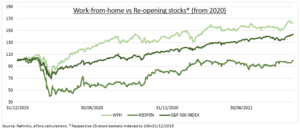

SIGNS OF LIFE: ‘Re-opening’ stocks should accelerate. Attention focused on car rental this week, as Avis (CAR) share price doubled after strong results. But all should benefit as 1) virus cases have plunged 55% from September peak. 2) There is plenty of room for lockdown restrictions to ease. The US ‘stringency’ index is at 56 versus a pre-pandemic zero and high of 75. 800,000 daily vaccinations to pick up with vaccine mandates. 3) The economy is rebounding. Atlanta Fed GDP NOWCast is at 8% growth vs 0% last quarter. These positives offset the higher oil hit for some, such as the airlines. Re-openers are out-of-favour, with depressed and recovering earnings, and cheap underlying valuations.

WFH RISKS: Reopener earnings are recovering fast, but still 65% below pre-crisis. A full recovery would put them under the 15x P/E valuation they traded then. By contrast, work-from-home (WFH) stock are on 26x, with earnings 40% above pre-crisis. This makes WFH vulnerable to disappointment. See Peloton (PTON) and Activision (ATVI).

OUR INDEX: Our 15-stock ‘Reopening’ basket includes airlines, cruises, car hire, hotels, casinos. From Boeing (BA) to Marriot (MAR). ‘Work-from-home’ is gaming, home improvement, e-commerce, data centres. From Activision (ATVI) to Zoom (ZM).

TODAY: US employment report to see a part-recovery from last month’s 194,000 jobs shock. Forecast is for 450,000 new jobs, 4.7% unemployment, and 4.9% wage growth.

All data, figures & charts are valid as of 04/11/2021