Markets enjoyed a session for the record books, while Ethereum’s chart setup warrants a closer look for investors using technical analysis.

Thursday’s TLDR

- Stocks rip on trade-war hopes

- Ethereum charts in focus

- Bank earnings on the way

What’s happening?

Dip-buyers who have been accumulating stocks since April 3rd — the first major down leg of the recent plunge — were put to the test over the last few days. Then they were rewarded with Wednesday’s action.

The S&P 500 gained 9.5%, the Nasdaq 100 climbed 12% and US stocks exploded higher throughout the day.

The move comes as the Trump Administration backed off its recent trade-war rhetoric. Despite saying they were unfazed by the market correction and wouldn’t back down, they seemingly reversed course by implementing a 90-day freeze on most tariffs. The one major exception here is China, where the US continues to levy high tariffs against the second-largest economy.

Wednesday’s action highlighted how important an improvement in the trade-war situation is for investors. Remember, markets crave certainty and a step toward improved clarity resulted in a huge day for Wall Street.

We won’t know for weeks or months whether that was the low in US stocks, and we still face the risk that trade-war tensions could increase in the short term (or in 90 days). But for now, we have some good news, so let’s enjoy Wednesday’s response.

Want to receive these insights straight to your inbox?

The setup — Ethereum

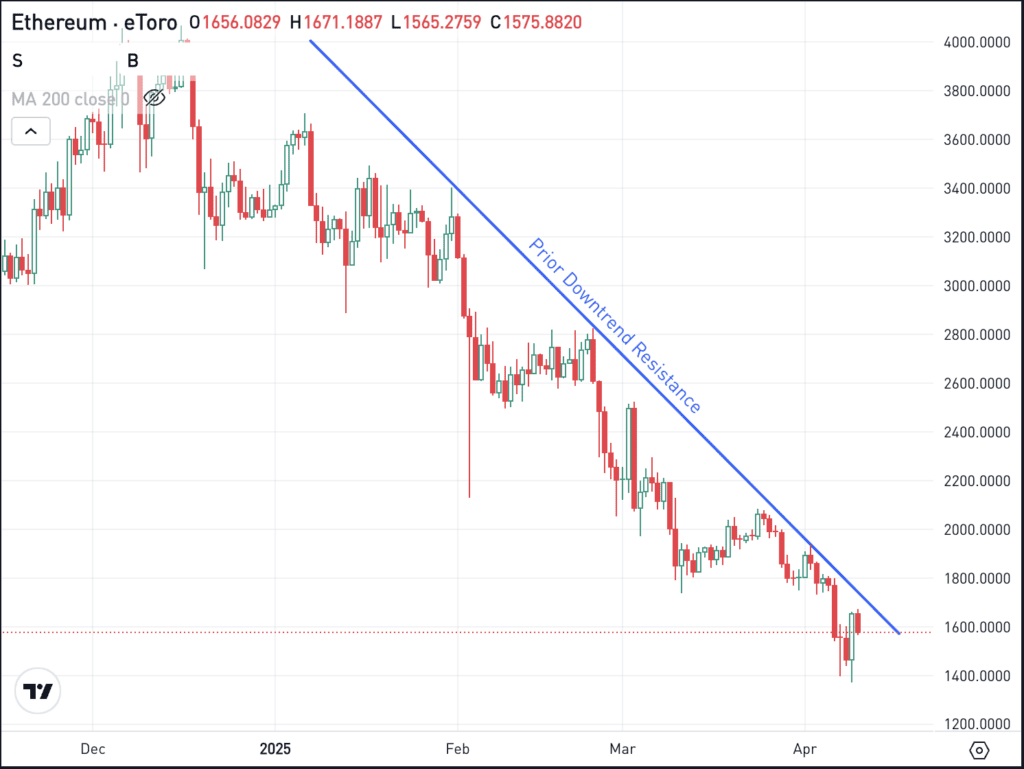

Locked in a painful downtrend, Ethereum has struggled this year as it’s fallen about 50% so far in 2025.

With many risk-on assets performing well lately, bulls might be looking for a rebound in ETH. Crypto has been quiet despite the stock rally. Will that change in the days ahead?

Notice how Ethereum recently found support near $1,400. That is a level active bulls will want to see ETH stay above in the days and weeks ahead.

On the upside, they’ll want to see Ethereum break above downtrend resistance. If it can do so, and then clear the $1,750 to $1,800 area, we could potentially see an even larger rebound take hold.

On the downside, a clear break of $1,400 could expose ETH to more downside.

What Wall Street is watching

DAL – Delta shares were down about 5% in pre-market trading after reporting earnings. CEO Ed Bastian said the US’s trade policies were the “wrong approach” and noted that “in the last six weeks, we’ve seen a corresponding reduction in broad consumer confidence and corporate confidence.” Yet shares soared more than 20% yesterday as trade tensions eased and investors flocked back into equities.

AMD – While stocks like Nvidia had a great day on Wednesday (rallying almost 19%), many lagged AMD, which was a strong performer with a gain of nearly 24%. After making new one-year lows earlier in the week near $76.50, shares surged higher yesterday, nearly hitting $98. Check out the charts for AMD.

XLF – The Financial Sector ETF — XLF — will be in focus on Friday, as the big banks kick off earnings season. Specifically, JPMorgan, Wells Fargo, Morgan Stanley, and BlackRock will report on Friday morning, with many others reporting next week.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.