Hi Everyone,

Our hearts go out to all those affected by the devastating Hurricane Dorian.

Many times these type of events trigger a rush of people who are interested in helping out but with all of the scammers out there these days it’s not always clear how to donate in a safe and secure manner.

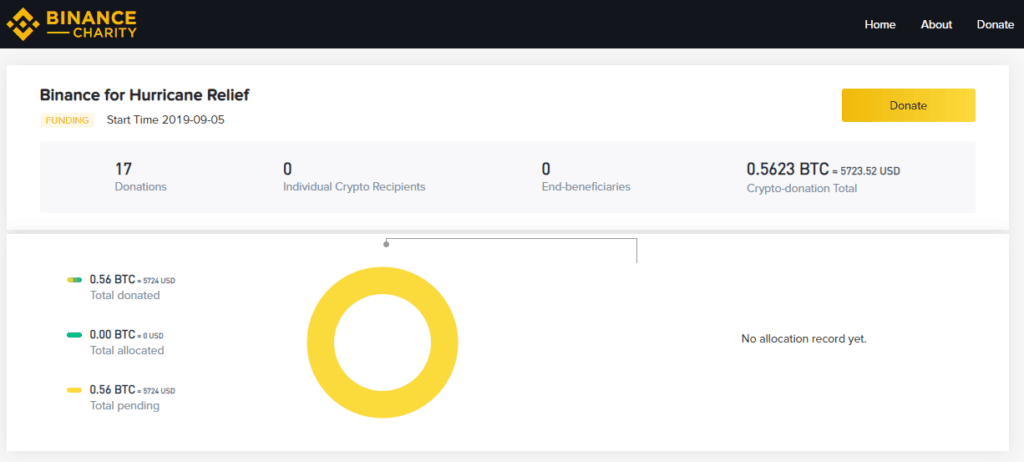

That’s why some crypto exchanges have stepped up to allow their clients to contribute to the victims directly.

The open-source nature of cryptocurrencies is a perfect solution for this issue as it allows people to track the funds they’ve sent and hold accountable those who are collecting on behalf of the victims.

Progress is slow so far but Binance has already managed to collect 0.5623 BTC over the last few hours since announcing the program.

Today’s Highlights

- Easy Going China

- Prince Minister

- BTC Rising Fundamentals

Traditional Markets

A lukewarm jobs report from the USA out on Friday has many analysts upping their conviction that the Federal Reserve Bank will once again cut their interest rates when they meet again on September 18th.

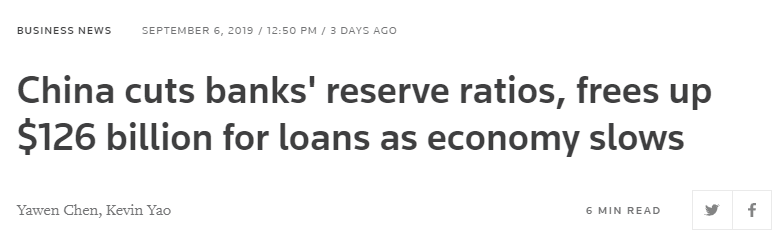

Not to be outpaced in the currency war, the People’s Bank of China has now stepped in with its own form of stimulus for China’s banks.

Explanation: In the current financial system known as ‘fractional reserve banking’ each bank is required to hold a certain amount of cash in their reserves for every dollar, or in this case yuan, they lend out.

As of September 16th, that ratio will be the lowest level China has seen since before the financial crisis.

Per the headline above, that means banks will be able to spend about $126 billion in order to bolster the economy.

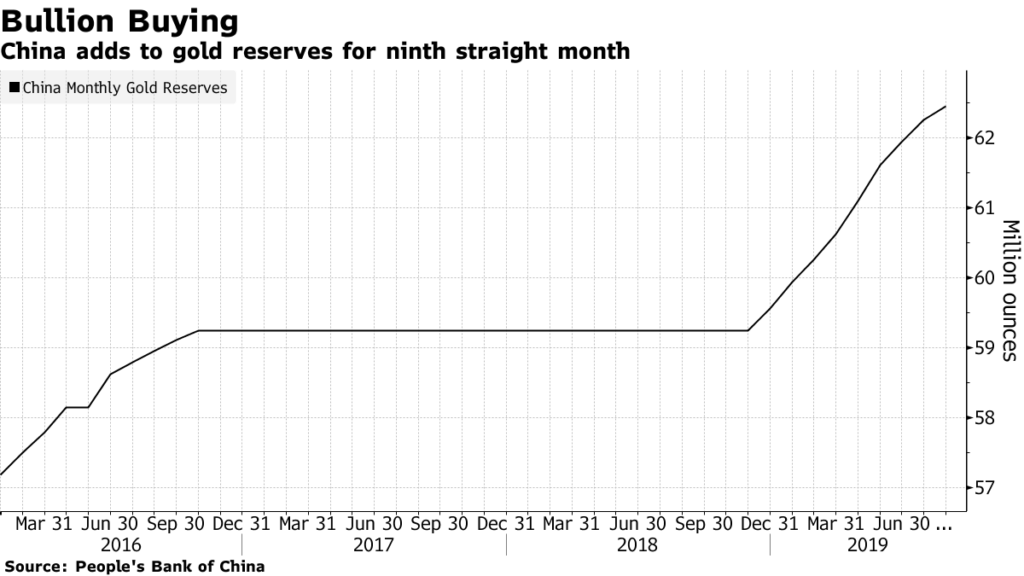

Almost concurrently, China is also stocking up on gold. I wonder why…

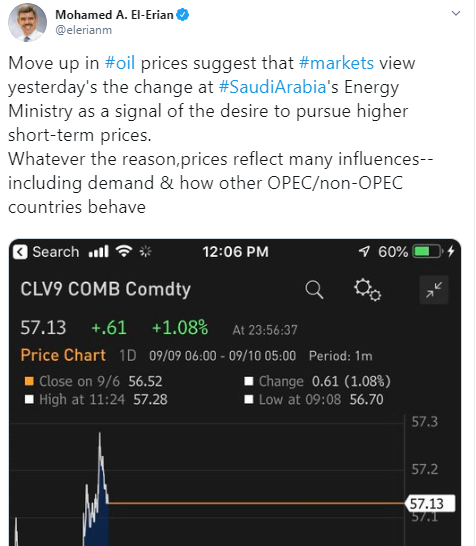

New Prince Oil Minister

So, King Salman has appointed a new official to replace him. This person is a bit closer to the King’s scepter, his brother. That’s right. For the first time in the Kingdom’s history, a Prince is now the Minister of Energy.

According to people who know him, Prince Abdulaziz is very knowledgeable in the markets and has a very decisive character. However, KSA’s policy regarding oil production is not likely to change much.Some analysts have pointed out however, that the market reaction is pretty telling of what this move might indicate.

BTC Rising Fundamentals

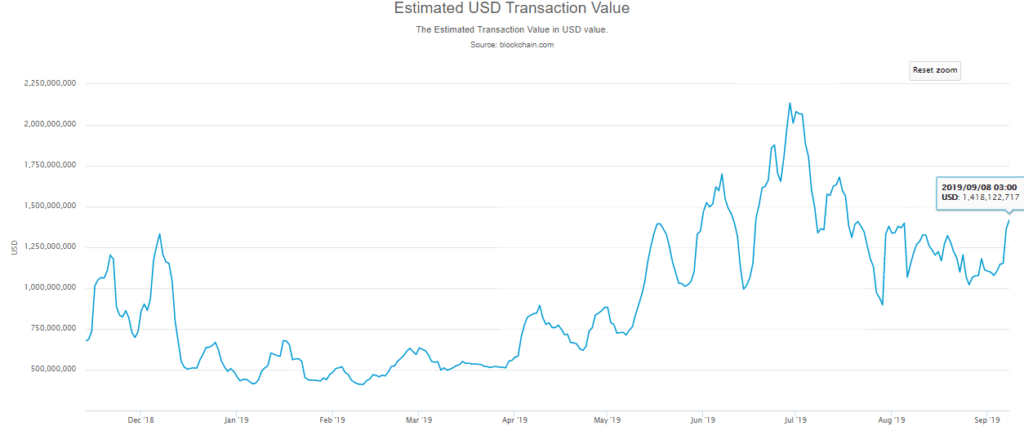

The crypto markets have been rather stagnant on the surface lately yet it seems that some of the fundamentals have been creeping up on us.

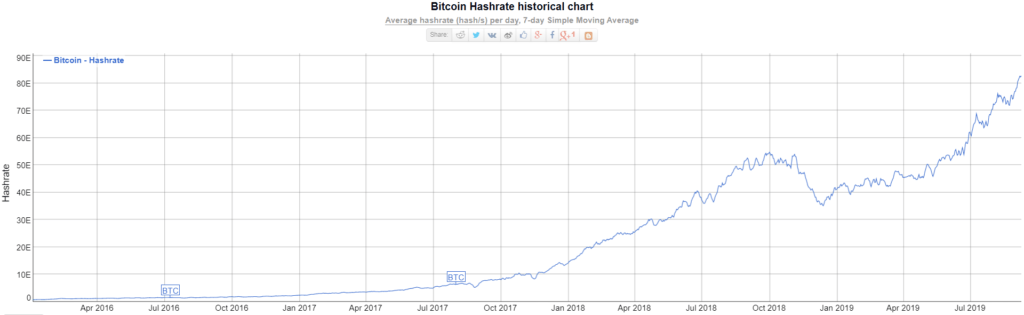

One of the most obvious metrics that many have ignored is bitcoin’s hashrate, which continues to stretch higher and higher into uncharted territory. The amount of computing power securing the bitcoin network is now approximately 6 times stronger than it was when bitcoin’s price reached its all-time high in December of 2017.

Still, the technical setup displayed on the chart is a rather bearish one. So it will be interesting to see how this controversy might be reconciled.

Musical inspiration for today’s daily market update comes from the only true Prince.

https://www.youtube.com/watch?

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.