The Daily Breakdown looks at a very busy week ahead as investors near the end of the year. PANW undergoes a 2-for-1 stock split.

Tuesday’s TLDR

- The retail sales report is today.

- The Fed is tomorrow.

- BTC, GOOG hit new highs.

Weekly Outlook

US stocks have a shortened trading session next week, with a half-day of trading on Tuesday (Dec. 24) and no trading on Wednesday (Dec. 25). Therefore, we have a loaded schedule this week, with plenty to focus on.

This morning, we’ll get the US retail sales report, giving us one final update on the health of the consumer before we enter 2025. For retailers, the hope is that consumer spending remains strong.

Wednesday is a big one, with the Fed’s last meeting of the year. Current market expectations call for one more 25 basis point cut — bringing the total to 100 basis points of rate cuts since September (and for the year).

On Wednesday, we’ll also have earnings from Micron, Lennar, General Mills, and Birkenstock.

Thursday morning brings us the third and final reading for Q3 GDP, with estimates holding firm at 2.8% annualized growth. We’ll also have earnings from Nike, FedEx, and BlackBerry, among others.

And finally, on Friday we’ll get the PCE report — the Fed’s preferred inflation gauge. If this feels like an early time to receive the PCE results, that’s because it is. This report is usually released on the last Friday of the month, but is being moved due to the holidays.

Also on Friday? Earnings from Carnival Cruise.

Want to receive these insights straight to your inbox?

The setup — PANW

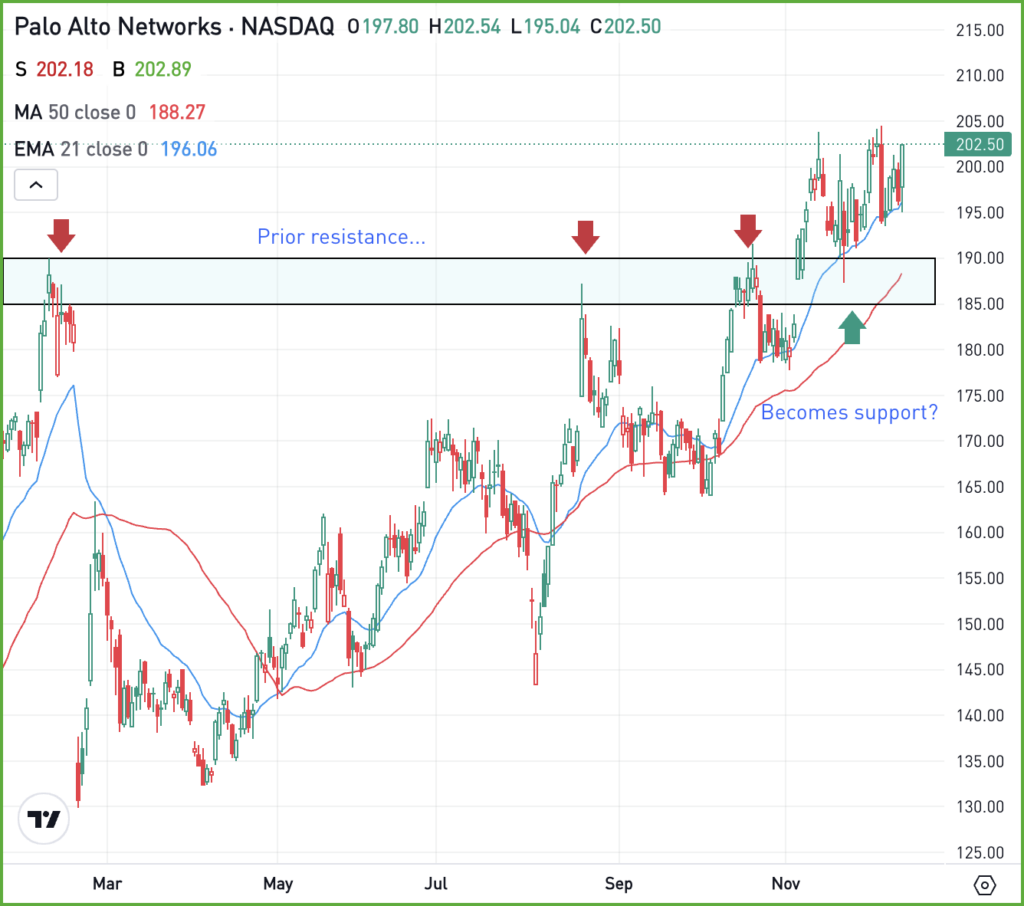

Palo Alto Networks, a leading cybersecurity firm, has done well this year, up more than 37%. Starting today, shares will begin trading after a 2-for-1 stock split — meaning the number of shares double and the stock price is cut in half.

Bulls are hoping this can act as a catalyst for the stock, which has been quietly consolidating above recent resistance in the $185 to $190 area.

Bulls want to see PANW continue holding above this prior resistance zone. When shares dip, they’ll also want to see support from a key moving average — like the 50-day moving average, for example.

As long as Palo Alto Networks can hold above this zone, the technicals remain constructive for the bulls. However, if shares break down below this zone, momentum could shift into the bears’ favor.

Options

The stock split lowered the price of PANW stock, which makes its options pricing lower as well. For some investors, that may make the options more approachable.

For bulls, buying calls or call spreads may be one way to take advantage of further upside. For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

AVGO — Shares of Broadcom have now climbed more than 38% in the last two trading sessions after the firm reported strong earnings. This isn’t a small company either, as the rally vaulted Broadcom’s market cap above $1 trillion.

GOOG — Excitement over Alphabet’s quantum computing update has ignited shares higher, with GOOG hitting all-time highs in recent trading. While not as impressive as AVGO, Alphabet shares have climbed more than 12% over the past week, as mega cap tech gains momentum.

BTC — Bitcoin has been enjoying the ride too, as it made fresh all-time highs on Monday. BTC seems to be getting comfortable above the $100K mark — for now — after previously struggling with this area. Bulls are hoping it can continue to make new highs as we march toward 2025.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.