It has been a big week on the market for companies such as Zoom Video Technologies and Tesla. With big wins and significant losses, the market remains as unpredictable as ever. Check out our weekly stock market update to find out who the stock market’s biggest winners and losers were, discover the highlights and lowlights of the past week and explore our stock market weekly forecast.

Last Week’s Market Winners

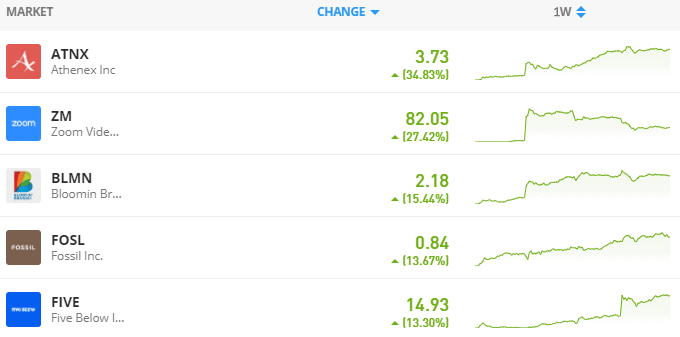

Nasdaq Stock Market (NASDAQ)

Analysing the Nasdaq Stock Market’s weekly performance, Athenex (ATNX), Zoom Video Technologies (ZM), Bloomin Brands (BLMN), Fossil (FOSL) and Five Below (FIVE) all came out on top.

Athenex’s impressive 34.83% weekly growth comes after the company’s New Drug Application for two breast cancer treatments was accepted by the FDA, while Zoom Video Technologies saw strong movement of 27.42%, with the video conferencing company continuing to be favoured by those working remotely. Bloomin Brands, Fossil and Five Below also experienced weekly uplifts of 15.44%, 13.67% and 13.30% respectively.

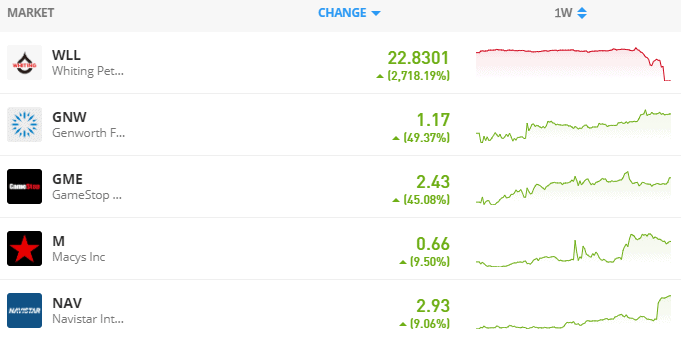

New York Stock Exchange (NYSE)

Over on the NYSE, the week’s winners included Genworth Financial (GNW), GameStop (GME), Macys (M) and Navistar International (NAV). Whiting Petroleum (WLL) also resumed trading on the NYSE after successfully completing a corporate & share restructure that was described by eToro Popular Investor Mohammad Ishfaaq Peerally as a 1:80 reverse split followed by a dilution of shares by 3,200%.

With a week-over-week growth of 49.39% and 45.08% respectively, Genworth Financial and GameStop saw the greatest improvement over the last seven days. Genworth Financial’s growth comes off the back of news that China Oceanwide has successfully secured financing to purchase the company, while GameStop stocks saw an uplift following word that RC Ventures, managed by Ryan Cohen, had acquired a significant stake in the company.

Although their growth was not quite as significant as Genworth Financial and GameStop, Macys and Navistar International also saw some strong movement. Macy’s stocks climbed 9.50%, while Navistar International stocks lifted by 9.06%.

Last Week’s Market Losers

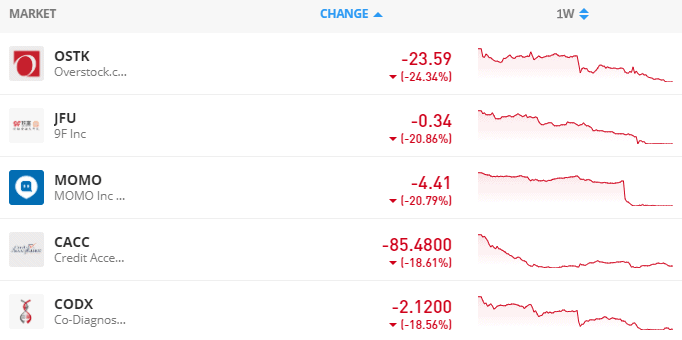

Nasdaq Stock Market (NASDAQ)

Taking a look at the Nasdaq Stock Market’s weekly trends, the past week wasn’t so kind to Overstock.com (OSTK), 9F Group (JFU), Momo Inc. (MOMO), Credit Acceptance (CACC) or Co-Diagnostics Inc. (CODX).

Plunging by -24.36% week-over-week, Overstock.com stocks took the greatest hit following several months of strong growth. The 9F Group, owners of a digital financial account platform, saw a drop in stock value of -20.86%, while Momo Inc. stocks fell by 20.79%.

It was a less than ideal week for Credit Acceptance and Co-Diagnostics Inc. too, falling by -18.61% and -18.56%, respectively.

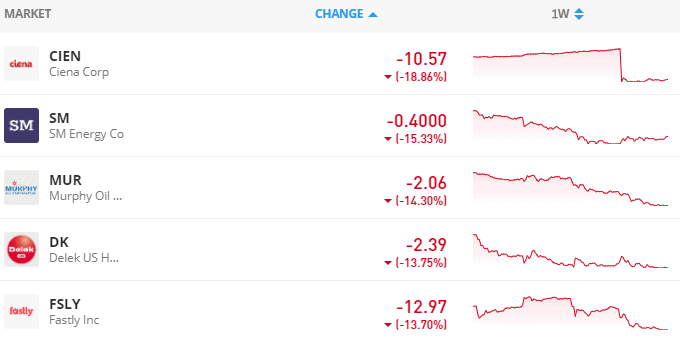

New York Stock Exchange (NYSE)

Last week on the New York Stock Exchange, Ciena Corp (CIEN), SM Energy (SM), Murphy Oil Corporation (MUR), Delek US Holdings Inc. (DK) and Fastly Inc. (FSLY) all saw the greatest negative movements.

Ciena Corp saw a drop of -18.86% off the back of comments by CEO Gary Smith that the company would experience a slow or flat growth in tail half of the year. SM Energy also took a hit of -15.33% over the past week, while Murphy Oil stocks dropped by -14.30% over the same period. The week wasn’t particularly kind to Delek US Holdings Inc. or Fastly Inc. either, with the companies experiencing week on week declines of -13.75% and -13.70%, respectively.

Highlights and Lowlights

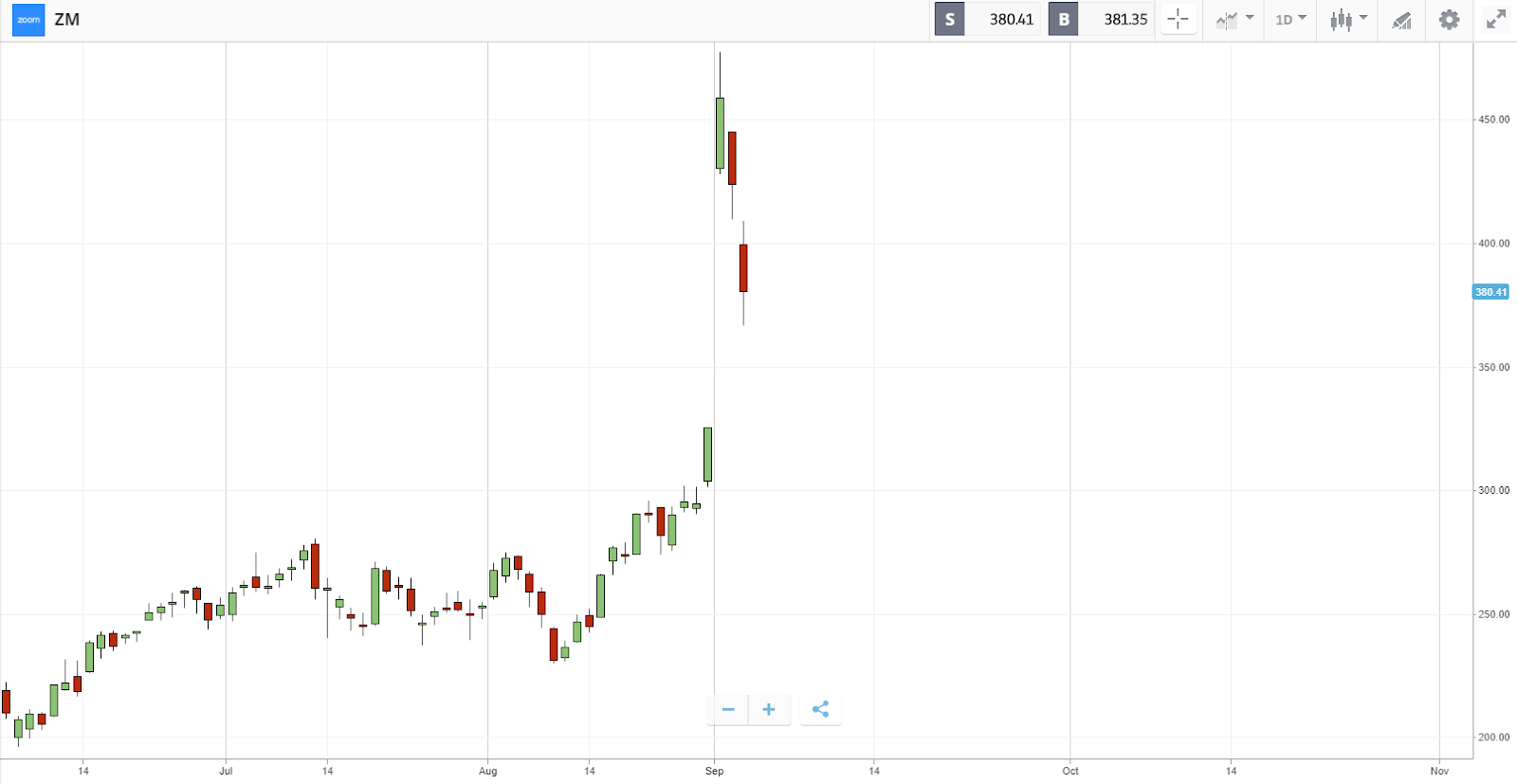

Zoom Soars

Taking the business world by storm in the face of the current global pandemic, Zoom Video Technologies (ZM) continues to gain impressive traction. On Tuesday, the video conferencing firm’s stock value increased by an impressive 40%. Despite suffering a 10% drop on Thursday, Zoom continues to smash all revenue forecasts made for the year so far, with its one-month return sitting at 71% and its year-to-date return at 572%.

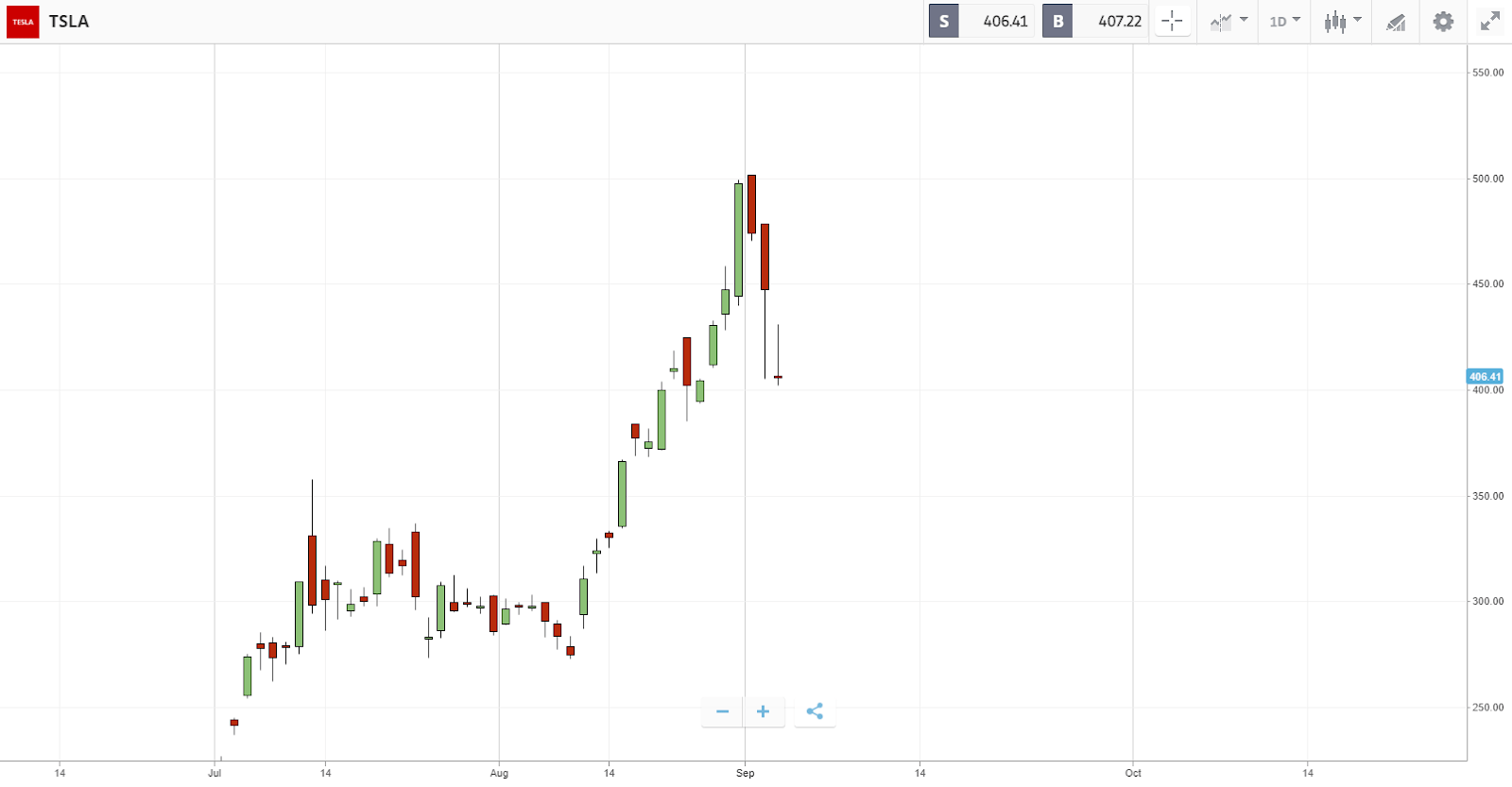

Tesla Loses Its Spark

Following several months of mammoth gains, Tesla stocks have fallen over the past week. Dipping by as much as 15%, the Elon Musk helmed company is said to have been impacted by the actions of Baillie Gifford, an Edinburgh-based investment firm looking to cut its stake to take a profit, and from the general uncertainty fueled by the company’s plans to sell up to $5bn in stocks to boost their capital. Despite this recent drop, Tesla stocks continue to be a golden goose for long-term investors, with its one-month return at 74% and its year-to-date return at a massive 468%.

What’s in Store for the Market this Week?

Following some big market moves coming in September, the week ahead will be the true litmus test for whether stock values will continue to rise or fall. The recent drops, especially in the tech sector, may just be a natural retracement following rapid increases in value, or a more ominous sign of things to come.

Cautious investors will likely be using this time to sit back and watch for any developing weekly trends that could signal whether this is just a bump in the road or the beginning of a bear market, while others may see this as a chance to increase their portfolios at ‘bargain’ prices.

Your capital is at risk.