Major Developments for the Week

- MicroStrategy buys $786M Bitcoin

- Cosmos DAO Osmosis introduces a fee-free Bitcoin bridge

- Ronin Network unveils permissionless zkEVM

- Standard Chartered opens Bitcoin and Ethereum trading desk

- Fidelity seeds $4.7 million in Ethereum ETF

- Fetch.ai and AI-related tokens surge as Nvidia peaks

- Uniswap‘s crypto game earns Emmy nomination

- Synthetix is live on Arbitrum

Bitcoin

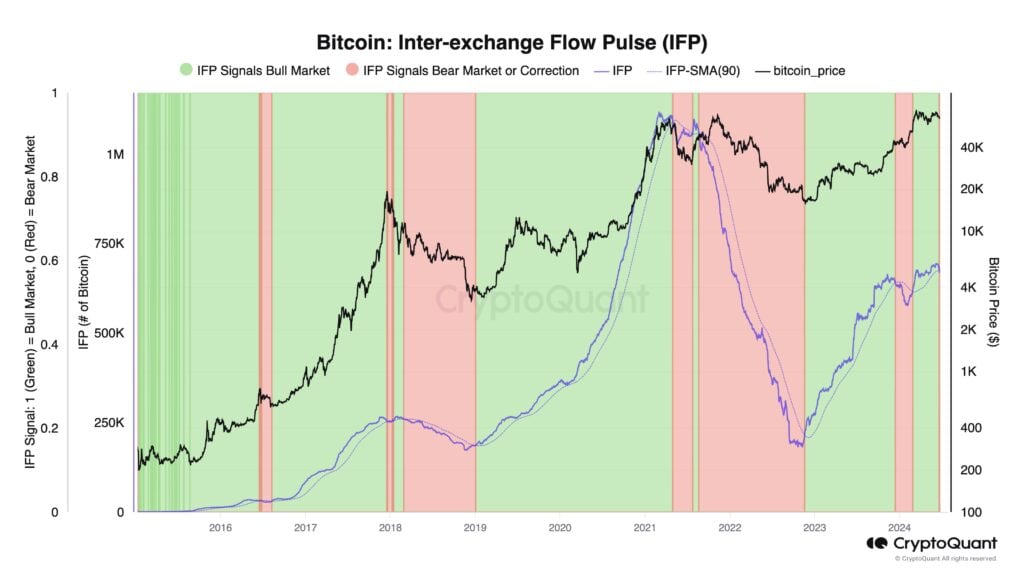

Bitcoin’s Price Dynamics and Whale Transactions

While Bitcoin‘s price recently dipped below $60,000, nearing a critical support level, large-scale investors, often referred to as “whales,” are playing a significant role in the market. These big buyers seem to be stabilizing prices during downturns, indicating they might be strategically accumulating more Bitcoin. This behavior is essential for predicting short-term market trends and understanding the broader sentiments that drive major price movements in the cryptocurrency market.

Past performance is not an indication of future results

CleanSpark’s Strategic Acquisition in Bitcoin Mining

CleanSpark, a leader in sustainable energy for Bitcoin mining, has expanded its operations with a $25.6 million acquisition of new facilities. This expansion boosts CleanSpark’s mining capacity and highlights the increasing trend of using renewable energy in cryptocurrency mining. By enhancing their ability to mine Bitcoin more sustainably, CleanSpark aligns with global efforts to promote environmentally responsible crypto mining practices.

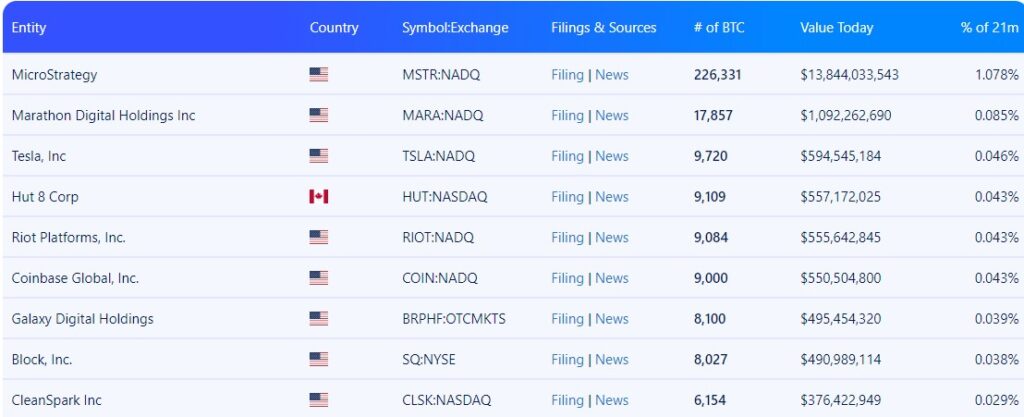

MicroStrategy’s Massive Bitcoin Acquisition

MicroStrategy has made another significant investment in Bitcoin, purchasing an additional $786 million worth. Despite recent market fluctuations, this move underscores the company’s strong belief in Bitcoin as a valuable asset. This purchase significantly increases MicroStrategy’s Bitcoin holdings, further linking the company’s financial performance to Bitcoin’s market behavior.

The Top 10 Public Companies That Own Bitcoin

For those looking to invest in Bitcoin, eToro’s @BitcoinWorldWide Smart Portfolio offers a diversified approach focused on Bitcoin. This portfolio benefits from substantial institutional investments, which could support Bitcoin’s broader adoption and stability in the market.

Smart Contract Platforms

Cosmos’ Osmosis DAO Innovates with Fee-Free Bitcoin Bridge

The Cosmos DAO, known as Osmosis, is introducing an innovative fee-free bridge for Bitcoin transactions. This new development aims to make transactions faster and cheaper, making the Cosmos network more appealing to developers and users who want affordable blockchain solutions.

Ronin Network Steps into zkEVM Arena

The Ronin Network has unveiled its new permissionless zkEVM, which promises to enhance scalability and privacy for its users. This move is in line with the rising trend of Layer 2 solutions designed to overcome the limitations of Ethereum’s main chain, such as speed and transaction costs.

eToro’s @Scalable-Crypto Smart Portfolio aims to take advantage of the growth potential of such scalable blockchain solutions as Cosmos and Ronin. These solutions are crucial for the widespread adoption of blockchain technology across different industries.

DeFi and TradFi

Standard Chartered Launches Crypto Trading Desk

Standard Chartered Bank has started a new trading desk for Bitcoin and Ethereum. This move shows the growing interest and acceptance of cryptocurrencies in traditional finance. It may also encourage other financial institutions to include crypto options in their services.

Fidelity’s Bold Move into Ethereum ETFs

Fidelity Investments has made a notable $4.7 million investment in a future Ethereum ETF. This decision demonstrates Fidelity’s strong commitment to the crypto market and supports the potential growth of Ethereum in the financial world.

eToro’s @DeFiPortfolio Smart Portfolio is designed to benefit from the combination of decentralized finance (DeFi) and traditional finance (TradFi). This is especially relevant as major financial players like Standard Chartered and Fidelity start to embrace cryptocurrencies.

Web3

AI Tokens Surge Led by Fetch.ai

AI-related cryptocurrencies are on the rise, with Fetch.ai leading the pack. This surge is happening as Nvidia becomes the world’s most valuable company, thanks to its focus on AI. The growing value of AI tokens highlights the strong connection between advances in AI technology and their use in blockchain.

Uniswap’s Gaming Innovation Earns Emmy Nod

Uniswap has made history with a crypto-based game that has been nominated for an Emmy. This groundbreaking nomination shows that the game’s innovative approach is gaining mainstream attention. It also highlights the increasing recognition of crypto platforms in the entertainment world.

eToro’s @Web3Applications Smart Portfolio offers a strategic investment opportunity that aligns with advancements in Web3 applications. It leverages the intersection of blockchain technology with sectors like AI and entertainment for potentially higher growth and broader adoption.