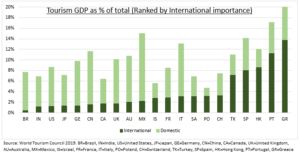

REBOUND: Global travel is rebounding on pent-up demand, lower virus cases and restrictions, and is a relative haven to current market volatility. This may drive ‘the biggest summer of travel of our lifetime, led by international travel that has only regained a fraction of domestic travel. Leisure is four-fifths of travel and tourism spending, which is over 10% of global GDP. This is a boost to bigger economies, from Spain to Greece (see chart), and ‘reopener’ stocks from JETS to @TravelKit. It is existential for many smaller countries, from Maldives to Macau, at 50%+ GDP.

COSTLIER: But the summer holiday is going to cost more. Average US airfares rose 19% in last week’s inflation report as demand outpaces tight capacity, and with $110 oil prices. Similarly average US hotel room prices are rising at double-digit rates. Car rental leaders Avis (CAR) and Hertz (HTZ) reported 21-28% Q1 increases in rental day rates. These are well over 8% inflation, but likely to be paid with labour markets tight and consumers with large accumulated savings.

STOCKS: Broad recovery exposure is possible through ETFs like JETS (US airlines), and smart portfolio @TravelKit (47 gaming, cruise lines, travel booking, and airline stocks). A DIY portfolio could be owned. For example, hotels like Hyatt (H), Melia (MEL.MC), cruisers Royal Caribbean (RCL), Carnival (CCL/.L), and booking sites Airbnb (ABNB), Booking Holdings. (BKNG). Tourism focused economies like Mexico (EWW) and Spain (ESP35) will also benefit.

All data, figures & charts are valid as of 18/05/2022