In this article, we will look at growth and value stocks, the key differences between them, and how the strategies can overlap to help investors build a strong portfolio.

When investors talk about strategies, there are often two fundamental styles of investing that are mentioned repeatedly: growth and value investing. The two styles are often pitted against each other, but investment portfolios have room for both. Finding the right balance between growth and value stocks, depending on your overall investment goals, should lead to better portfolio diversification.

What are growth and value stocks?

A growth stock is a company stock that investors believe will deliver returns that are better than average, or at least better than expected. On the other hand, value stocks refer to companies that investors believe are currently undervalued in the market. These are the key differentiating factors between growth and value stocks.

One of the golden rules of investing is to understand the assets you buy, so it is worth learning exactly what each type of stock offers.

What are growth stocks?

Growth stocks are typically stocks of newer or smaller businesses, with earnings forecasts that are expected to outperform the overall market. Growth stocks can often be found in specific industries, such as fintech, robotics or space exploration.

These companies typically reinvest their profits, usually through acquisitions or expansion projects, rather than pay out dividends to stockholders. As a result, a growth stock investment strategy involves putting faith in the prospects of a company and focusing on capital returns.

There are risks attached to investing in growth stocks. For example, if the predicted expansion of market share doesn’t materialise, the price of the stock could fall.

Tip: Investing in both growth and value stocks involves an element of risk, but the risk-return of growth stocks is typically higher.

What are value stocks?

A value stock is a stock that appears to be trading at a lower price than its intrinsic value. Value investors screen the market for stocks and companies that the market may be underestimating.

The market sometimes reacts to news in a way that does not correspond with a stock’s longer term outlook. If the market reaction drives a stock price down, a value investor will buy the stock while it’s at the lower price point, as they believe the value of the stock will rise in the future — this is a potential opportunity to profit.

Tip: A value investor doesn’t typically follow the crowd and tends to hold long-term positions in companies they believe to be valuable.

| Growth Stocks | Value Stocks |

|---|---|

| Outperform the market | Undervalued |

| Low or no dividend yield | High dividend yield |

| Above average price/earnings ratio | Below average price/earnings ratio |

| High volatility | Might not grow or appreciate as expected |

How to find a growth or value stock

Growth and value investment strategies both have a strong following, with many investors preferring one technique over the other. However, depending on your chosen stock selection criteria, you will see that both types of investments can be included in your portfolio.

Growth stock investors may focus their attention on smaller firms that feel like “start-up” ventures. That being said, tech giants, such as Apple and Microsoft, are top ranked holdings in the Vanguard Growth ETF because of their pipeline of new, innovative products.

Value stock investors tend to find more opportunities when analysing larger companies. These firms may have limited growth prospects, but might just be good businesses that are experiencing a short-term dip in their share price.

When looking for growth and value stocks, there are a few key factors to look out for. For example, a utilities company may shift towards being more growth oriented after its management team changes, while a tech firm may choose to consolidate its business model and scale back on expansion programs.

The overlap between growth and value stocks comes down to two main factors:

- All stocks offer some degree of growth potential

- All stocks could potentially be considered “mispriced”

When the balance between these two features is equal, two analysts might argue that the same stock falls into different categories.

Tip: A growth stock can, in time, become a value stock, and vice versa.

Growth or value — which is the best strategy?

Growth and value are investing strategies that can complement each other and add diversity to a portfolio; one is not ultimately better than the other. Your own investment strategy will determine which type of stocks best suit your goals.

A value stock will typically be less volatile than a growth stock. However, investing in growing companies could help an investor to gain exposure to growing economies and trends.

A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful.

Warren Buffett

Each type of stock will perform differently in certain market conditions, and changes in those conditions are hard to predict, so it could be worth including both in your portfolio.

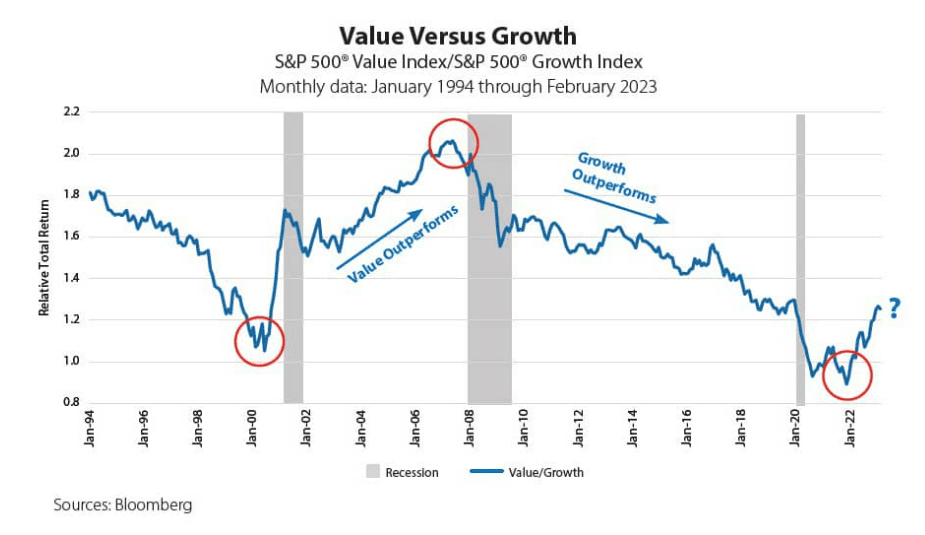

For example, when you compare the S&P 500 Value and Growth Indices, value stocks outperformed between 2000 and 2007, whereas growth stocks generated stronger returns between 2007 and 2022.

Deciding between value and growth stocks can largely come down to the aims of an individual investor, but investing in both types of stocks can often make sense. For example, growth stocks are often implemented in a shorter term strategy, whereas value stocks are usually preferred by investors with a long-term investment plan.

Past performance is not an indication of future results

Source: Western Southern

Tip: A well-diversified portfolio is often made up of both growth and value stocks as they offer alternative ways to navigate factors that are out of an investor’s control.

Final thoughts

It’s important to understand the assets and asset classes that you are buying, and growth and value investing strategies demonstrate that not all stocks are the same. Each trader will have their preferred approach, but embracing the difference between growth and value stocks, and considering investing in both, could help to manage risk and optimise returns.

Visit the eToro Academy to learn more about value and growth investing.

FAQs

- Does value or growth investing take longer to learn?

-

Value investors aiming to establish the fair value of a stock typically concentrate on research reports, as well as a company’s balance sheet, income statement and investor updates. This granular analysis can be difficult to learn and time-consuming to complete. Growth investors are more interested in identifying the latest trends, which requires more ongoing management.

- What tools can I use to find growth and value stocks?

-

Investors can use various techniques to find growth and value stocks, such as technical and fundamental analysis. Brokers offer a wide range of tools and information about stocks to help you determine if a stock meets the criteria for your investment strategy.

- What other strategies could I use to trade stocks?

-

There are many other investment strategies available, including momentum investing, income investing, impact investing, ethical investing and meme investing. Defining your investment goals will help you to decide which strategy (or combination of strategies) works best for you.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.