Could the smart contract platform replace Solana?

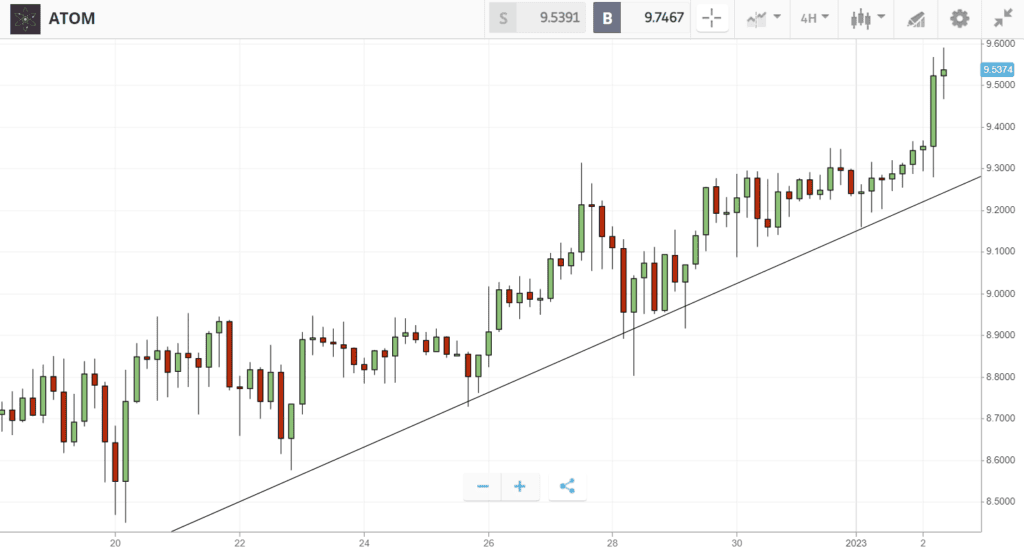

As investors bid farewell to a tumultuous year for crypto markets, Cosmos is celebrating with a 7% rally.

The smart contract platform dominated altcoin action this week, grabbing attention away from Bitcoin, which continues to tread water between $16K and $17K. This range has now been home to the leading cryptoasset for almost two months, as the market consolidates after one of the worst-performing years in crypto history. Although according to research, crypto prices have still held up relatively well compared to traditional markets.

Rivalling Cosmos, ApeCoin and Algorand have also made 7% weekly gains on new year optimism. Elsewhere, old favorite Litecoin is showing smaller percentage gains.

This Week’s Highlights

– Cosmos pops 7% as Solana drops 12%

– MicroStrategy doubles down on Bitcoin

Cosmos pops 7% as Solana drops 12%

Despite supportive comments from Ethereum founder Vitalik Buterin, Solana has fallen 12% over the last week amidst controversy around a recently collapsed crypto exchange.

Quick to seize the opportunity, other smart contract platforms are rushing to climb the market rankings. This includes Algorand and Cosmos, which both rose 7% as Solana sank.

In the coming year, some analysts expect that one of these smart contract platforms could surpass Solana to become Ethereum’s biggest rival.

MicroStrategy doubles down on Bitcoin

Much to the dismay of Bitcoin investors, American software company MicroStrategy disclosed on Wednesday that it had sold the cryptoasset for the first time

Yet the sale didn’t indicate loss of appetite for Bitcoin, as the firm immediately turned around and purchased 810 BTC on the same day in a maneuver that is thought to have generated a tax benefit.

Doubling down even further, MicroStrategy also announced last week that it will launch Lightning services in 2023 to “onboard millions” onto Bitcoin’s most popular Layer 2 network.

Week ahead

As we move into the new year, crypto investors are wondering whether brighter days could be ahead.

One indicator of this is growing US search volume for phrases such as ‘how to buy Bitcoin‘, which suggest recent conversations at Christmas and Thanksgiving festivities could have reignited interest in the market.

In the coming week, however, crypto prices are likely to be driven by critical US economic data. This includes the release of details from the Federal Reserve’s final policy meeting of 2022 on Wednesday, followed on Friday by the December jobs report.