The Daily Breakdown gives a check-up on healthcare stocks, as the sector is poised for strong growth over the next six quarters.

Friday’s TLDR

- Healthcare stocks have big earnings expectations

- But some may question the valuation

- Can AT&T maintain strength?

The Bottom Line + Daily Breakdown

Earlier this month, I included a “spoiler alert” in one of our notes saying that we’d talk more about healthcare stocks. Today is that day.

As a sector, healthcare may not command as much attention as tech or financials, but it’s a group that many investors are familiar with on an individual stock basis. Pfizer and Moderna. UnitedHealth and Johnson & Johnson. Eli Lilly and Novo Nordisk.

These businesses have become household names, as well as well-known stocks among market participants depending on the newscycle — I’m talking Covid-19, ozempic, etc.

When it comes to an ETF, the Health Care Select Sector Fund — XLV — is a common choice among investors. Its top holdings include LLY, UNH and JNJ, followed by AbbVie and Merck. Those five holdings make up about 40% of the fund.

Earnings growth

There are only three sectors that analysts expect to generate approximately double-digit earnings growth in each of the next six quarters: Tech, Communications, and yep, you guessed it — Healthcare.

I say “approximately double-digit earnings growth” because these are estimates and estimates are not only prone to change, but are prone to change often. For the healthcare sector over the next six quarters, Bloomberg estimates call for year-over-year earnings growth of: 9.7%, 21.2%, 46.3%, 15.3%, 18.1% and 13.3%.

Those are very strong expectations and while these estimates may not come to fruition, they lay out a roadmap of impressive growth potential. When we dig further into the sector, the industries driving that earnings growth include biotech and pharma, healthcare equipment and supplies, and healthcare providers and services.

Not surprisingly, those make up a huge part of the overall sector, but it helps speak to why analysts are so optimistic on the space.

Growth comes at a price

The healthcare space currently trades at about 19.5 times forward earnings. That’s on the high end of its range when looking back over the past four years. Investors will have to decide if that valuation is worth paying for these growth expectations.

Investors who are willing to do the work and dig into these groups can likely uncover a hidden gem (or two). However, others who decide they feel bullish may feel more comfortable casting a wider net in the form of a fund or an ETF.

That said, there’s nothing wrong with investors who go with an even more broad approach and buy something like an S&P 500 fund (like the VOO or SPY). These funds have exposure to healthcare and would benefit if the sector does well. And so far, these funds have benefited from a number of sectors this year, with all 11 S&P 500 sectors up by 10% or more on a total return basis so far in 2024.

Want to receive these insights straight to your inbox?

The setup — AT&T

Shares of AT&T have been doing quite well this year, up 37.5% on a total return basis.

AT&T still pays a dividend yield of around 5.1%, so it’s not hard to imagine why income-oriented investors might be attracted to this stock as the Fed is now lowering interest rates.

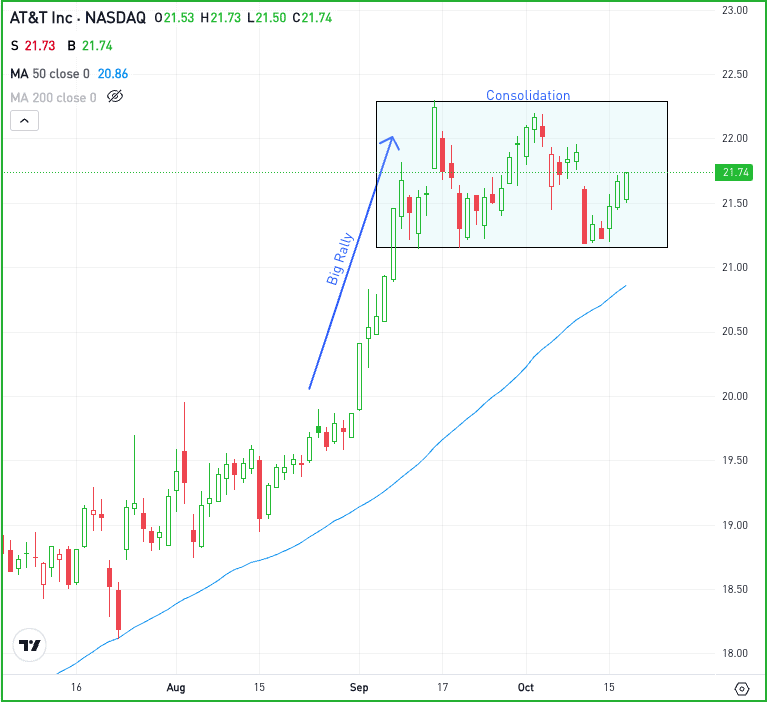

Looking at the chart below, investors can see how T has been consolidating some of its recent gains:

Lately, support has been coming into play around $21. If AT&T can hold this level — as well as the rising 50-day moving average — then it’s possible that the stock maintains its bullish trajectory.

However, if T stock breaks below these measures, we might see more selling pressure ensue.

Options

For options traders, calls or call spreads could be one way to position for a bullish outcome. In these scenarios, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect downside could speculate with puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.