The Daily Breakdown takes a closer look at silver and gold, as precious metals continue to shine in 2024.

Tuesday’s TLDR

- Silver and gold hit year-to-date highs

- Financials hit all-time highs

- Verizon dips on earnings

What’s happening?

How many investors have been paying attention to gold? It has climbed to new all-time highs again this week, notching another record in 2024.

While investors are focused on the S&P 500 and Bitcoin — and for good reason — it’s hard to ignore precious metals right now.

Gold prices are up 33.5% so far in 2024, while silver is up 42.5%. Although silver is not hitting record highs, spot silver prices are hitting their highest levels in more than a decade.

Investors could trade futures on these commodities or buy the physical metal in coin, bar, or bullion form. There are also various stocks and ETFs as well.

For gold and silver, the two most popular ETFs include the SPDR Gold Trust (GLD) and the iShares Silver Trust (SLV).

Some investors may prefer to buy mining ETFs, like the VanEck Gold Miners ETF (GDX) and the smaller VanEck Junior Gold Miners ETF (GDJX), which are up 40% and 42.5% on the year, respectively.

Want to receive these insights straight to your inbox?

The setup — Financials

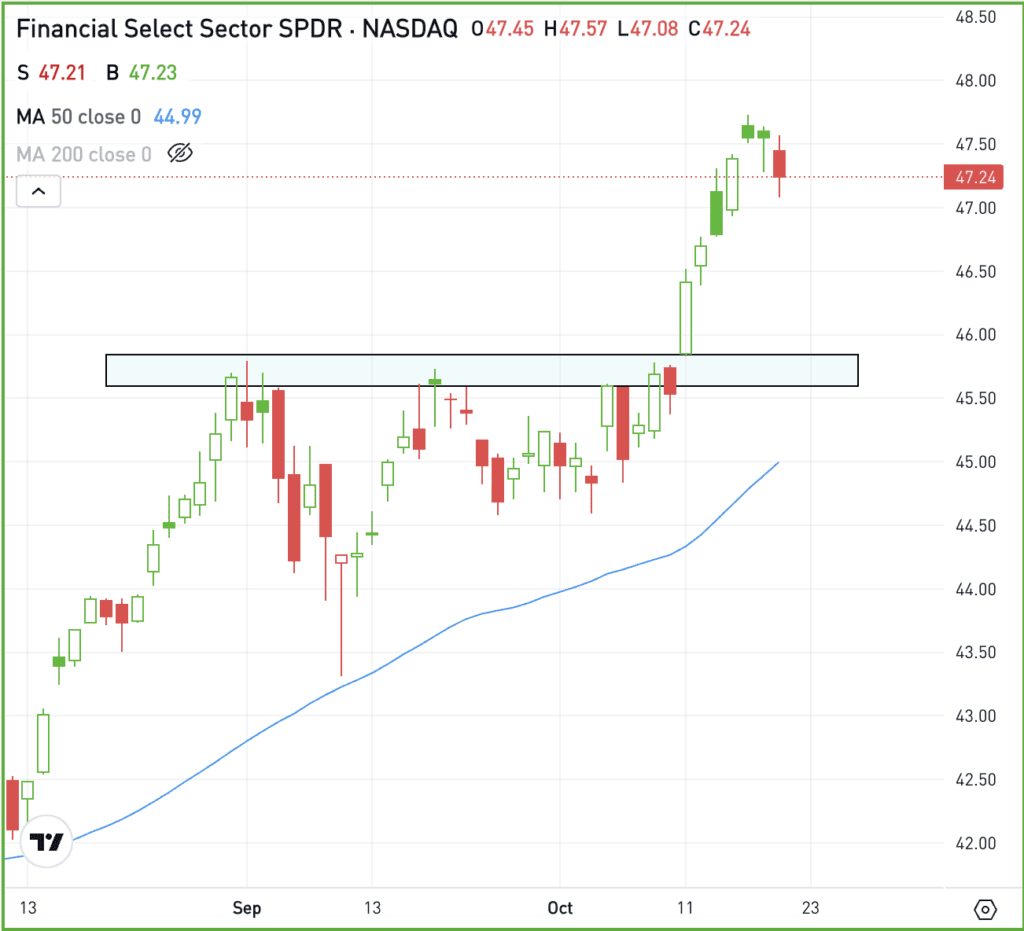

Financials are the second-best performing sector so far this year, up more than 25%. It’s also the best-performing sector so far in Q4, up more than 4% — although it helps that many firms in this group have already reported earnings.

The Financial Select Sector SPDR Fund (XLF) recently closed higher in six straight sessions and hit all-time highs. That’s as the ETF breaks out over resistance, with the recent rally being driven by earnings — a good fundamental development that investors want to see.

If the XLF pulls back into the $45 to $46 area — which is the breakout zone highlighted above — bulls will likely look for this area to act as support.

If it holds, investors will likely hope for a rebound back toward the recent highs, and perhaps even new highs if the momentum is strong enough. However, if this zone doesn’t hold as support, more selling pressure could ensue.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock/put.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

VZ – Can you hear me now? Shares of Verizon are under pressure this morning, falling about 3.5% as of 8:00 a.m. ET after the firm beat on earnings estimates, but missed on revenue expectations. Coming into today’s session, shares were up almost 16% on the year.

NVDA – Shares of Nvidia hit new all-time highs on Monday, climbing more than 4% in the session. The rally comes after shares dipped last week on worries about a slowdown in the space following ASML’s earnings results.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.