Earnings season is starting to roll out and The Daily Breakdown looks at what the banks have had to say. Plus, Uber continues to hold up well.

Tuesday’s TLDR

- Banks keep beating earnings

- Uber is holding support

- China deals a blow to Boeing

What’s happening?

Bank earnings are acting more like a sigh of relief rather than pouring gasoline on the panic fire.

JPMorgan, Wells Fargo, and Morgan Stanley all beat earnings estimates on Friday. Goldman Sachs tacked on a top- and bottom-line beat yesterday, and now it’s Bank of America and Citigroup doing the same thing this morning.

A surge in trading revenue is helping fuel strong revenue growth at these firms — and some are reporting record trading results — which is padding the bottom line despite clearly volatile and uncertain times.

While these earnings reports have timed up with a bounce in US stocks, the rally in banks is acting like a “deep breath in, hold, deep breath out” for investors. Remember, financials (the XLF ETF) account for about 15% of the S&P 500.

To be fair, the tone out of Wall Street is cautious; that is, the conference calls have talked about uncertainty and a concern for the economy. But in terms of red flags and major breakdowns in the consumer, they just aren’t seeing it — yet.

That’s good news and keeps the “cautiously optimistic” approach to markets alive, but we have to be cognizant that things can get worse. Let’s hear what BofA and Citigroup have to say today on their conference calls.

Want to receive these insights straight to your inbox?

The setup — UBER

Uber stock has been somewhat stagnant, with shares flat over the past 12 months. However, the stock is still up more than 20% year to date and has been handling itself pretty well.

While Uber is prone to disruptions in the travel industry, it continues to hold up pretty well on the fundamental side. Analysts expect roughly 15% revenue growth both this year and in 2026, to go alongside estimates of 32% earnings growth in 2025 and 38% earnings growth in 2026.

Uber’s shift to profitability has helped elevate the stock price, but it has struggled for traction in this environment. Should the company deliver on its growth expectations, bulls are hoping they will be rewarded in the long term.

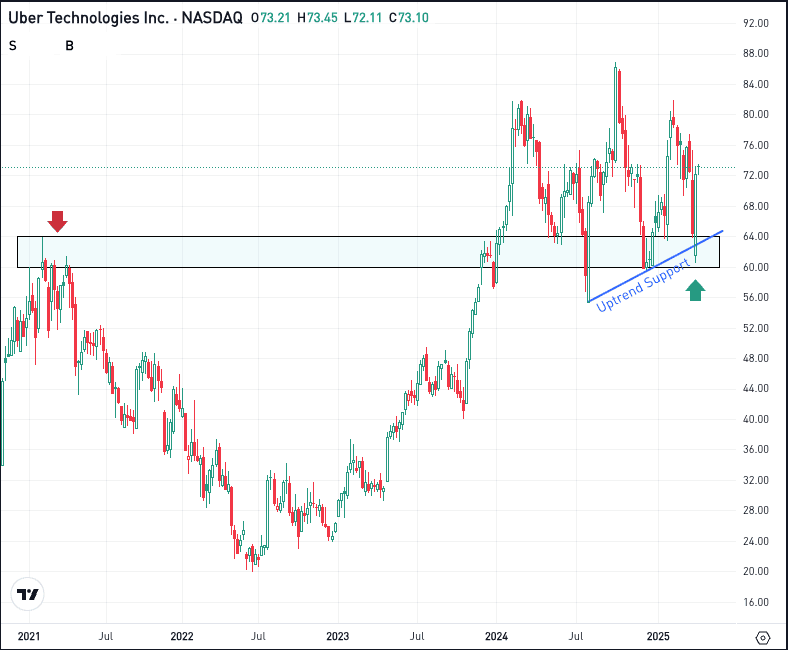

When we look at the technicals, notice how the $60 to $64 area went from resistance in 2021 and Q4 2023 to support in mid-2024. This area is still acting as support and while Uber has bounced nicely from this zone, investors can’t rule out another potential test of this zone given the volatile environment.

If support continues to hold, investors might consider a long position to take advantage of Uber’s potential long-term growth. However, if support fails, it could usher in more selling pressure as bearish momentum accelerates.

Options

Investors who want long exposure to Uber can participate with calls or call spreads. If speculating on further upside, investors might consider using adequate time until expiration, or using spreads to help mitigate the impacts of elevated volatility levels.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

BA – Boeing shares are under pressure this morning, as China has reportedly ordered its airlines to stop taking deliveries from Boeing. Further, the government wants them to halt purchases of aircraft parts and equipment from US companies. This serves as a reminder that the trade war between the world’s two largest economies is still ongoing and prone to escalations.

JNJ – Shares of Johnson & Johnson are slightly lower this morning in pre-market trading despite the firm beating on earnings and revenue expectations. Further, the company gave a modest boost to its operational revenue outlook, while maintaining its guidance for full-year earnings growth of 6.2%. Check out JNJ’s chart here.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.