There’s a lot to learn when you start investing, but bearing some of the core principles in mind will hopefully help you to become a better investor. Follow these rules for investing to avoid beginner investment mistakes.

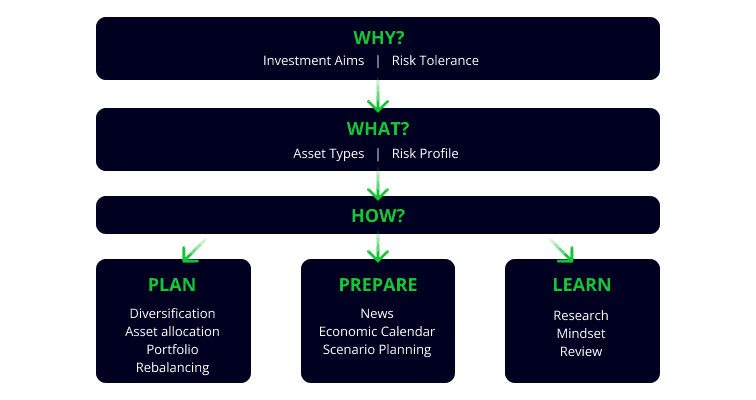

Conducting research before investing can be interesting as well as financially rewarding. However, when it comes to achieving financial independence, there are higher level factors that might have a greater influence on your long-term returns. Before investing, remember to ask “Why?”, “What?” and “How?” Each of those questions is linked to the five golden rules of investing, which, if followed, will put you in the best position to avoid investment mistakes.

The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule.

Warren Buffett

Rule 1: Know Your Aims and Investments

Establishing “why” you want to invest should also teach you what rate of return you’re aiming for, as well as the length of time you want to invest for. Those two factors are a crucial part of the investment process, and raise the following question: “what” assets should you invest in to achieve your goal?

For example, an aggressive investment strategy aims to make a high return in a short period of time, but runs the risk of a higher loss of capital. This would require buying assets with a high risk-return profile.

On the other hand, investors with more modest expectations and a longer investment time horizon can build a portfolio out of lower risk assets. The longer the investment timeline, the higher the likelihood that these assets will increase in value in line with long-term average rates of return.

Tip: The first rule of investing is to devote time to self-analysis and establish what you want to achieve, and how much you are willing to risk.

Rule 2: Plan

When considering “how” to become a better investor, it’s important that you design and implement a strategy, outlining what assets you plan to buy and when you plan to buy them. Investors should fully understand the assets or markets they invest in and factor patience and tolerance into their plan, while acknowledging that not all positions will be profitable.

The 5 Golden Rules of Investing: Maximizing Returns and Minimizing Risks.

Tip: A demo account is an ideal way to practise investing in a risk-free environment. Demo accounts allow you to test your strategies using virtual funds.

Rule 3: Diversify

Asset allocation is the process of deciding which markets and assets to invest in. This part of your investment plan needs to be given considerable thought, because every time you convert cash into an investment position, you’ll increase the risk level of your portfolio.

One risk management technique used by experienced investors involves buying a range of assets to diversify their portfolio. Therefore, if one small position goes wrong, it will have less impact on total returns. Building positions in different types of assets, and investing in multiple sectors or geographical regions, generally leads to overall returns being smoother.

Tip: Research different types of assets and markets, and only invest in instruments you understand and that have a risk-profile that matches your investment aims and personal attitude to risk.

Rule 4: Prepare

Risk management needs to be considered during the planning stage of your investing journey, but becomes crucial once you make your first trades. As soon as you enter the market and buy an asset, its value will start fluctuating in line with the market price. Positions entering into profit or loss can lead to emotional investing, potentially causing you to deviate from your investment plan.

Tip: Keeping calm is important and is helped by only investing an amount of capital you can afford to lose, while holding some cash back in an emergency fund to finance real-world spending.

News events, which can influence asset prices, can be tracked using economic calendars that warn investors about upcoming announcements. Other factors, such as natural disasters, usually come as a complete surprise, but it is still possible to plan in advance and have a rough idea of how you will react to different scenarios. If the markets suffer a correction — a decline in the price of an asset between 10 and 20% — you won’t need to make rash decisions during a market downturn.

Rule 5: Never Stop Learning

Your investment aims and risk appetite will inevitably change over time. You’ll also want to spot new investment trends and take advantage of them as they occur. Continued expansion of your knowledge and skills will help you to become a better investor. Investors should also review their past performances to see how they could have improved returns in retrospect.

Tip: Good quality brokers provide their clients with free research. Some also offer social trading — where you can discuss ideas with other traders — and copy trading — where you can set up your account to copy the investment decisions of others.

Final Thoughts

Following the five golden rules of investing will put you in the best possible position to manage the inevitable ups and downs of the market. They will help you to develop a plan that suits your personal situation and show you the benefit of revisiting and adapting your plan in the future. This should also help you to evaluate how you will achieve your personal version of financial freedom.

Visit the eToro Academy to learn more about the techniques you can use to keep your investment decision-making on track.

Quiz

FAQs

- Which is the most important rule for investing?

-

The five golden rules of investing aim to keep investors focused on higher level factors that can make a material difference to your investment returns, rather than worrying about potentially inconsequential factors that won’t. They ideally work in conjunction with each other, but establishing your aims and investments is perhaps the most important rule and should form the foundation of any investment plan.

- When should I rebalance my portfolio?

-

Portfolio rebalancing involves adjusting asset allocations by selling existing positions and buying new ones. It can be done at any time, as long as the relevant markets are open. Rebalancing a portfolio helps to adjust its risk profile and should be done following changes in market conditions or when pursuing a different investment strategy.

- How can I measure how much risk is in my portfolio?

-

Measuring portfolio risk can be a highly technical operation involving complicated statistics. Measuring portfolio risk involves looking at the extent to which investment returns vary over time. If your profit/loss reading is moving dramatically, or more specifically, moving to an extent that makes you uncomfortable, you should consider rebalancing your portfolio by rotating into lower risk assets.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.