Hi Everyone,

The economic landscape has undergone a radical swing from an expected recession to a somewhat stable footing in a very short time.

In his speech yesterday the Chairman of the US Federal Reserve, AKA the man who controls most of the money on the planet, explained how the economy is now on a path to solid growth. This is a radical change in tone from just last month when the Fed cut their interest rates due to uncertainty ahead.

If forecasting the economy is like forecasting the weather, we’ve gone from winter to summer in about two weeks. It boggles the brain and I don’t buy it!!

Let’s take a deeper look below…

Today’s Highlights

- The Surface Example (Individual economies)

- Behind the Scenes (Yield curve uninversion)

- The Tech Case (What Disney+ Tells Us)

Traditional Markets

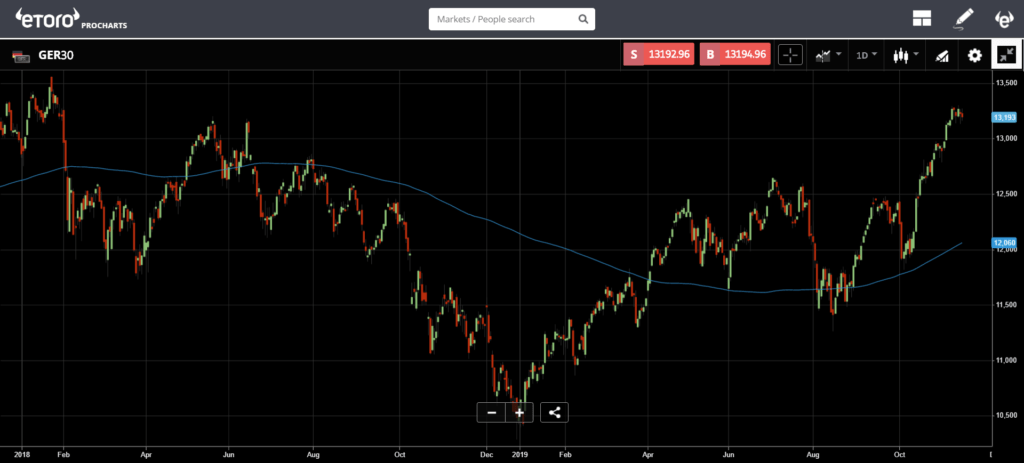

Following on the heels of Great Britain, Germany produced some slightly reassuring data this morning showing 0.1% growth in their economy thus narrowly avoiding an official recession.

The ‘return to growth’ celebration is without much joy however as the country’s economy is still considered to be quite fragile. What’s more, it still faces a major headwind as President Trump’s trade war increasingly focuses on Europe’s automotive exports.

The GDP data out this morning is possibly the worst thing that could have happened. Had the number come in negative as economists had forecasted by analysts, there would have been a strong case for the Government to come in with a strong hand and provide generous stimulus measures.

It’s apparent that the DAX index is having trouble rallying on the news because they’re quite familiar with the dilemma that this unexpected growth presents. But what’s more interesting is the rally we’ve seen in the last few weeks leading up to this moment that has the index very close to its all-time highest level.

Behind the Scenes

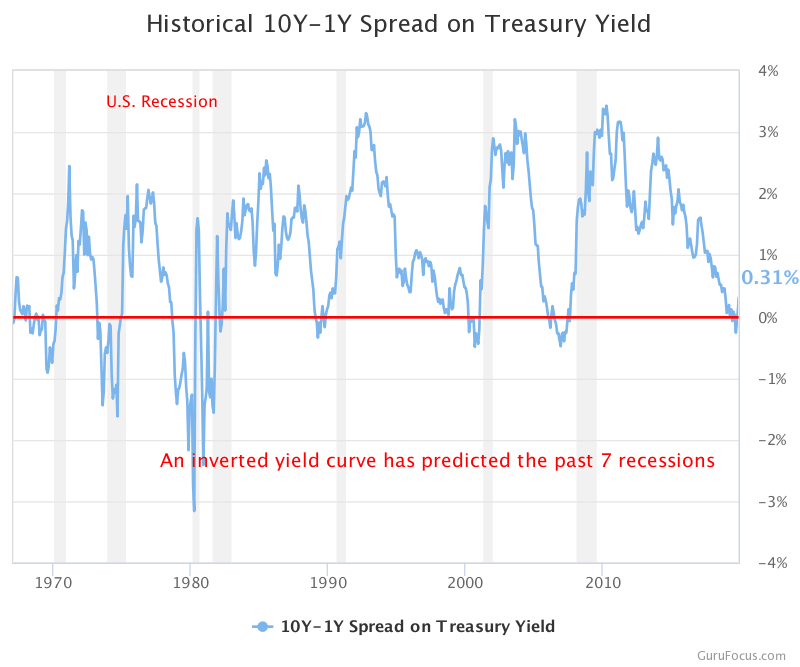

Where did these whispers of a recession come from in the first place though?

Well, most analysts who were predicting doom based their projections on the yield curve. The fact that short term bonds were paying more than long term ones was a clear indication that institutional traders were forecasting trouble ahead.

Now that the yield curve is positive again, does that mean we’re in the clear?

Heck no!!

Over the last century, every time the yield curve went negative it was followed by a recession. Check the red words embedded permanently on this chart.

Indeed, we can plainly see that every time the blue line went below 0%, it was followed by a recession. Not always immediately though. Most conspicuously, the curve was inverted from January 2006 to July 2007 and was well into positive territory by the time the 2008 crisis hit.

Is this a guarantee of troubled times ahead?

Absolutely not. The central banks seem to think we’re all good now and stock markets are testing new record highs, so clearly some traders are content with this sudden recovery narrative. After all, just because a yield curve inversion has preceded seven out of the last seven recessions doesn’t mean it will happen again.

There’s no doubt that we’re deep into new territory and witnessing an economic condition that’s never happened before. Prolonged stimulus, artificially suppressed interest rates, and now a significant amount of negative-yielding bonds, this simply has never happened before so it’s kind of hard to know what to expect.

The Tech Case

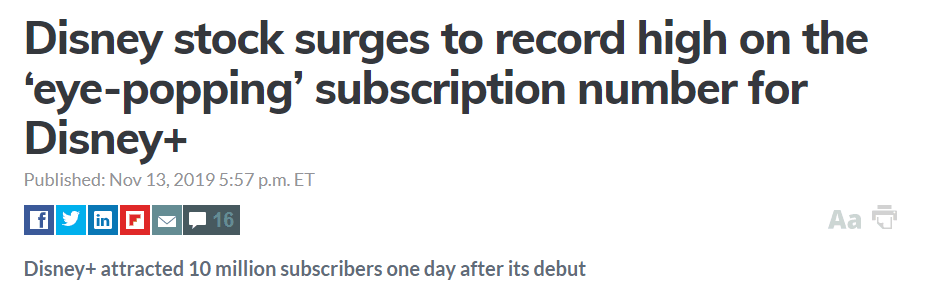

We’re also in an interesting inflection point as far as technology is concerned. This story has been generating a lot of buzz and has me thinking as well…

Sure, what parent on this planet wouldn’t pay seven bucks a month for easy access to all of Disney’s content? Just think of the titles Pixar, Marvel, Star Wars, the Simpsons, all the princesses. :O

The bigger question in my mind is where those $7 from each person is going to come from?

Netflix hasn’t lowered its prices and it doesn’t seem likely that people will unsubscribe from them any time soon. Furthermore, virtually none of that stimulus money mentioned above is being funneled into personal home entertainment budgets.

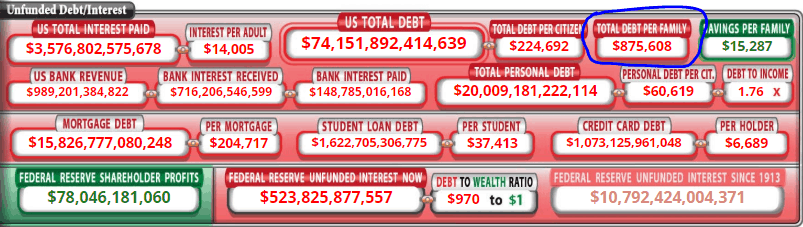

Money going into Disney stock is easily explained and can easily be willed into existence from the Fed’s magic lamp, but money for subscriptions needs to come from somewhere. Oh, right… there it is!!

Don’t get me wrong, nobody will be more delighted to see the economy pull through this and to be cleared. My personal portfolio will perform much better if it does.

HUGE thanks to everyone for reading!! Your awesome daily feedbacks, insights, and amazing questions are what inspire me to continue writing. So please keep it coming.

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.