In recent days, we’ve taken a peek into the portfolios of the world’s most successful investors. Each quarter, institutions managing more than $100 million “show their hand” through a form 13-F, which documents what they bought and sold in the past three months.

These reports provide insight into their thinking and show where the so-called “smart money” is moving. But they don’t serve as a step-by-step, more like a compass that helps experienced investors spot trends, identify opportunities and rethink their strategies.

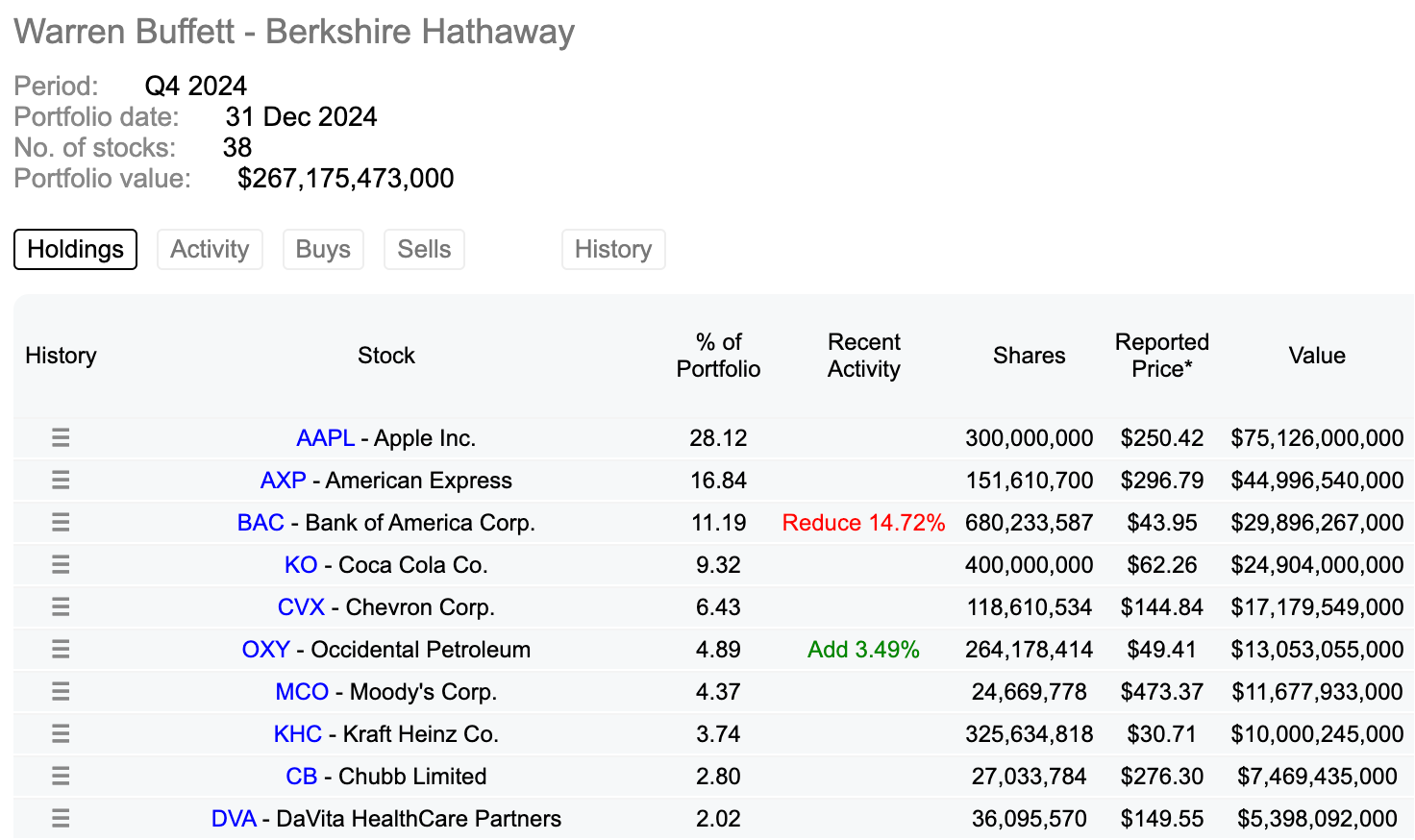

Warren Buffet is Adding to the Cash Pile

“The Oracle of Omaha” Warren Buffett needs no introduction. As a value investor, he seeks out fundamentally strong companies with a competitive advantage that are trading below their intrinsic value. Buffett is famous for his long-term holdings of stocks, which confirms his belief in owning quality companies. He has held American Express stock since 1984, Coca-Cola since 1988, and Moody’s since 2000.

His most significant move in recent years has been building a giant position in Apple, which has become Berkshire’s largest holding. In recent quarters, however, Buffett has begun to sell Apple, stoking fears of slowing innovation and growth. When Buffett moves, investors follow.

Warren Buffet Top 10 Holdings (dataroma.com)

In Q4, Buffett reduced his holdings in financial stocks. He reduced Bank of America, one of his largest holdings, and cut his stake in Capital One Financial and Citigroup. However, he kept American Express, which makes up 16.8% of Berkshire’s portfolio.

In terms of purchases, Buffett continued to snap up his favorite, Occidental Petroleum. Outside of the energy sector, Buffett surprised with investments in consumer stocks. He nearly doubled his stake in Domino’s Pizza and increased his stake in Pool Corp. by 50%. New additions to Berkshire’s portfolio also include Constellation Brands, the giant behind brands like Corona, Modelo and other popular beverages.

What’s interesting lately, however, is not what Buffett is buying, but rather that he’s not buying. Berkshire Hathaway’s cash reserve has grown to a record $325.2 billion!

Check out Warren Buffett’s portfolio on eToro!

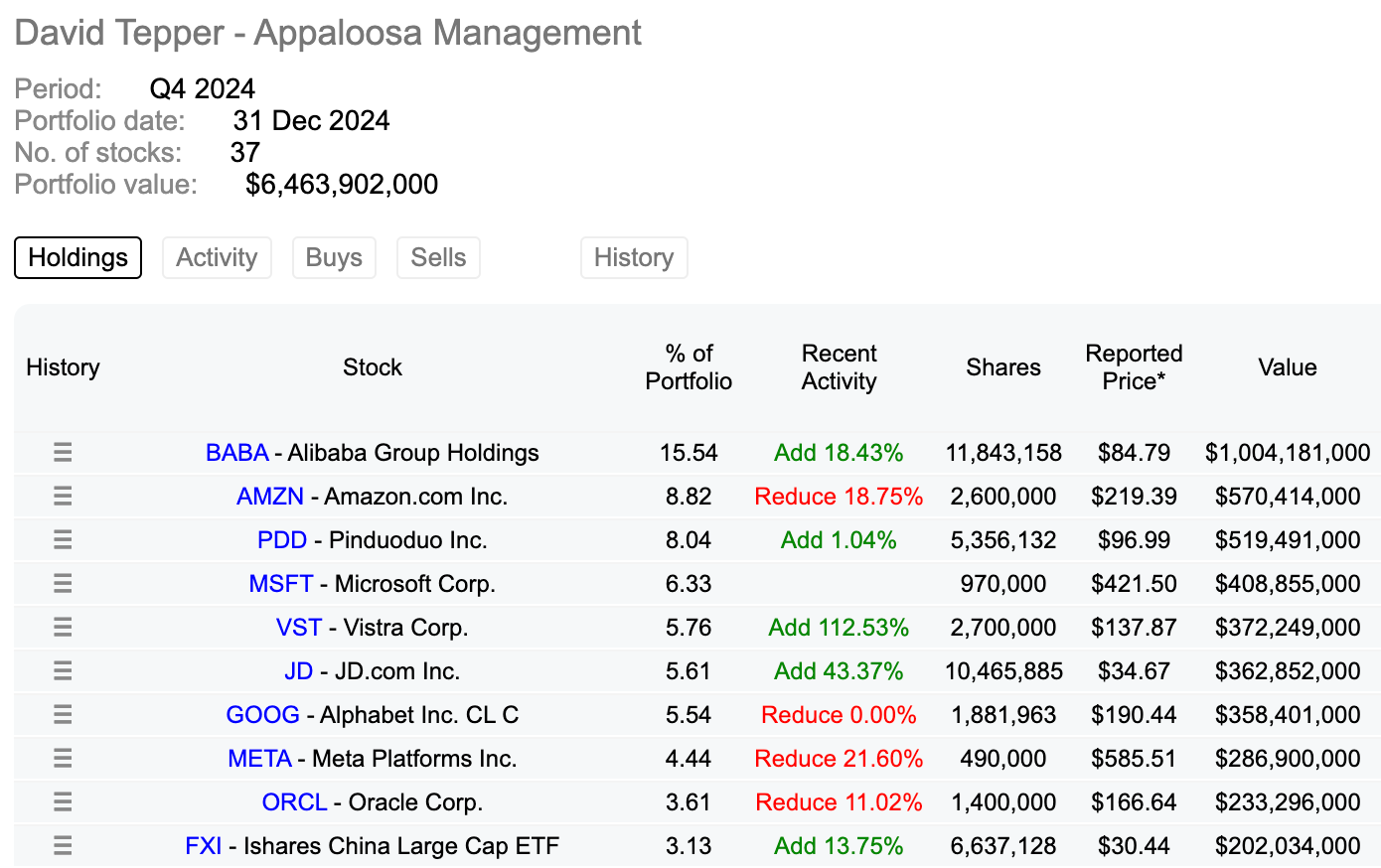

David Tepper Doubles Down on Chinese AI

Tepper is the billionaire founder of Appaloosa Management, a hedge fund known for its aggressive investment style. His strategy combines deep fundamental analysis with a macroeconomic approach. He often makes bold bets on sectors or companies that other investors avoid. This makes him one of the most respected investors on Wall Street.

David Tepper Top 10 Holdings (dataroma.com)

David Tepper is very bullish on AI-and his portfolio proves it. Nine of his top ten positions are related to the AI revolution. In Q4, Tepper increased his position in Vistra, a major energy supplier in Texas, which has become a key area for data center construction.

He’s betting big on China – where Alibaba is his biggest position. He upped it by 18%, pushing it past the $1 billion mark. Alibaba is investing heavily in AI and recently announced that its latest model, Qwen2.5-Max, can outperform both GPT-4o and DeepSeek-V3-a bold claim that underscores its ambitions in the AI race.

Tepper also doubled his stake in ASML, the Dutch chipmaking industry giant. He also significantly increased his investments in NRG Energy and Expand Energy, further bolstering his bullish bet on energy infrastructure for AI development.

On the other hand, Tepper partially reduced stakes in Amazon and Meta, but added to Nvidia. Does this mean the potential of the “Magnificent 7” is changing?

Tepper’s recent deals show a strong focus on AI, energy and China, suggesting he sees a big opportunity in the AI revolution.

Ray Dalio’s Bets on Broad Growth

Ray Dalio is the founder of Bridgewater Associates, one of the largest hedge funds in the world. He employs a macro-focused, risk-balanced strategy. He is a big believer in diversification and his views on global economic trends are highly respected.

Ray Dalio Top 10 Holdings (gurufocus.com)

Although he owns more than 800 different stocks in his portfolio, he has made some interesting changes.One of the most notable bets this quarter is energy. Dalio doubled his positions in Vistra and Constellation Energy, likely buying the dip caused by DeepSeek.

At the same time, he trimmed his investments in the “Magnificent Seven”-reducing his stakes in Google, Meta, Amazon, and Microsoft by about 20%.

Conversely, he doubled his holdings in PayPal and Salesforce and massively increased his investment in AT&T by 400%- is he seeing hidden value in the telecom? Beyond that, he bet on the tobacco sector. He increased his stake in Altria by 85% and in British American Tobacco by as much as 260%.

Dalio’s trades confirm the narrative that energy companies may be the hidden winners of the AI revolution. His reduction of the “Magnificent Seven” is also interesting.

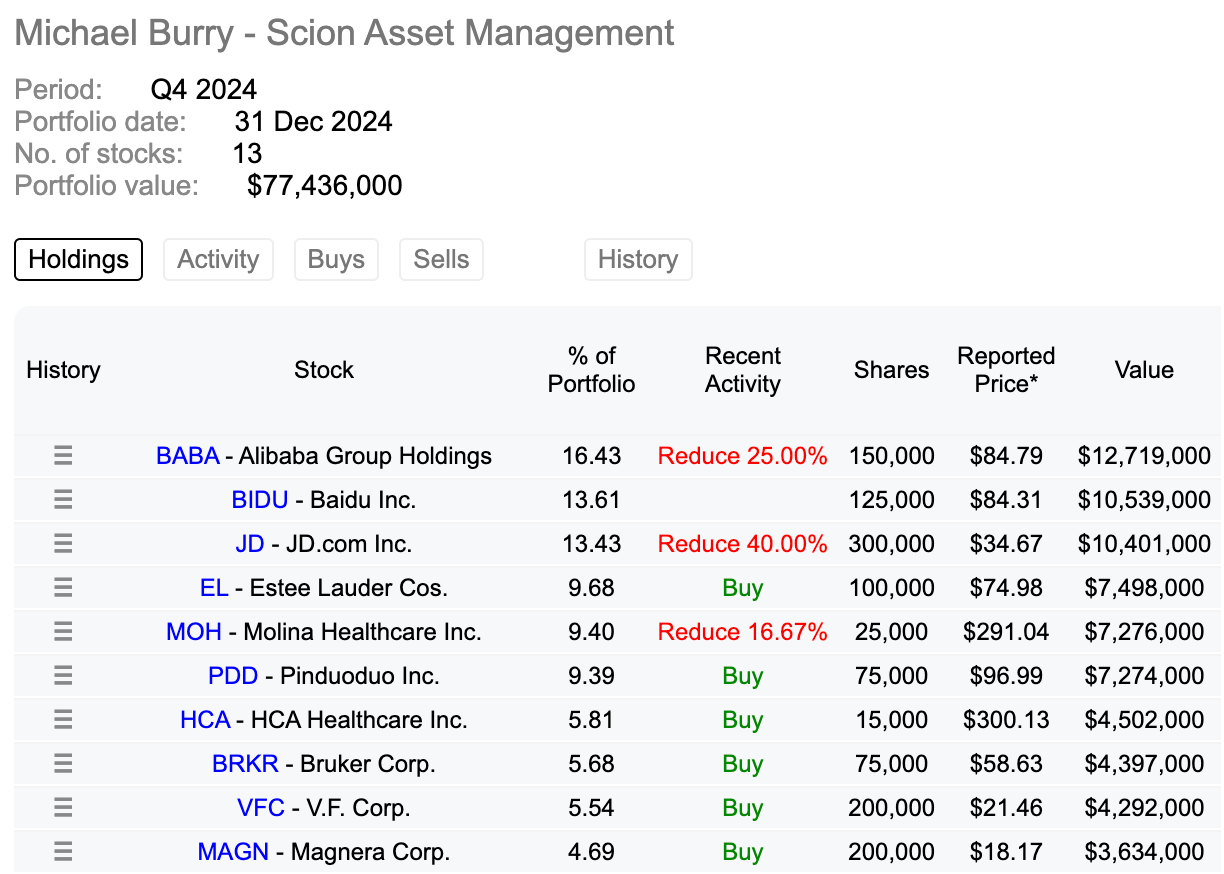

Michael Burry Exits Chinese Bets

Michael Burry, best known for “The Big Short”, gained worldwide attention by predicting and profiting from the 2008 real estate crash. Burry is a fundamental investor focusing on undervalued and overlooked assets. His trades attract considerable attention because of his unconventional view of the market.

Michael Burry Top 10 Holdings (dataroma.com)

Burry is known for its rapid portfolio changes-and Q4 was no exception. This time he significantly reduced his exposure to Chinese stocks Alibaba and JD, signaling a move away from companies he previously trusted.

Burry is known for his rapid-fire portfolio changes—and Q4 was no exception. This time, he massively reduced his exposure to Alibaba and JD, signaling a shift away from firms he had previously bet on.

Instead, he bet on Estée Lauder, China’s Pinduoduo, and HCA Healthcare. Burry’s trades are typically short-term, tactical bets aimed at taking advantage of market anomalies, rather than long-term investments. Given his track record of spotting mispriced assets—like the infamous housing bubble short—his moves often catch investors’ attention.

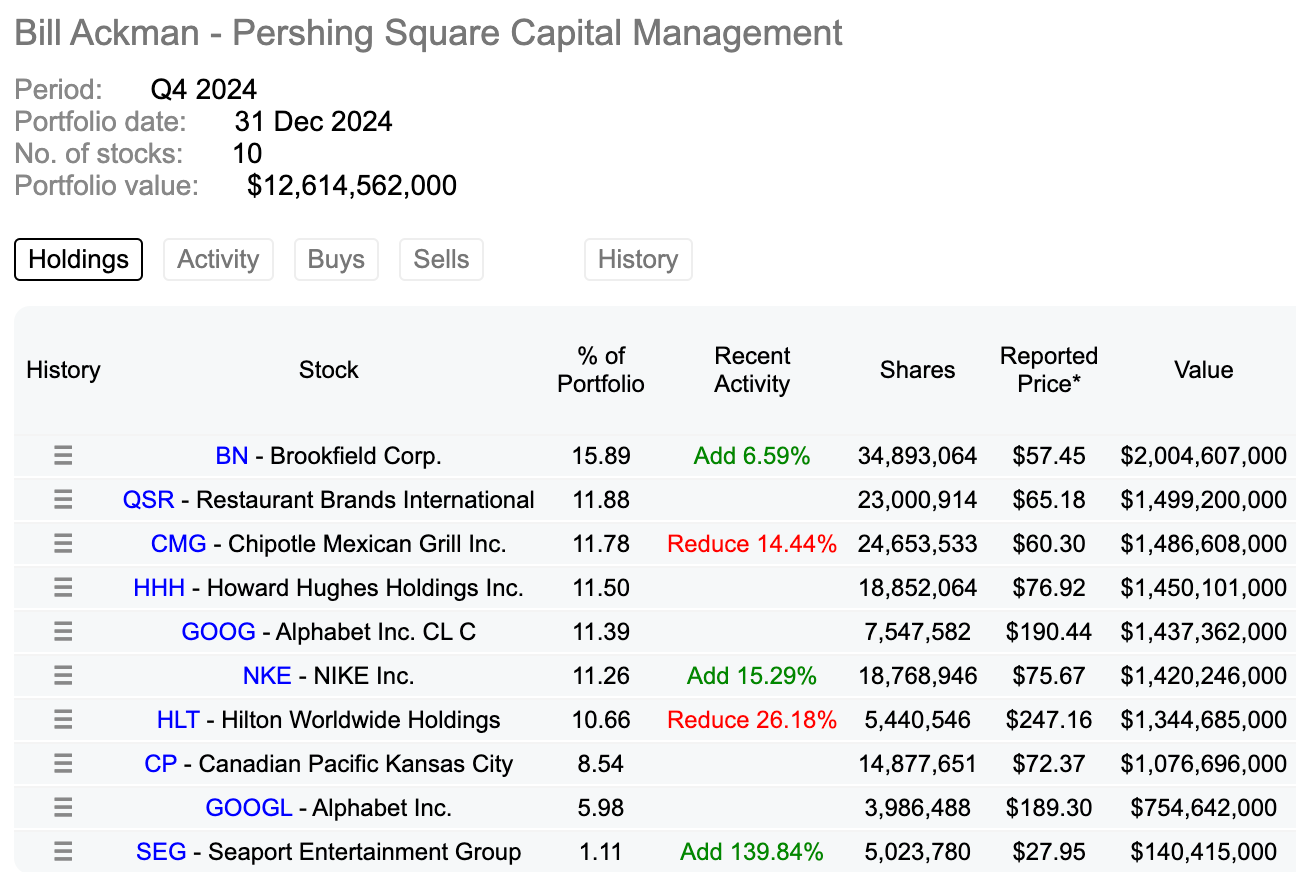

Bill Ackmann Suprised Markets With Aggressive Bets

Bill Ackman is an activist investor, meaning he doesn’t just buy stocks, he buys influence. His strategy often involves taking large positions in companies and pushing for changes to improve shareholder value.

Bill Ackman Top 10 Holdings (dataroma.com)

In Q4, Ackman made some notable moves, adding to his stakes in BN, Nike, and Seaport while continuing to trim his positions in Hilton and Chipotle—both of which have been massive winners for him over the years.

But the biggest headline? A huge $2.3 billion stake in Uber. Ackman is bullish on the ride-hailing and delivery giant, calling it “one of the best-managed and highest-quality businesses in the world.” He believes Uber is trading at a massive discount to its intrinsic value.

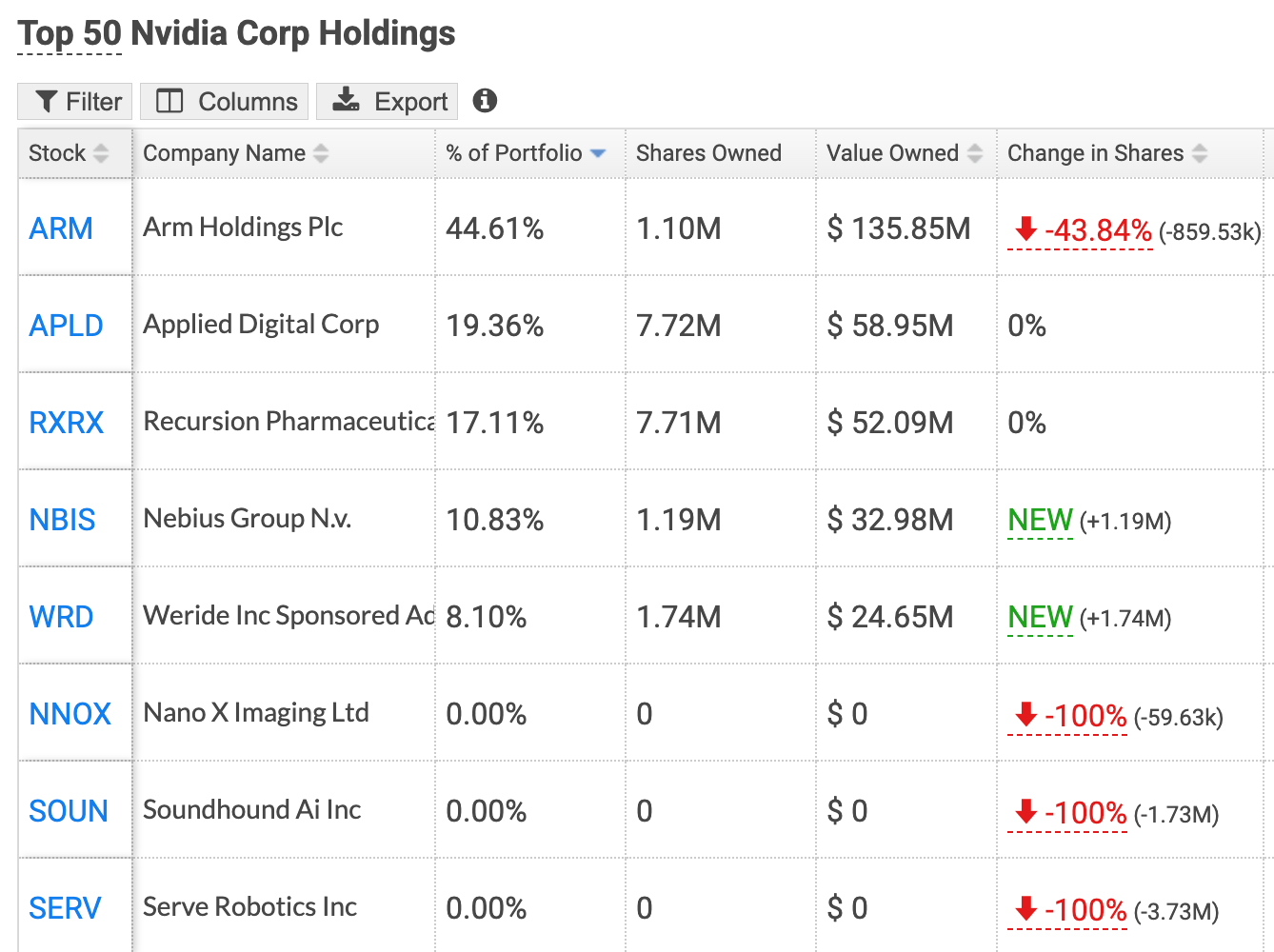

Nvidia Is Changing Course

Yes, you read that right—Nvidia isn’t just selling chips, but also actively investing. It is strategically investing in small companies, especially in the AI space. And when Nvidia changes course, the market takes notice – often in a big way.

Nvidia Top 10 Holdings (hedgefollow.com)

In Q4, Nvidia slashed its stakes in four AI companies:

- ARM (-3% after the release)

- SoundHound (-30% after the relese)

- Nano-X (-12% after the relese)

- Serve Robotics (-43% after the relese)

Each of these stocks took a hit after the news broke, but it’s worth noting that they had already experienced massive rallies over the past year—SoundHound, for example, had surged by hundreds of percent. Whether Nvidia is losing interest in their business models or simply locking in profits, the cuts signal a shift in its focus. So where is Nvidia moving its money now? Self-driving technology. The chip giant made fresh investments in:

- Nebius Group, an AI infrastructure company

- WeRide, a Chinese self-driving tech startup

With autonomous vehicles expected to be a $2 trillion industry by the end of the decade, Nvidia seems to be positioning itself at the center of this transformation. While the company’s core business remains in AI hardware, its investment moves suggest a long-term bet on AI-driven mobility and transportation.

You know what they say—”money never sleeps,” and neither do these top investors. With market tides shifting rapidly in recent weeks, it’s more important than ever to evaluate your holdings and spot opportunities—or risks—before they unfold.

While 13-F filings are not a step-by-step guide, they offer a roadmap for where some of the sharpest minds in investing see value. Whether it’s Buffett hoarding cash, Tepper doubling down on AI, or Ackman making a bold move into Uber, these filings can provide a starting point for your research.

After all, if the smartest money in the game is moving, shouldn’t we be paying attention?

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.