The Daily Breakdown looks at the February inflation report ahead of next week’s Fed meeting. Plus, there’s a pullback in Palantir.

Tuesday’s TLDR

- The February CPI report is today’s big focus.

- Palantir stock is dipping into potential support.

- Oracle jumps on earnings.

What’s happening?

US stocks paused on Monday as investors await the monthly inflation report on Tuesday morning.

February’s CPI report will be released at 8:30 a.m. ET and will be the last notable inflation report ahead of the Fed’s two-day meeting next week. That’s part of the FOMC announcement, which will be announced midday on Wednesday, March 20.

The bond market isn’t pricing in any rate change this month, but the consensus expectation is that the Fed will cut rates in June.

Last month, the CPI report came in hot, showing an uptick in inflation. If the February report comes in hot too, we may see some doubt start to creep in about whether the Fed will actually cut rates in the first half of this year. That would be bad for stocks and bonds.

But let’s not freak out! Instead, let’s see what this report looks like first.

Ideally, we’ll see in-line or lower-than-expected results showing that inflation continues to cool. So far the market has taken bad news in stride, so even if today’s number is disappointing, it may only result in a short-term hiccup.

Want to receive these insights straight to your inbox?

The setup — PLTR

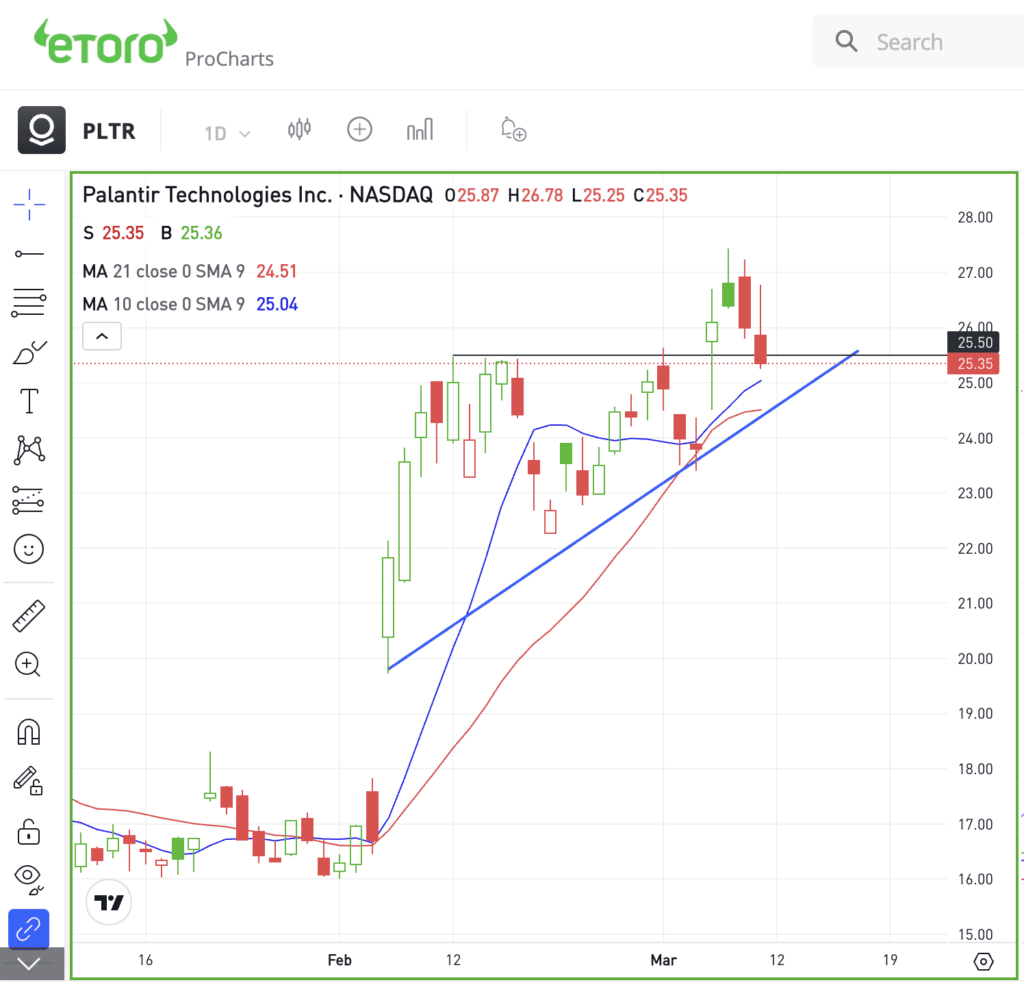

Palantir has been on fire after it jumped more than 30% on February 6 on earnings. The stock is now up about 48% year to date and more than 60% over the past six months.

On Thursday, Palantir hit 52-week highs at $27.50. To get there, notice how shares had to break out over short-term resistance near $25.50. Now under pressure, bulls are watching this stock closely.

Bulls are looking for Palantir to find support, ideally somewhere between $24.50 and $25.50. If that happens, the stock will hold its short-term moving averages, like the 10-day and 21-day, and keep its uptrend intact.

A rebound from this zone could put the $27.50 high back in play. However, if support fails here, we could be looking at a larger correction into the low-$20s.

Remember, our options trading contest* is live.

There are $4,000 in prizes up for grabs and the contest runs through the end of the month.

If you’re interested but not sure where to start, you can join me on a webinar next week.

We’ll run through some of the best trades from the last contest and go over a few options basics. Plus, it will get you an extra entry in the contest.

*Terms and conditions apply. You must be approved for an options account in order to participate.

What Wall Street is watching

ORCL — Oracle is rallying in pre-market trading after reporting Q3 earnings yesterday. Earnings of $1.41 a share beat expectations of $1.38 a share, while revenue of $13.28 billion barely missed expectations. However, the rally is being propelled by new cloud contracts and AI demand.

BALY — Bally shares surged over 28% following a buyout offer from hedge fund Standard General, which values the casino operator at $15 per share — a 41.2% premium to last week’s closing price.

MRNA — Moderna shares soared more than 8% on Monday, its largest one-day increase since December. It led as the top performer in the SPDR S&P Biotech ETF (XBI), although it wasn’t enough to propel the ETF into positive territory, as it fell by 2.1% yesterday. Moderna is now up more than 25% over the last month and 12.6% year to date.

BTC — Bitcoin continues to find bullish momentum, rallying to new all-time highs on Monday. Ethereum isn’t back to all-time highs, but like Bitcoin, it continues to knock out new 52-week highs. As the Bitcoin halving approaches, investors have continued to buy both Bitcoin and the ETFs that were approved earlier this year.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.