What Happened This Week (27th June – 1st July)

It’s official! The first half of the year is completed!

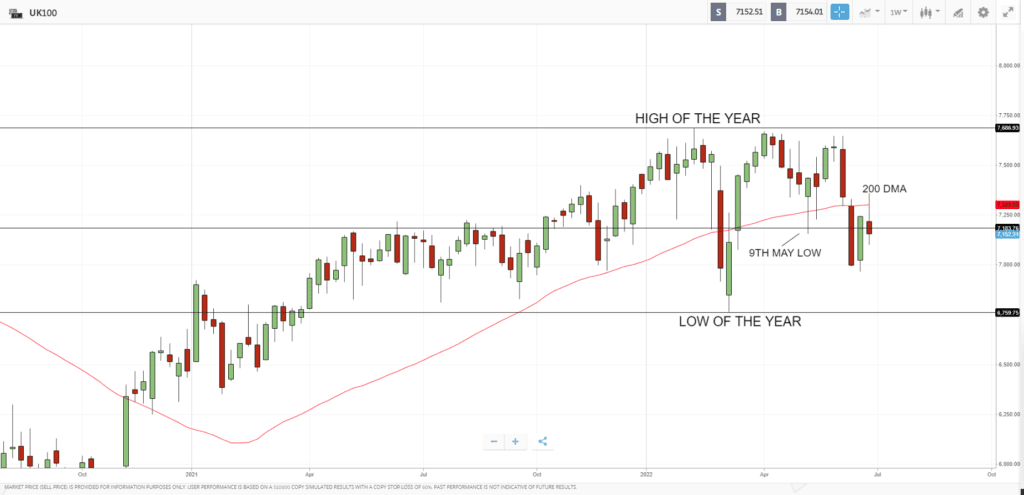

As mentioned last week, navigating through the end of the month, quarter and first half the of the year was always going to be difficult. We saw volumes rise across the board and markets swing one way to another almost at ease and the FTSE confirmed its worst month since the pandemic struck. I said last time out that I usually leave these periods alone and I am relatively happy that I did, however I do think we are in for an interesting finish for the week. If you have a look at the FTSE 100 below, it is looking like it could finish near enough where we started the week and significantly off its low. That can mean either indecision or for those who are glass half full, that the market is acting more resilient than its counterparts who have yet again struggled.

If we look at the first half of the year, the FTSE finished down just under 3% whilst the Dax finished down 20%, the Nasdaq 30% and the S&P 500 21% just to name a few. With the exposure of value stocks in the energy, health and banking sectors, the FTSE has held up well and if you like your facts, it is the best performing stock benchmark out of 18 tracked by Bloomberg.

Following last Friday’s lowest ever level for UK consumer confidence it is worth noting that retail investors are starting to look at the UK market as a brighter spot. Elsewhere, Bank of England Governor Andrew Bailey said on Wednesday that they will not necessarily have to act forcefully to get inflation under control. This dovish tone hasn’t seemed to of affected markets too much as we are still priced in for an 80% chance that the Bank of England will raise interest rates by 50bps in the August meeting. This would be the first time they have raised by such a margin since 1995.

Chart In Focus

Winners & Losers from the FTSE 100

Winners

Shell PLC – Rising on record profits and high oil prices as it looks set to have its second positive week in a row

Standard Chartered – Share price briefly makes a new high for the year as it continues its good run

Rolls Royce – In the losers last week and in the winners this one, but still flirting near lows of the year

Losers

British Land Company – Brutal week as share price drops down to low of the year

Aveva Group PLC – Despite three positive weeks in a row, the engineering and industrial software company struggled over the last five days

Abrdn PLC – Continues recent downtrend to trade near 2009 low

Next Week

The first thing to note for any trader or investor out there is that Monday is a Bank Holiday in the States. UK markets will be open but with a large portion of participants away, volume will be considerably lower as the United States celebrate Independence Day. With over a month to go until the next Bank of England meeting, all eyes will be on data releases and any central bank speaker comments. However, from a data point of view, it is a pretty quiet start to July for the UK. On Tuesday we see the final reading of the UK Services and Composite PMI and on Wednesday we get the Construction PMI figure for the month of June. Whilst investors will keep an eye on those data points and the market could move off of them, a couple of relatively quiet weeks wouldn’t be the worst thing in the world for the UK markets. The next Inflation reading isn’t until the 20/07 and the Preliminary Q2 GDP reading isn’t until the 12/08 which are two of the most important areas for investors to watch out for right now.

Quiz Question

For those who tuned in last week, the answer was *of course* Eye of The Tiger – Survivor. How many of you got that right? The other two songs were from the 90’s but congratulations if you managed a lucky or calculated guess.

For this week’s question, I want to know if you know when the FTSE 100 was first launched?

a) 1957

b) 1984

c) 1971

Tune in next time to find out, don’t cheat!!

See you next week!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.