What Happened This Week (20th – 24th June)

A week like this one is exactly what we all needed. A breather!

With not too much on the calendar for the week and a bank holiday in America on the Monday to kick things off, markets performed better than we have become accustomed to and look set to snap their losing streaks. The FTSE 100 is now back above 7,000 despite a 40-year high on the latest Inflation reading. May’s report showed Y/Y Inflation at 9.1% and with the Bank of England expecting a reading over 11% this year, you could have been forgiven for thinking that the UK’s biggest index would move lower. However, the Core Inflation (excluding volatile and seasonal prices like petrol for example) reading actually slightly missed expectations. Enter the silver lining. With all eyes on the UK to see if there will be stagflation, a lower than expected Inflation figure could show signs that retailers are starting to accept tighter margins now demand is flagging. There is a lot of data between now and the next BoE meeting (August 4th) but with things for now not getting worse, it might be that the rate increase remains at just 25bps.

For those interested, Josh Gilbert and I discussed UK Inflation on this week’s podcast. We also talked about the recent crypto crash and whether a recession in the United States could happen.

Chart In Focus

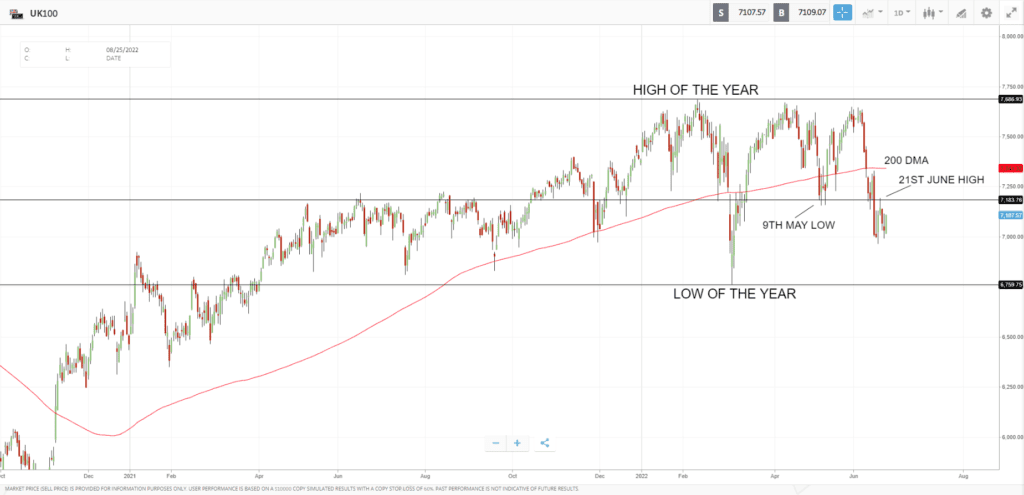

Whilst the FTSE 100 hasn’t come under as much pressure as US equities this year, it is still significantly lower than its high and the 200 day moving average. The key level around 7,180 marks a good line in the sand for the buyers and sellers. From being the low of the 9th May to being the high of this week, the market has shown it cares about that area. From a technical analysis point of view, bulls will be happy to see price rise above it whilst the bears will want to defend it in order to start the next move lower.

Winners & Losers from the FTSE 100

Winners

JD Sports Fashion PLC – Share price boost as they announce corporate overhaul after exit of chair Peter Cowgill

Avast PLC – Breaks key resistance at 500GBP and is set to have highest weekly close since early May

AstraZeneca – Share price edges closer to all-time-high following positive cancer drug news

Losers

Anglo American – Share price breaks key support to trade near low of the year as yearly returns fall more in line with earnings growth

Rolls-Royce Holdings – Continued rise of cost of living weighs on share price as it moves closer to the low of the year

Rio Tinto – Set for the lowest weekly close of the year as iron ore prices continue to fall

Next Week

From a UK perspective it is a relatively quiet week on the data front and it is not until Thursday 30th where we get a report of any significance. At 07:00 BST we get the Final GDP Growth Rate reading from Q1 but with two readings already released it would be unusual to have too many surprises there. For those keeping an eye on the housing market, you may want to pay attention next Friday 1st as the UK report Mortgage Approvals and Mortgage Lending data at 09:30 BST.

Even though next week is calmer on the data front once again, it is worth noting that next Thursday marks the last trading day of the month, quarter and first half of the year. If my years as an intra-day trader have taught me anything, it is that this period is usually best left alone. Whether it be month end flows, buying or selling of dollars, big institutions rebalancing their books or for this year, people gearing up for a long weekend ahead of Independence Day in the States, markets can act in an unfamiliar way.

Webinars

Every Monday, Ben Laidler (eToro Global Market Strategist) and I do an hour long webinar previewing the week ahead and reviewing any key developments from the previous 7-days. If you would like to attend you can click the link HERE to attend live or watch on-demand once the webinar has concluded.

Alternatively we also have a Market Watch webinar every Tuesday where we look at all the different asset classes from a technical perspective to see if there are any investing opportunities. On Wednesday is ‘Crypto This Week‘, where I am joined by Glen Goodman to discuss all things Crypto.

You can see a full list of all webinars on the eToro Academy.

Quiz Question

Last time inflation was this high in the UK, which of the following songs was Number 1? Tune in next week for the answer.

a) Nothing Compares 2 U – Sinead O’Connnor

b) Eye Of The Tiger – Survivor

c) Ice Ice Baby – Vanilla Ice

See you all next week!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.