The Daily Breakdown looks at the upcoming retail sales report to get a gauge on the consumer, as well as Warren Buffett’s Berkshire Hathaway.

Thursday’s TLDR

- Taiwan Semi earnings dazzle

- Netflix earnings on deck

- Retail sales report due up

What’s happening?

In Monday’s Weekly Outlook, we touched on the strength of small caps — which have continued to do great this week — and talked about what a highlight Thursday was going to be.

This morning, we received a lower-than-expected inflation report out of Europe and a surprisingly positive earnings report from Taiwan Semiconductor.

Remember, while TSM may not be as popular as Nvidia, it’s a behemoth in the industry with a market cap that could near $900 billion when it begins trading this morning. The stock’s post-earnings response is giving the entire semiconductor space a lift at a time where ASML’s results were weighing on the group.

But we’re not finished yet.

At 8:30 a.m. ET, the US retail sales report will be released. Investors are looking for another month of growth and more strength from the consumer. Remember, it’s not a bad thing to see a strong consumer — over two-thirds of US GDP is driven by consumption. At the end of the day, we want to see a strong consumer.

Lastly, we have Netflix earnings after the close. While Netflix may not be in the Magnificent 7, it still commands quite a bit of attention with its $300 billion market cap.

Want to receive these insights straight to your inbox?

The setup — Berkshire Hathaway

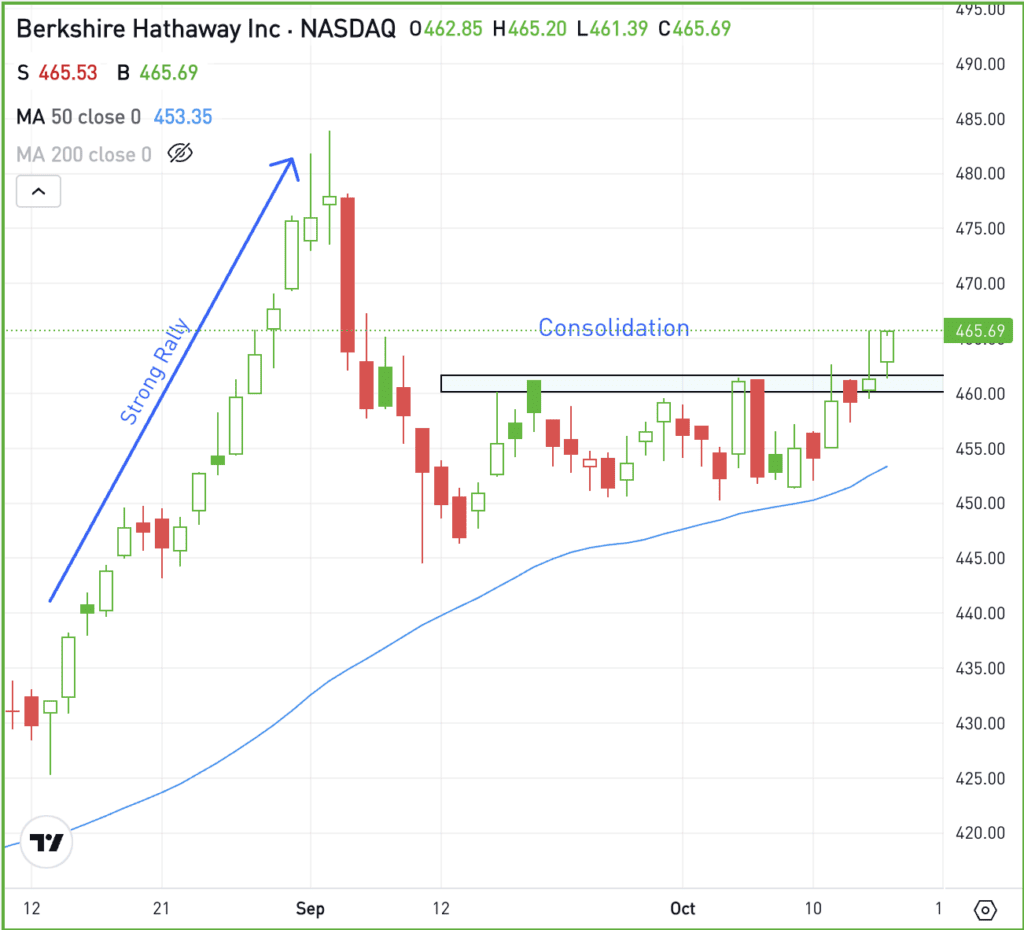

Financials continue to chug higher, with the sector ETF — XLF — hitting new all-time highs each day this week. Despite being a top weighting in that ETF, Warren Buffett’s Berkshire Hathaway has not been hitting new highs lately.

That’s not to say shares have done bad — the stock is up more than 30% year to date — but it’s got some investors wondering if it could play catch up in the weeks ahead.

Now, Berkshire shares are trying to break out:

BRK.B has been consolidating for more than a month. Now clearing recent resistance near $460, active traders could see more bullish momentum should the stock hold up above this level. If it continues to rally, the prior highs could be in play.

On the flip side, a break back below resistance could put recent support near $450 back in play. Below that level and the selling pressure could accelerate as momentum turns bearish.

Options

For options traders, calls or bull call spreads could be one way to speculate on more gains in BRK.B. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads. Remember, call spreads cap investors’ potential gain, but reduce the overall cost of the trade.

Conversely, investors who expect a decline in the stock price could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

UBER – Shares of Uber are under pressure this morning, falling on reports that the company has explored a possible acquisition of Expedia. While there has not been a formal offer, that isn’t stopping the stocks from moving on the news, with EXPE rallying in pre-market trading.

MS – Morgan Stanley shares hit all-time highs on Wednesday after the firm delivered impressive quarterly results. Earnings of $1.88 a share came in well ahead of expectations for $1.58 a share, while revenue of $15.38 billion topped estimates by more than $1 billion. Dig into the financials for MS.

SMH – It’s been a bumpy couple of days for the VanEck Semiconductor ETF — SMH. Just as the ETF was regaining its footing, ASML’s disappointing results knocked it lower. Now though, shares are rising about 3% in Thursday’s pre-market session after Taiwan Semiconductor’s promising results. Check out the chart.

KRE – Regional bank stocks are making strides in rebuilding from the losses they suffered in 2022 and 2023. That’s as the SPDR Regional Banking ETF — KRE — quietly made new 52-week highs on Wednesday as earnings continue to roll in for the group.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.