October is Cybersecurity Awareness Month.

Now, in its 18th year, Cybersecurity Awareness Month is a collaboration between the US government and the National Cyber Security Alliance (NCSA), designed to raise awareness about the importance of cyber protection, and ensure that every individual is safe and secure online.

The theme for Cybersecurity Awareness Month 2021 is “Do Your Part. #BeCyberSmart.” This theme aims to empower individuals and organisations to own their role in protecting their part of cyberspace.

The importance of cybersecurity today

It is not hard to see why governments and industry bodies are strongly promoting cybersecurity today. The reality is that cybercriminals are an enormous threat to society. A serious problem for governments, businesses, and individuals alike, cybercrime is creating unprecedented economic damage around the world, and the costs associated with it are rising at an exponential rate.

This year, for example, cybercrime is predicted to inflict $6 trillion worth of damage globally, according to Cybersecurity Ventures. That is up from $3 trillion in 2015. Looking ahead, the global annual cost of cybercrime is expected to hit $10.5 trillion by 2025. That’s more than the total global trade of all major illegal drugs combined.

“Cybercrime is the greatest threat to every company in the world” – Ginni Rometty, Former Chair and CEO of IBM.

With cybercriminals increasingly more sophisticated in their approach, no one can afford to ignore cybersecurity today. It has become a cornerstone of human life, and is needed for every single connected device, whether a smart watch, a laptop, an electric vehicle, or a multimillion dollar piece of business machinery.

Why now could be a good time to consider cybersecurity stocks

For investors, there appears to be a big opportunity here.

In the current environment, in which many employees work remotely, companies are ramping up their spending on cybersecurity solutions in a big way. Businesses are aware that a breach can have massive ramifications — including loss of revenue, reputational damage, and regulatory fines — and are making cyber protection their number one priority.

This is benefitting companies that operate in the industry. For example, CrowdStrike, which combines advanced endpoint protection with expert intelligence to stop sophisticated cyber attacks, saw a 70% increase in revenue in the quarter ended July 31st, 2021. Meanwhile, Zscaler, which offers cloud security for enterprises, saw revenue growth of 57% in the same quarter.

It is worth noting that this spending is fairly “defensive” in nature. If economic conditions deteriorate, firms are still likely to spend heavily on cybersecurity. Businesses simply can’t afford to risk being attacked.

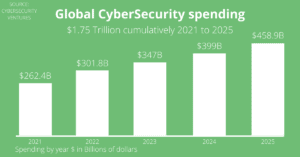

Looking ahead, spending on cybersecurity solutions is expected to continue to rise. Between now and 2025, annual spending is projected to rise from $262– $459 billion, with the total amount spent between 2021 and 2025 expected to exceed $1.75 trillion.

One key driver of future spending will be the growth of the cryptoasset market. While blockchain technology is generally very secure, breaches of digital wallets and exchanges are quite common. In 2020, hackers stole nearly $4 billion worth of crypto. With digital currencies growing in popularity, we can expect to see spending on blockchain-related cybersecurity rise.

This rise in spending on cybersecurity solutions is likely to provide massive tailwinds for those in the industry in the coming years.

Source: https://cybersecurityventures.com/cybersecurity-spending-2021-2025/

However, investing in cybersecurity stocks can be a little tricky. This is due to the fact that the industry is extremely dynamic and tends to shift course as cyber threats evolve. In other areas of technology, companies can take charge of their own destiny by continually improving their products or services over time. However, in the cybersecurity industry, it is the threats themselves that often dictate the roadmap. This means it can be hard to build a sustainable competitive advantage.

The best approach for investors, therefore, is to spread capital across a wide range of companies in order to obtain broad exposure to the industry. This minimises the risk of investing in an industry laggard.

The easy way to invest in cybersecurity stocks

Those looking to allocate capital to this high-growth industry may wish to consider eToro’s CyberSecurity Smart Portfolio. This is a fully allocated investment portfolio that provides exposure to a range of leading cybersecurity companies.

There are two main advantages of investing through this Smart Portfolio. The first is that you can instantly gain diversified exposure to the industry. With just one click, you can gain access to a vast range of top cybersecurity companies including Fortinet, Crowdstrike, Palo Alto Networks, Zscaler, and Cloudflare.

The second is that you may be able to minimise your stock-specific risk. In total, the portfolio contains nearly 30 cybersecurity stocks, meaning that if one or two of these stocks underperforms going forward, overall performance may not be impacted significantly.

With governments, businesses, and individuals making cyber protection a top priority, cybersecurity stocks look well placed for strong growth in the years ahead. eToro’s CyberSecurity Smart Portfolio represents an innovative and cost-effective way to capitalise on the growth of the industry.

Your capital is at risk.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.