Major Developments for the Week

- Bitcoin’s bull run continues, hits new all-time high of $93K

- Altcoin’s BTC-fueled momentum:

– Solana surges past $225 resistance

– Hedera Hashgraph rockets 60% this week; trading volume soars over 500%

– SUI up 19%; reaches new ATH, predictions suggest further increases

– NEAR Protocol rallies 41% this week, climbing from $5.17 to $6.02,

– Litecoin surges – up by 16.68% over the past week

– Bonk Inu jumps 112% over the past week: Traders bet on even higher gains

– Dogecoin rises, continues to shine amid market excitement - IBIT options trading launch: BlackRock’s BTC ETF expands horizons

- Regulatory clarity ahead?: Andreessen Horowitz sees a brighter future for U.S. crypto with clearer pathways emerging

- Innovations take center stage: ETHGlobal hackathon finalists showcase AI agents, crypto games, DAO tools, and more

- SEC faces legal pushback: Republican state attorneys general and DeFi lobby sue SEC over enforcement actions

Bitcoin hits new all-time high; Altcoins rally across the board

The cryptocurrency market is buzzing with activity as Bitcoin reaches unprecedented levels and altcoins ride the wave of bullish sentiment. BTC’s rally has positively influenced the broader crypto market, lifting altcoins and improving investor confidence – although traders should be wary of profit-taking, which could trigger short-term pullbacks.

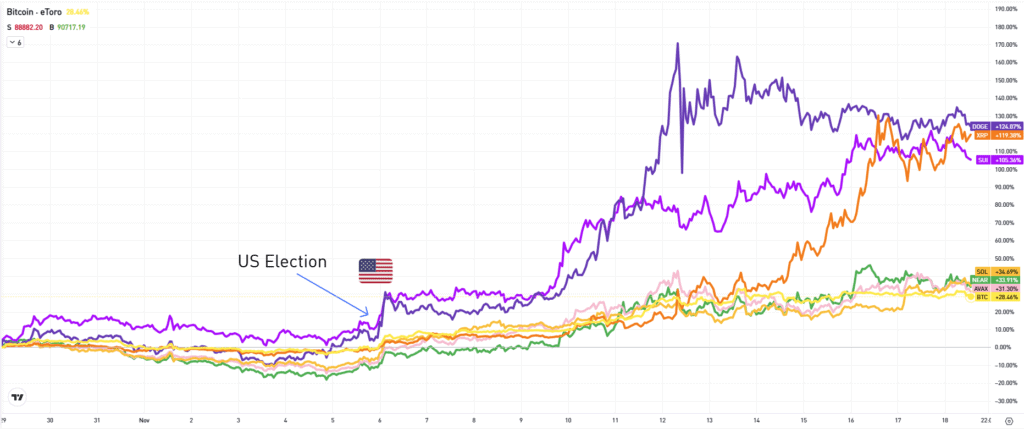

The percentage by which BTC and several altcoins have increased.

Image creation: Sam North, eToro analyst

Past performance is not an indication of future results.

Historic surge

Bitcoin has been on a relentless bull run, climbing over 16% this week and setting a new all-time high above $93K, up from $79K on November 12. This extraordinary performance is fueled by strong whale activity, with large investors continuing to buy and hold despite the high price levels. Such confidence from market participants has stabilized Bitcoin’s price near its peak, paving the way for further gains.

Altcoin momentum fueled by Bitcoin

Since the U.S. election, crypto markets have surged, shaking off their pre-election stagnation. (See above image.) Analysts credit the rally to election-driven optimism and lower U.S. interest rates fueling positive sentiment.

Bitcoin’s dominance has paved the way for many altcoins to shine – this week saw impressive performances from Dogecoin, Bonk Inu, Solana, Litecoin, Avalanche, Sui, Hedera Hashgraph and NEAR Protocol among others.

Hedera Hashgraph has exploded this week, surging nearly 60% to $0.1444 and more than doubling its trading volume to over $2 billion daily. This marks a significant bullish breakout, with analysts eyeing a potential target price of $0.14, supported by technical indicators like the weekly 200 MA.

Dogecoin surged to $0.3999 on November 13, with $20 billion in trading volume, before rebounding 5% on November 15 after a brief pullback. Peaking with a $58.7 billion market cap, Dogecoin’s strong retail interest and Elon Musk’s support keep it in the spotlight.

Bonk Inu soared over the past week, hitting a new all-time high of $0.000055 with a price surge of 112%. It has become the top meme coin on Solana by market valuation, driving $2 billion in trading activity. Analysts see further potential for BONK, drawing comparisons to Shiba Inu’s meteoric rise in 2021.

Sui saw remarkable growth, breaking out from $2.37 and eyeing $4, with potential to reach $4.70 if momentum holds. Near Protocol has rallied 41% this week, climbing from $5.17 to $6.02, with its market cap growing from $6.3 billion to $7.3 billion. High trading volumes and increased development activity have fueled bullish momentum, with analysts eyeing $8.52 as the next target if it surpasses key resistance at $6.41.

Litecoin surged by 16.68% over the past week. Solana surged past its $225 resistance, signaling bullish momentum with targets of $260 and potentially $304 if buying pressure persists. Avalanche is showing strong bullish momentum, breaking through the key $30 resistance level and setting its sights on the next target at $32.

IBIT Options Trading Launch

BlackRock’s iShares Bitcoin Trust (IBIT) will make history today (Tuesday) with the launch of options trading on Nasdaq, a major milestone for crypto markets. With $43 billion in AUM and nearly 472,000 Bitcoin, IBIT has quickly become the largest Bitcoin ETF since its launch earlier this year. This move, backed by key regulatory approvals, reflects rising institutional demand and renewed optimism fueled by surging ETF volumes and Trump’s reelection.