The Daily Breakdown looks at the recent selloff in semiconductor stocks, as AMSL’s quarterly results were accidentally released.

Wednesday’s TLDR

- A disappointing outlook sinks ASML…

- And weighed on semiconductor stocks

- Cruise stocks sail to new one-year highs

What’s happening?

ASML was supposed to report earnings on Wednesday morning, but the results were accidentally published during US market hours on Tuesday. The Netherlands-based firm had a fine quarter by most standards, but the guidance sent a shockwave through the semiconductor space on Tuesday.

Previously, ASML had expected gross margins of 54% to 56% for 2025, but reduced that outlook to a range of just 51% to 53% (vs. consensus estimates of 53.9%). Further, the firm saw net sales for 2025 of 30 billion to 40 billion euro, but narrowed that outlook to a new range of 30 billion to 35 billion euro (vs. consensus estimates of 35.95 billion euro).

Not surprisingly, the downbeat outlook soured the mood among semiconductor investors, with Advanced Micro Devices, Nvidia, Broadcom and other staples within the space falling hard.

Even the semiconductor ETF SMH took a big hit, dropping 5.4%.

But it was even worse for semiconductor equipment makers. Applied Materials, KLA Corp., Lam Research and ASML all fell more than 10% on the day.

It’s worth pointing out that semiconductor firms like Nvidia and Taiwan Semiconductor had been trading much better than the equipment makers in the weeks leading up to today’s news.

While that doesn’t make those companies immune, it’s possible that demand could remain strong for them. Let’s hear what Taiwan Semiconductor has to say when it reports on Thursday morning.

Want to receive these insights straight to your inbox?

The setup — Consumer Discretionary

As a sector, consumer discretionary hasn’t traded all that well relative to the other 10 S&P 500 sectors. Up 11.5% so far this year on a total return basis is impressive, but less so when it’s only outperforming the energy sector in 2024.

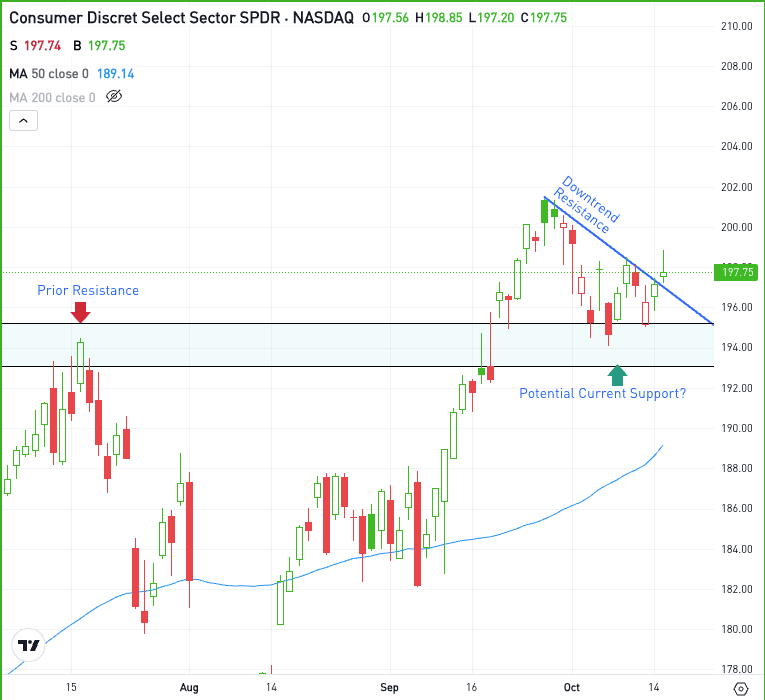

That said, the Consumer Discretionary ETF — XLY — just hit new 52-week highs in September and the charts remain constructive as we head into earnings season.

After the ETF hit new one-year highs, notice the way shares pulled back to a prior resistance and held that level as support. Now the XLY is clearing downtrend resistance as well.

If XLY can stay above the $194 to $195 area, then bulls may maintain momentum. If the ETF can stay over downtrend resistance, that momentum could turn more bullish. However, below these measures and that momentum can shift toward the bears’ favor and more selling pressure could ensue.

The top five holdings for the XLY include: Amazon, Tesla, Home Depot, McDonald’s, and Lowe’s — in that order.

Options

Options could be an alternative for investors who want exposure to XLY. Remember the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and XLY rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

CCL – Cruise stocks sailed higher on Tuesday. Carnival led the pack higher, gaining 6.6%, while Norwegian Cruise Line and Royal Caribbean climbed 4% and 2.8% on the day, respectively. All three hit new 52-week highs on the day.

XLF – The Financial Select Sector SPDR ETF — XLF — hit a new record high for the third straight session in a row as bank earnings continue to pour in. JPMorgan, Wells Fargo, Citigroup, and Goldman Sachs are a few of the recent reports. Check out the chart for XLF here.

UNH – Shares of UnitedHealth took a hit on Tuesday, falling 8.5% after reporting earnings. Revenue of $100.8 billion beat estimates of $99.2 billion and adjusted earnings of $7.15 a share beat estimates of $6.99 a share. However, management’s full-year outlook weighed on investor sentiment.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.