The Daily Breakdown looks at the pullback in the S&P 500 ahead of earnings from big tech companies like Tesla, Microsoft, Meta and Alphabet.

Monday’s TLDR

- Meta, Microsoft, Alphabet, and Tesla earnings are this week.

- The GDP report and inflation will be on watch, too.

- Okta stock pulls back into possible support.

What’s happening?

The S&P 500 closed lower all five days last week and is currently riding a six-day losing streak.

That being said, it would probably surprise some investors to hear that Dow actually closed positive last week, eking out a gain of about three points. It helped that UnitedHealth — a stock we talked about earlier this month — climbed 14%, helping to offset some of the weakness in other Dow components.

As for this week, bulls are starting to fish around for a short-term low. The headlines will continue to fly, while geopolitical tensions will be in focus along with earnings.

Tesla, Meta, Microsoft, and Alphabet are the main focus, but investors will also be keeping an eye on earnings from companies like Intel, Boeing, Visa, Snap, Royal Caribbean, Ford, Exxon Mobil, and Chevron.

As for economic reports, there are some big ones this week.

They include the PMI report on Tuesday, the Q1 GDP report on Thursday, and PCE report on Friday. Remember, that last one is the Fed’s preferred inflation gauge.

Want to receive these insights straight to your inbox?

The setup — OKTA

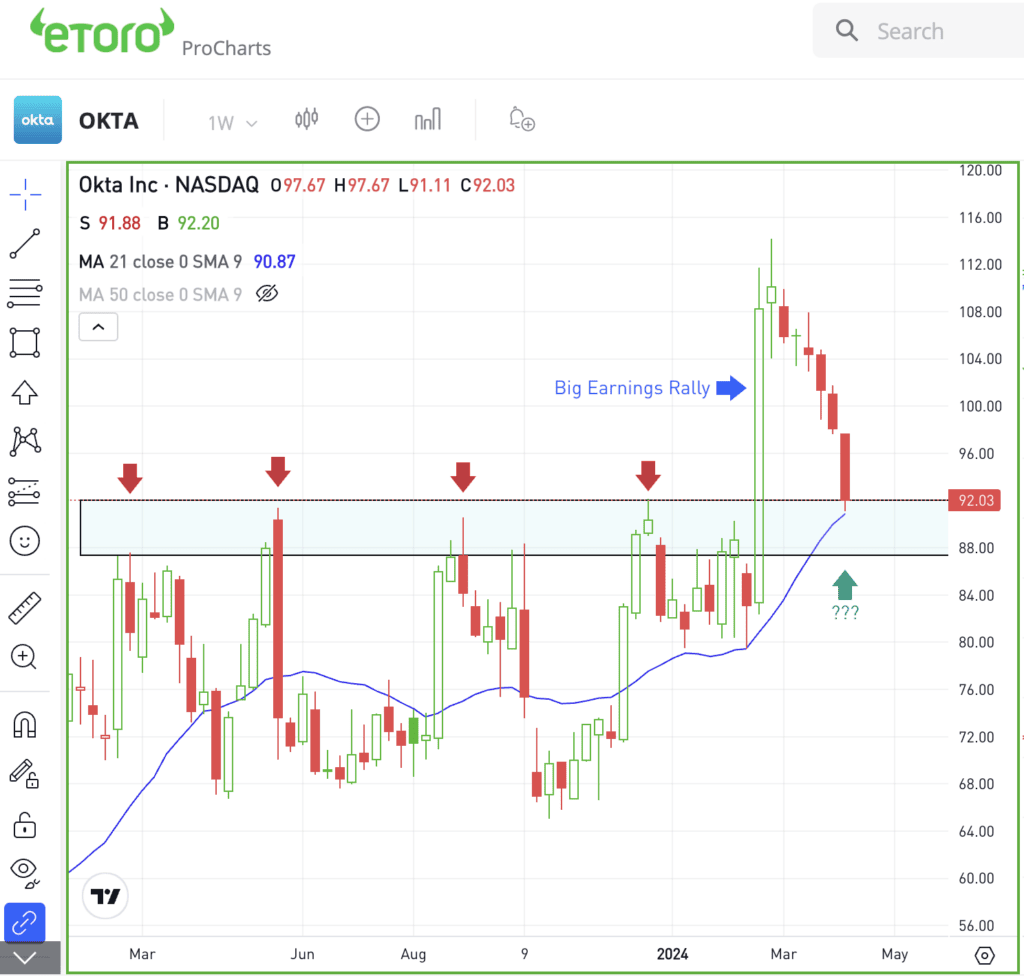

At one point, Okta stock was up 26.5% on the year after a big, post-earnings rally. However, the stock has since come under selling pressure, falling about 20% over the past few weeks.

Keep in mind, Okta stock — and many stocks right now — have been quite volatile. That should have many investors using smaller position sizes and keep some investors away entirely if it’s too much risk.

That all said, Okta is approaching an interesting area on the weekly chart below:

The pullback in Okta has sent shares right into the critical $87 to $92 area.

While this is a rather wide $5 zone, it was a key resistance point throughout 2023. When the company reported earnings in February, the results were enough to trigger a big breakout over this area.

Now pulling back into this zone — and testing down to the 21-week moving average — I’m curious to see if this zone will hold as support. If support fails and Okta breaks below $87, dip-buyers can look to reduce their long exposure and wait for a better opportunity.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

Remember, options will be a bit more expensive right now as implied volatility levels are higher amid the current pullback. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

NVDA — Chip stocks were in focus on Friday as the group took a beating. That included Nvidia, which sank 10% on the day and fell 13.6% overall last week. Shares hit their lowest level since February 22 as selling pressure dinged one of Q1’s best-performing stocks.

AXP — Shares of American Express ended the week on a strong note, rallying more than 6% after reporting earnings on Friday morning. The firm delivered an earnings and revenue beat, according to Bloomberg, while the stock ended Friday with an all-time closing high — although it remains just below its all-time high of $231.69.

BTC — After the Bitcoin halving this weekend, Bitcoin — as well as the Bitcoin ETFs — will be on watch this week. So far, Bitcoin prices have remained somewhat muted, roughly flat over the past week. However, investors will be eager to see if the event impacts sentiment.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.