The Daily Breakdown looks at the earnings reports from various retailers and focuses on Target as the stock rallies on strong results.

Wednesday’s TLDR

- Target beat on earnings and revenue estimates.

- Now, shares try to hold a key technical level.

- Netflix hits a new all-time high.

What’s happening?

Shares of Walmart have been hitting all-time highs since reporting earnings last week. Now Target and TJX Companies are rallying on earnings this morning. These reports follow the stronger-than-expected retail sales figures from last week.

Is the US consumer doing okay then?

That’s a loaded (and difficult) question to answer, but the latest data is at least reassuring to investors that we’re not teetering on the brink of a recession.

Remember, more than two-thirds of US GDP is driven by consumer spending. So how consumers are behaving is more important than just Target or Walmart hitting their quarterly numbers.

Consumer spending is what makes the US economy go ‘round, and consumers can’t spend if they don’t work. There’s no denying that the labor market has softened over the last few months, and later this morning, we’ll get a jobs revision from the Bureau of Labor Statistics (which is responsible for publishing the jobs data that economists rely on).

We’re not out of the woods yet when it comes to US jobs and consumers. However, the last few weeks have shown that perhaps the consumer is more resilient than they’ve been given credit for.

Want to receive these insights straight to your inbox?

The setup — TGT

Target delivered a Q2 earnings and revenue beat and raised its full-year earnings outlook. The report is sending shares notably higher in pre-market trading.

While Target had a strong start to the year — rallying more than 27% at one point — it’s been a tough few months as the stock has been pulling back. Now though, shares are trading above $160 after today’s report.

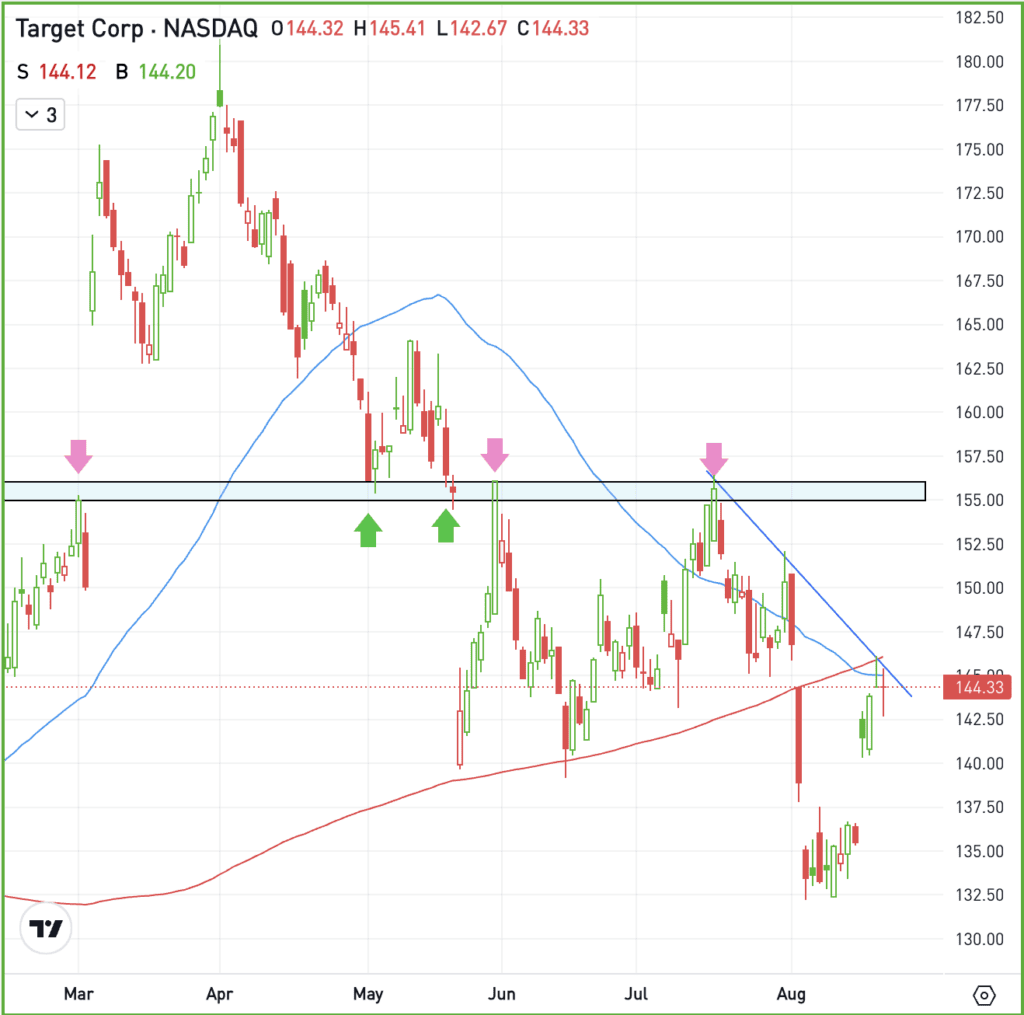

If TGT can maintain today’s momentum, it will have reclaimed all of its daily moving averages. But perhaps more important may be a close above the $155 to $157 area.

This zone has been a notable support and resistance level throughout 2024 (see arrows on the chart). A close above this area could mean it turns back into support, shifting momentum into the bulls’ favor. A close below this mark doesn’t necessarily doom the stock, but it would be a disappointing development for technical analysts.

Options

One downside to TGT is its share price. Because the stock price is high, the options prices are high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

NFLX — Netflix hit a new all-time high on Tuesday fueled by surging ad sales and excitement for upcoming sports content. The company saw a 150% increase in upfront ad sales as it prepares for NFL and WWE debuts. Shares are now up 43.5% so far on the year.

SPX500 — The S&P 500 snapped an eight-day win streak on Tuesday, falling 0.2% on the day. Over the last 20 years, the index has had six other eight-day win streaks and was on the verge of its first nine-day win streak since October 2004.

SNOW — Snowflake has had a rough 2024, down almost 20% over the last three months and down more than 33% so far this year. The firm is set to report earnings after the close today and bulls are hoping that the stock can turn things around. Analysts expect the company to earn 16 cents a share on revenue of $852 million.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.