Nvidia, Walmart, Snowflake and others lead the charge for earnings this week. The Daily Breakdown digs in and looks at what’s important.

Wednesday’s TLDR

- Retail and tech earnings in focus

- Uber looks to break out

- Healthcare stocks tumble

Weekly Outlook

It’s a quiet week of economic reports, but a surprisingly busy week of earnings. Both retailers and tech are going to be in focus as companies report their quarterly results.

Before we get to the outlook, let’s address the selloff. The Nasdaq 100 fell all five days last week and the Russell 2000 declined in four out of five days. It wasn’t a great showing for the bulls.

However, we’re still in a bull market. While we may see some profit-taking, it’s hard to get overly bearish — in my view — until we start to see trends reversing and a shift in the fundamentals. We’re not there right now.

On Monday, bulls will look to see if the stock market can steady itself after a tumultuous Friday and a tough week. The S&P 500 fell 1.3% on Friday and ended lower by 2.1% last week, while the Nasdaq 100 fell 2.4% on Friday.

On Tuesday, key retailers like Walmart and Lowe’s will report earnings. Retail will remain in focus on Wednesday morning too, as Target and TJX Companies report.

However, the focus will shift to tech in the afternoon, with Snowflake, Palo Alto Networks and — the biggest of them all — Nvidia reporting after the close.

Thursday features earnings results from companies like Deere, Baidu, Gap, Ross Stores, and Warner Bros Discovery, among others.

Want to receive these insights straight to your inbox?

The setup — UBER

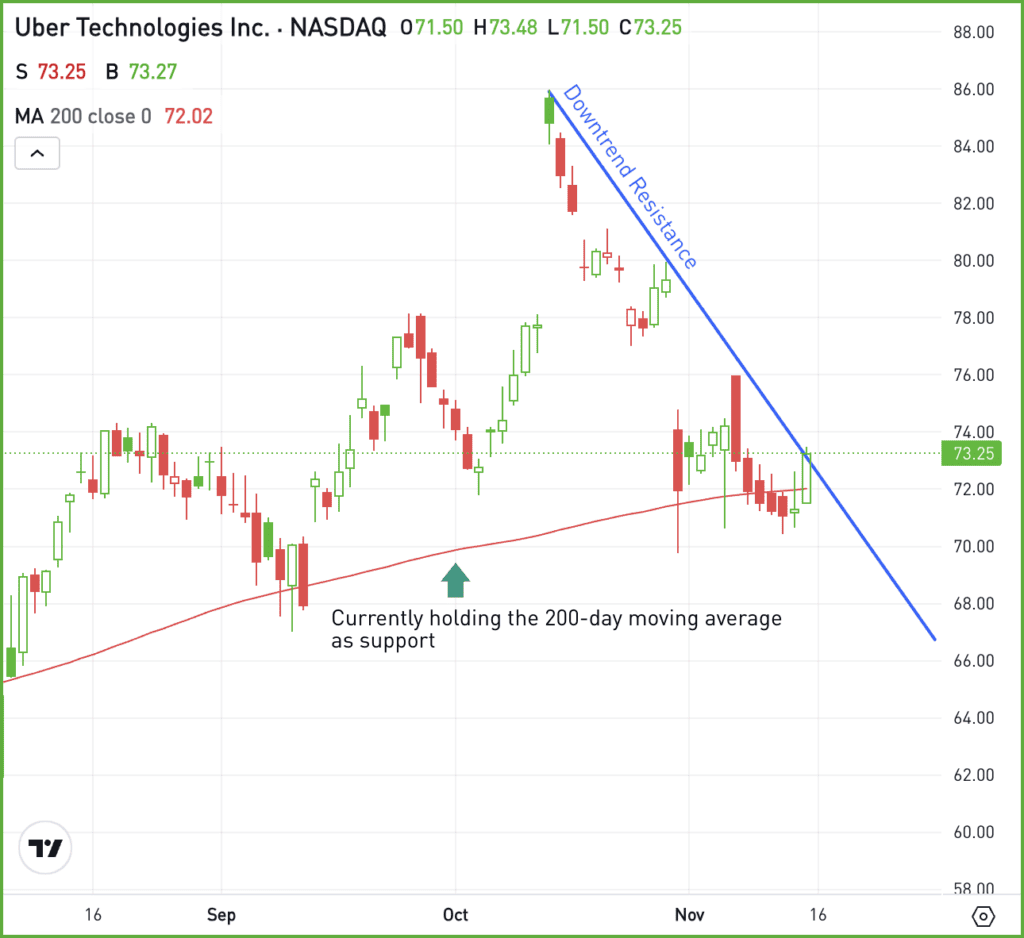

Uber traded really well in response to Tesla’s Robotaxi event in mid-October, gaining almost 11% in one day. However, shares have cascaded lower since and are under a bit of pressure this morning on worries that Tesla’s autonomous efforts will gain even more ground under a Trump administration.

From the close on October 11th to the most recent close on November 15th, Uber stock is down 15.1%. However, bulls are hoping that it can find its groove.

That’s as Uber sits on its 200-day moving average and is nestled just below downtrend resistance:

Right now, bulls want to see Uber hold the $70 area, which has been recent support. Ideally though, they want to see the stock rally above $73 and clear downtrend resistance. If it can do so, perhaps a larger rally could unfold.

If $70 doesn’t hold as support, more selling pressure could weigh on the share price.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, investors might consider using adequate time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TSLA – Shares of Tesla sport a 52-week high of $358.64, a figure that will be in focus if today’s pre-market rally gains more steam. The stock is rallying on reports that a Trump administration will be more favorable to autonomous driving regulations, opening the door for Tesla’s robotaxi ambitions.

XLV – On the flip side, healthcare was the worst-performing sector in the S&P 500 last week, down 5.5%. That weighed heavily on the XLV ETF, as biotech’s tumble exacerbated the selling pressure. The sector is not reacting well to the idea of some of President-elect Trump’s potential cabinet picks.

BTC – Bitcoin continues to consolidate its recent gains, bouncing between $87,000 and $92,000. The largest cryptocurrency has now gained in three straight weeks, as bulls look to see how it will do this week. Many are hoping for a push to $100K before year-end.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.