterday I pointed out the breakout in semiconductors and on the same day, the XLF broke out too.

The rally cleared downtrend resistance and the 50-day moving average — two bullish developments.

As long as shares stay above $40, bulls can maintain momentum. On the upside, note that the 52-week high is up at $42.22. If the stock breaks back below $40, it could open the door back down to the recent lows, near $39.50.

The top five holdings in the XLF include Berkshire Hathaway, JPMorgan, Visa, Mastercard and Bank of America.

Options

For some investors, options could be one alternative to speculate on XLF. Remember the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and the ETF rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

PLTR — Palantir plunged despite beating revenue forecasts, with sales coming in at $634.3 million, up 20.8% year over year. Earnings were in-line with expectations, while management raised its full-year revenue outlook to between $2.677 to $2.689 billion vs. consensus estimates of $2.68 billion.

DIS — Disney shares fell despite reporting strong Disney+ growth and beating earnings expectations. That’s as revenue forecasts slightly missed estimates and as management anticipated a loss in its direct-to-consumer segment next quarter.

RACE — Ferrari stock declined over 6% despite surpassing quarterly earnings expectations. While sales grew 10.5% year over year and management reaffirmed its full-year guidance, investors seemingly wanted more as shares dipped on the results.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.