The Daily Breakdown looks at the week ahead, as well as takes a closer look at Ferrari stock, which has pulled back in recent weeks.

Monday’s TLDR

- Friday’s jobs report in focus

- So are retail and tech earnings

- Ferrari stock dips

Weekly Outlook

With the Thanksgiving holiday behind us, investors waltz into December with the S&P 500 up more than 25% so far this year and with Bitcoin up more than 100%.

That said, we have a few more key events to get through this week, as well as a surprising amount of earnings.

Today we’ll have some ISM data to sort through in the morning, followed by earnings from Zscaler after the close.

Earnings really pick up on Tuesday, with Salesforce, Okta, Box, and Marvell all reporting after the close. In the morning, we’ll also get the JOLTs data (job openings) at 10 a.m. ET.

On Wednesday morning, retail comes into focus, with Chewy, Foot Locker and Dollar Tree reporting before the open, then American Eagle, Five Below, and PVH Corp reporting after the close.

Retail stays in focus on Thursday, with companies like Lululemon, Ulta, Kroger, and Dollar General reporting earnings.

From an economic perspective, Friday is this week’s big focus. That’s as the monthly jobs report for November will be released. This will be the latest (and biggest) update on the labor market and a key report ahead of the Fed’s meeting in mid-December.

Want to receive these insights straight to your inbox?

The setup — Ferrari

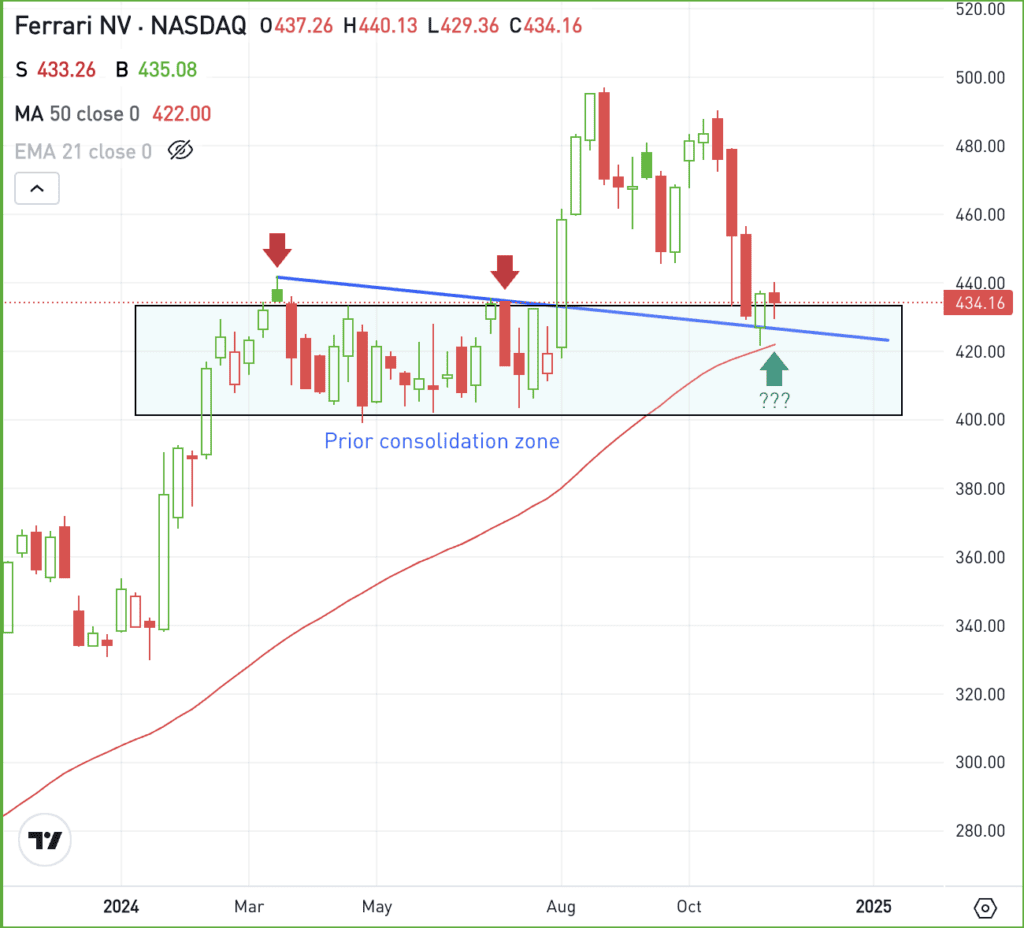

Ferrari stock has been on a tear since going public in October 2015, up more than 600% from its opening price.

After its latest push to record highs though, shares have pulled back. The stock is now testing its 50-week moving average, right near the top of its prior consolidation zone between $400 and $435.

Active, short-term traders will want to see RACE hold above the recent lows near $420. Long-term, patient investors simply want to see Ferrari stay above $400.

If those observations remain true, it’s possible that a rebound could ensue. However, if these levels fail to hold, the momentum could turn more bearish for Ferrari.

What Wall Street is watching

XRT – Retailers like Walmart, Amazon, Best Buy and Target are in focus this morning on reports that online Black Friday sales tallied $10.8 billion — a new high. That’s up more than 10% from last year, as more shoppers continue to shift online.

STLA.US – Shares of Stellantis are in focus this morning as CEO Carlos Tavares will resign from the automaker, citing “different views” between Tavares and the board as the reason for the split. Stellantis owns brands like Jeep, Dodge, Ram, Alfa Romeo, Fiat, and Maserati, among others.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.