As we enter the final quarter of 2024, the global markets present both challenges and opportunities for investors. Navigating these waters requires a strategic approach, focusing on assets that are poised to perform well amidst economic uncertainties, geopolitical shifts, and technological advancements.

Here are the top assets (representing a diversified mix of five stocks, two ETFs and one cryptocurrency) that you might want to consider adding to your portfolio right now.

1. Tesla (TSLA)

Tesla continues to be a trailblazer in the electric vehicle (EV) sector, with its innovations and expanding market share making it a compelling investment. With the increasing global push towards sustainability, Tesla is expected to benefit from the ongoing shift to EVs.

Disclaimer: Your capital is at risk.

2. Microsoft (MSFT)

Microsoft has maintained its status as a tech giant through strategic acquisitions and growing industry focus on cloud computing. With AI integration and the continued expansion of its Azure cloud services, Microsoft is well set up to capitalise on the increasing demand for digital products across industries.

Disclaimer: Your capital is at risk.

3. SPDR S&P 500 ETF (SPY)

The SPDR S&P 500 ETF offers broad exposure to the US equity market, making it a popular choice for investors seeking diversification in order to mitigate risks associated with individual stocks. In Q4 2024, with economic uncertainties still looming, this ETF provides a balanced approach, capturing gains from a diverse set of sectors.

Disclaimer: 51% of retail CFD accounts lose money

Disclaimer UAE: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

4. Bitcoin (BTC)

Although cryptocurrencies continue to be a dynamic and often unpredictable market, Bitcoin remains the flagship asset in this space. As institutional adoption grows and regulatory clarity improves, Bitcoin’s role as a digital store of value is likely to strengthen. Bitcoin could even possibly benefit from a scenario of economic instability, making it a valuable addition to a diversified portfolio.

5. NVIDIA (NVDA)

NVIDIA is at the forefront of the AI revolution, with its GPUs powering everything from gaming to AI-driven data centres. As AI continues to drive technological advancements across various industries, NVIDIA’s leadership in this space makes it a top asset to watch. With ongoing developments in AI, gaming, and the metaverse, NVIDIA is well-positioned for continued growth.

Disclaimer: Your capital is at risk.

6. iShares Global Clean Energy ETF (ICLN)

The clean energy sector is gaining momentum as countries commit to reducing carbon emissions and to transitioning to renewable energy. The iShares Global Clean Energy ETF offers exposure to companies involved in solar, wind, and other clean energy technologies. With increasing government support and technological advancements, this ETF provides an opportunity to invest in the future of energy.

Disclaimer: Your capital is at risk.

7. AstraZeneca (AZN)

AstraZeneca remains a strong player in the pharmaceutical sector, particularly with its focus on oncology, immunology, and cardiovascular treatments. As global healthcare challenges persist, including continued demand for vaccines and treatments in the wake of new health concerns, AstraZeneca’s robust pipeline and innovative treatments make it a promising investment.

Disclaimer: Your capital is at risk.

The final quarter of an eventful year

Investing in late 2024 requires a balanced approach, focusing on assets that offer both growth potential and stability. The seven assets listed above are a diversified mix of opportunities across different sectors, ranging from technology and clean energy to pharmaceuticals and cryptocurrencies. As always, it is essential to stay informed and adjust your portfolio as market conditions evolve.

Disclaimer: 51% of retail CFD accounts lose money

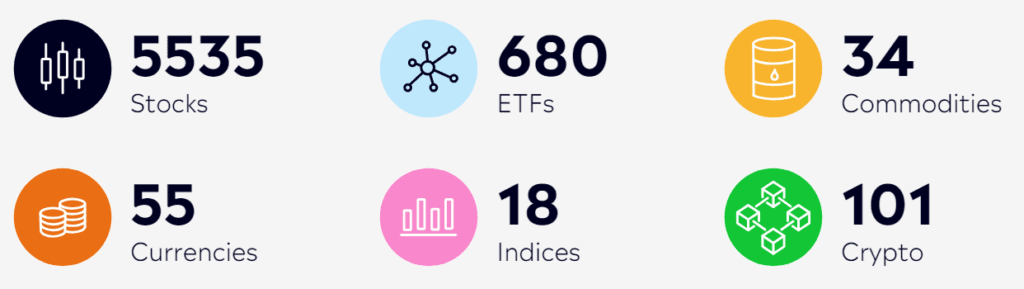

Create a truly diversified portfolio

eToro offers multi-asset trading

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.