For beginners, investing in stocks can seem a little daunting, but it doesn’t need to be. Before you get started, it’s important to understand what the stock market is and how it works. This stock investing guide will explain how to invest in the stock market and educate you on the different elements to look out for.

The process of investing in the stock market will vary for different investors. It can seem complicated, but there are several different options for investing in stocks. First and foremost, it is important to develop a basic understanding of the stock market and how it works.

What is the stock market?

The term “stock market” is used to describe the stocks and shares available to be bought and sold using one of more than 60 stock exchanges around the world. US listed stocks make up more than 60% of the global market, which is worth trillions of dollars.

Each stock represents part-ownership of the company it relates to. As the prospects of a firm improve, demand for its stock increases and the stock price rises. This positive price movement represents a profit for those who own the stock.

Stocks are first listed on stock markets when owners of private companies decide to exchange some of their ownership rights for cash. Those stocks are then bought and sold by other investors, who form their own view on whether a stock is a good prospect, or not.

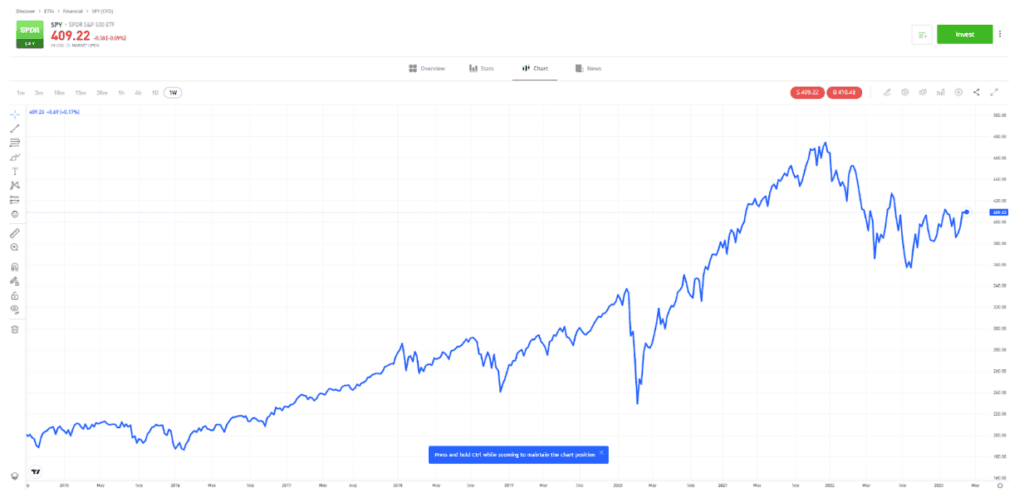

| SPDR S&P 500 ETF (SPY) – 2014–2023 |

Past performance is not an indication of future results

Source: eToro

What is the role of the stock market?

The stock market serves several purposes, but it primarily exists as a means of determining fair prices for public companies, while allowing investors to buy and sell assets and shares.

Stock markets perform a pivotal role for companies, which are able to raise money through the sale of shares and bonds. It can also provide a business with access to liquidity, which can be used to pay debts and invest in the future of the company.

Stock markets also impact the wider economy, with a thriving stock market helping to encourage business and drive economic growth. Stock markets are often used as a representation of a country’s economic health.

For investors, the stock markets simply provide an opportunity to own shares in a company, with the intention of earning profits on those shares in the future, if the stock price rises.

How do stock exchanges work?

Stock exchanges are marketplaces with strict rules and regulations. Stock exchanges are designed to make the process of investing in stocks as safe as possible. There is no guarantee that your chosen stock won’t fall in value, which is described as “market risk”, but the controls put in place by stock exchanges aim to limit “operational risk”.

Tip: Technological advances and online trading platforms have made stock investing more straightforward and cost-effective than it was in the past. However, there are still risks involved.

How do you invest in the stock market?

To invest in the stock market, investors will need to create an account with an online broker. The process usually takes minutes to complete, and once you have signed up, buying stocks or stock-related assets involves navigating to the right area of a trading platform, entering a quantity and clicking “buy.”

Other instruments, such as indices, futures, CFDs and ETFs, also enable investors to gain exposure to the stock market. Regardless of the asset in question, the process of booking a trade will be fairly similar.

The stock market, as a whole, has and will recover from every downturn.

Naved Abdali

Investing in stocks

Investing in stocks involves buying shares of a specific company. Stocks are one of the most popular asset classes, and most brokers offer markets in hundreds, if not thousands, of different stocks. To invest in stocks, investors will need to choose which companies they want to invest in, and then open a “buy” trade with their online broker. It is usually possible to buy fractional shares of individual stocks.

Investing in indices

Investing in indices involves opening a position in an index fund, which will track the performance of a basket of different stocks. For example, the FTSE 100 Index is made up of the stocks of the largest 100 firms listed on the London Stock Exchange. To invest in indices, investors should decide which fund they want to invest in and then open a long position in that index.

Investing in ETFs

Investing in ETFs involves buying a basket of stocks with a single “buy” instruction. Investors should decide which index, sector or region they are interested in, which can allow them to target a particular investment opportunity, such as fintech, commodity stocks or emerging markets.

Investing in futures

Investing in stock futures involves setting up a derivative financial contract that obligates you to buy or sell an asset at a predetermined future date and price. To invest in futures, investors will need to visit a futures exchange and decide on the stock futures that they are interested in. These will have specific expiration dates and will usually be organised by month of expiry.

Investing in CFDs

Investing in Contracts for Difference (CFDs) involves gaining exposure to price changes in an underlying asset, without actually owning the asset. To invest in CFDs, investors will either need to open a long or short position, depending on whether they believe the price of a stock will go up or down.

Tip: Selecting the right stock-related asset involves establishing your investment aims and considering your risk appetite. Building a diversified portfolio can help smooth out returns and mitigate against risk.

Tips for investing in the stock market

Picking the right stocks is only half the battle when investing in the stock market. There are some golden rules to consider when making investments.

Before investing in the stock market, investors should:

- Ensure that their broker is well-regulated

- Know what they are buying and why they are buying it

- Understand when they are able to buy or sell, according to their chosen stock exchange

- Develop a plan that factors in the benefits of diversification

- Conduct research and monitor news reports relating to their stock positions

- Develop a trading psychology

There are also certain stock market strategies that investors can employ, although these strategies should come secondary to the points mentioned above.

Final thoughts

Whether you are buying shares on the New York Stock Exchange, ETFs on the LSE or indices tracking the performance of the Japanese Nikkei 225 Index, the basic principles of stock investing are very similar. Most investors are interested in tapping into the potential of investing in stocks, but remember, there are elements of risk to be considered.

Visit the eToro Academy to learn more about the investment potential of stocks.

FAQs

- How much does it cost to buy stocks?

-

Some brokers charge a commission on each trade, whereas others offer commission-free trading, instead making their return on the bid-offer spread — the difference between the buy and sell price in a market. Buying stocks has become more cost-effective thanks to online brokers revolutionising the process, but it is important to check the T&Cs outlined by your broker before investing.

- What would be a good stock investment for a beginner?

-

There is no guarantee that any investment will be a “good” investment. For beginners, consider your investment aims and risk appetite. Some beginner investors choose to buy indices, or ETFs, as they have diversification built into them. With one trade, investors can allocate capital across a range of different stocks, rather than buy each stock individually.

- Is a stock exchange the same as the stock market?

-

The term “stock market” is usually used to refer to the entire universe of stocks, stock-related products and equities as an asset group. “Stock exchanges” are the marketplaces on which stocks are bought and sold.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.