Technical analysis tools can help with trade management and can also help you to make informed decisions, manage profits and losses, and approach the markets with a greater degree of discipline. Learn more about trade management and how to use technical analysis as part of a trading plan.

Technical analysis tools can help you to identify the appropriate price levels for buying and selling an asset, while also providing an indication of other factors such as market momentum.

Implementing technical analysis into your trade management will help you to manage your trades as they develop and provide you with additional confidence in your decision to take profits or cut losses.

What is trade management?

Trade management describes the actions you take, or do not take, while a trade is active. It covers the period between opening a new trade and closing it out, and typically incorporates risk management, strategy planning and news monitoring.

Trade planning is a crucial part of the investment process, potentially helping you to optimise returns on winning trades and mitigate against losses on losing ones.

Tip: When averaging into a position or following a momentum-based strategy, trade management can involve increasing or decreasing position size.

How to use technical analysis as part of trade management

Technical analysis uses historical market data to develop a view on the direction that price might take in the future. There are many tools available, most of which are based on mathematical and statistical formulas and can offer insights into whether price will continue in a specific direction, or if market conditions have changed.

After you have opened a trade, it is possible to use technical analysis to gauge the market mood and use support and resistance levels to establish the price level at which you want to change the size of your position. Technical analysis encompasses charting, patterns and indicators; when managing a trade, it is worth drawing on all three.

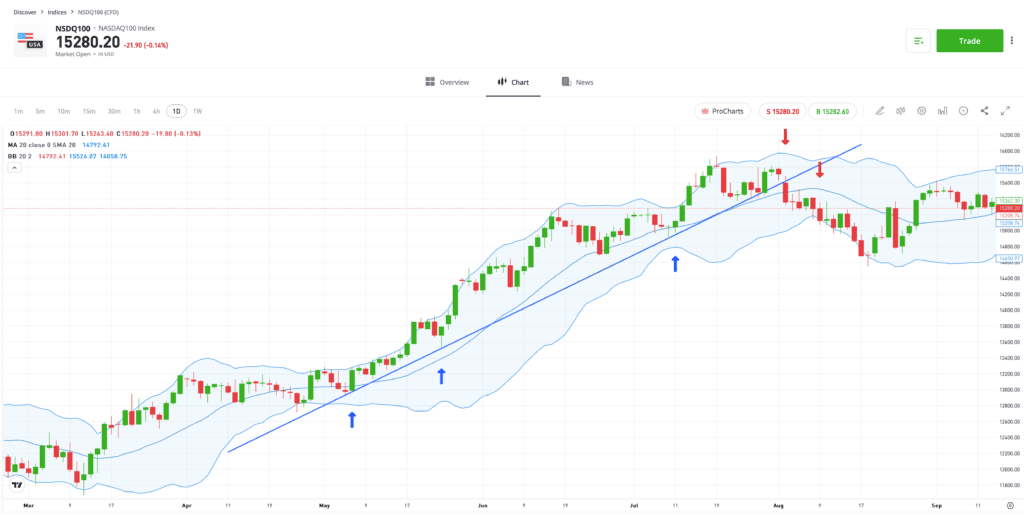

For example, in the NASDAQ100 Index chart below, the points at which price bounces off the supporting trendline, and the absence of any tests of the lower Bollinger Band, point to ongoing upward momentum. However, a breakout strategy should be applied after price breaks through the supporting trendline and trades outside of the lower Bollinger Band range.

Past performance is not an indication of future results

Source: eToro

How to use technical analysis as part of a trading plan

Technical analysis can offer you guidance at various stages of your trading plan.

Market analysis

Establishing whether a market is trending or ranging will help to determine the effectiveness of a trade management strategy.

Tip: If you prefer using range-trading or trending strategies, consider researching different markets to find one that fits your approach.

Trade entry and exit points

Technical indicators can be used to pinpoint price levels at which you want to execute a trade. If there are a range of levels in close proximity, then there is an opportunity to open or close positions over a period of time.

Position size

Scaling up or down on live positions is always possible, although it is best if your strategy plans for this prior to the trade being opened. This can help to reduce the risk of a decision being made based on emotions.

Trade volume data

An increase in trading activity is a sign that something has changed in a market, with more buyers and sellers taking a view on what might happen next. This could be good or bad news for your position, and should trigger further research into news events, fundamental analysis and even macroeconomic cycles.

Choose your trade monitors wisely

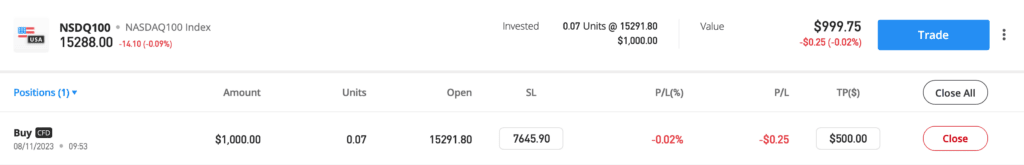

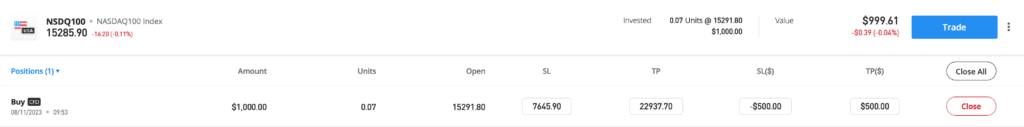

All traders approach the markets with a natural bias, and these can be exacerbated by price movements once a trade is live. If you find yourself reacting to the changing P&L readings on your account, consider filtering your account to remove that figure, as seen in the example below.

Alternatively, study the percentage return field, which can remove the temptation of closing out winning trades early to “bank” some profits.

Volatility

Price volatility indicators, such as the VIX Index, give an insight into whether other market traders expect price moves to become more or less extreme. This can influence your approach to risk management and target price levels.

Stop-loss and take-profit

Stop-loss and take-profit orders are particularly useful when managing the life of a trade using technical analysis. They have various functionality features that can help you to optimize returns, while also instilling discipline into your strategy.

Deciding the level at which you want to set your stop-loss orders will determine the maximum loss you are willing to take on a trade. They can be adjusted during the life of the trade, and trailing stop-loss instructions are automated instructions that follow the progress of winning trades.

Take-profit orders work in a similar way to stop-losses, but lock in gains by closing out some, or all, of your position at a predetermined target price. Using them not only gives your trading more structure, but also reduces the amount of time devoted to risk management.

Tip: While it can be good practice to move stop-losses to protect profits, widening them on losing trades is discouraged.

Final thoughts

Technical analysis tools provide an ideal way of monitoring the progress of a trading position. They analyze and interpret countless data points to offer a user-friendly way of forming a view on underlying market conditions. Using them also gives your trading plan greater structure, which is a key element towards achieving financial freedom.

Visit the eToro Academy to learn more about technical analysis and trade management.

Quiz

FAQ

- What is the difference between trade management and strategy management?

-

Trade management relates to the time during which trades are active, while strategy management can be done any time. The latter might involve changing your approach to a live position, but also involves activities that are carried out away from trading monitors, such as post-trade analysis, testing and research.

- What is the difference between trade management and strategy management?

-

If you find that your trade is showing an unrealized profit and is moving away from the trade entry price, then, moving your stop-loss to break even would help you to ensure that a winning trade doesn’t become a losing one.

Deciding whether to do this comes down to personal preference, as there is a greater risk that the trade stops out at the new level. However, it does remove the risk of your trading approach becoming distorted by a once profitable trade becoming a loss.

- What is the best time to use technical analysis indicators?

-

This will depend on your strategy, but most institutional and retail traders are more active when markets see an increase in trading volumes. The period around the opening and closing of exchanges are usually popular times to trade as they are generally associated with greater levels of trading activity. It is also worth studying the Economic Calendar to identify news announcements that could increase trade flow levels in markets.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments.

This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.