Gold prices are hitting new all-time highs and The Daily Breakdown dives into the reasons why the metal is up more than 20% so far in 2024.

Thursday’s TLDR

- Gold prices are up more than 20% so far this year.

- Interest rates and central bank buying are just two reasons why.

- Snowflake tumbles despite earnings beat.

What’s happening?

Gold has been a wonderful performer so far in 2024, up about 22.5%.

That’s better than the S&P 500 and Nasdaq 100, which are each up about 17.8%. Not surprisingly though, it lags Bitcoin’s 45% year-to-date gain.

Gold has been a strong performer this year thanks to several catalysts.

While inflation has fallen this year, it’s still elevated, which bodes well for gold. So does the anticipation of lower interest rates. With rates moving lower around the world — and anticipated to move lower in the US in September — that weakens fiat currencies. For instance, when the dollar weakens, it takes more dollars to buy something — like an ounce of gold.

Geopolitical tensions have also contributed to rising demand for gold, as gold tends to act as a “safe haven” asset. Gold purchases from countries (like China and India) looking to bolster their strategic holdings also helps drive up demand.

Lastly, gold plays a valuable role in technology, as it’s used in semiconductors. While there’s not much gold in each chip, there is a steady demand for the metal as an industrial component.

Want to receive these insights straight to your inbox?

The setup — AMT

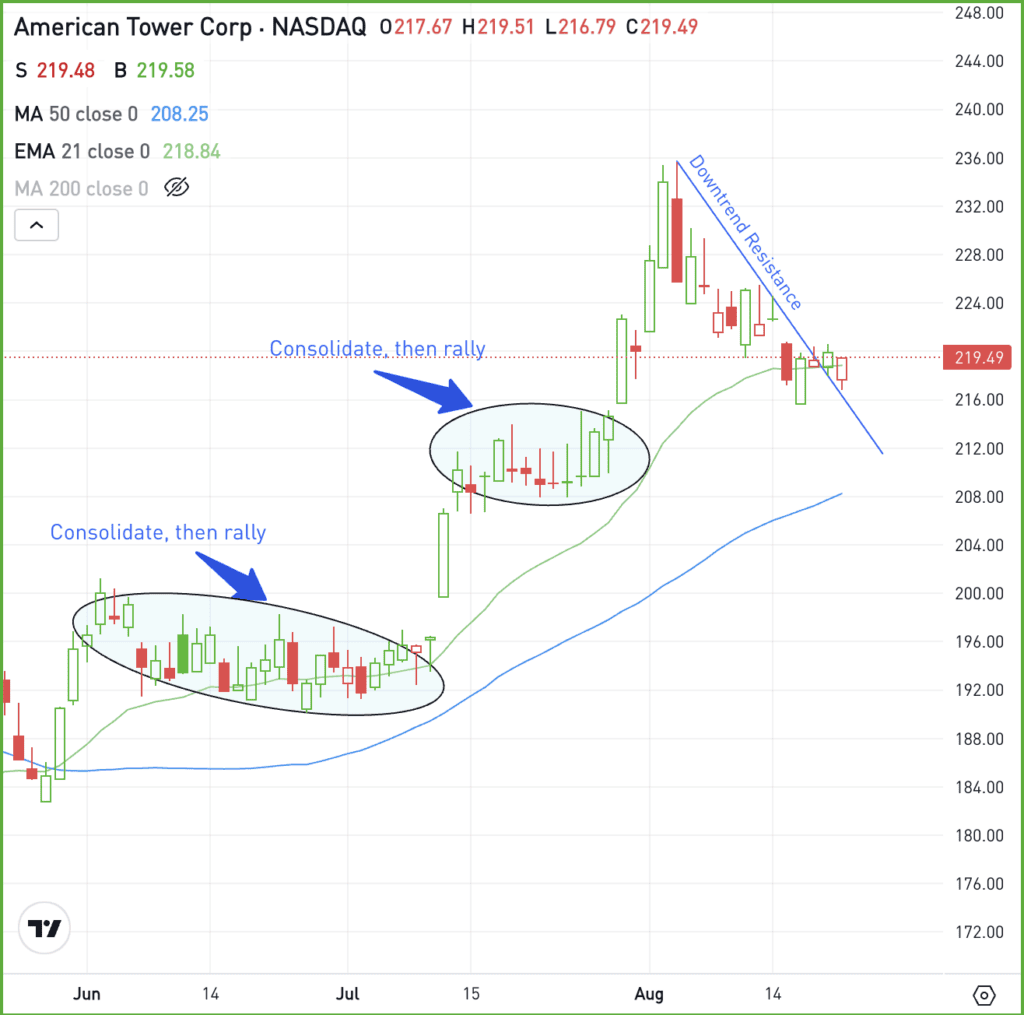

American Tower Corp has done really well lately, up 14.7% over the last three months and up roughly 25% over the past year. Despite these gains though, the stock is roughly flat so far in 2024.

As a REIT, the anticipation of lower rates coming into 2024 gave AMT a big boost. But as those rate-cut hopes faded in the first half of the year, so too did the stock. As you can see below though, shares have been rallying on hopes of a Fed rate cut.

AMT recently made a push to $236 before it retreated 8% and dipped to the 21-day moving average. The stock is finding short-term support near $217 while trying to break out over downtrend resistance.

The stock reacted well to earnings on July 30 and still pays a dividend yield of 3%. If shares can stay above $217, perhaps bulls can recapture some of the recent momentum we’ve seen, potentially putting a move back into the mid-$230s in play.

On a break below $217, one possibility could be that AMT might trade back down toward the 50-day moving average and the prior consolidation zone near $208 to $212 (shown on the chart above).

For some investors, AMT could be a good candidate for an options setup.

For those looking to learn more about options, consider visiting the eToro Academy — and remember to join our eToro Academy Learn & Earn Challenge, where you can take courses, pass quizzes, and earn up to $18 in rewards. Terms and conditions apply.

What Wall Street is watching

ETH — Ethereum gas fees hit a five-year low, dropping over 95% to as low as 0.6 gwei. Experts attribute the decline to users moving to faster, cheaper blockchains. Historically, such drops precede price rebounds. Currently, ETH is trading around $2,600.

SNOW — Shares of Snowflake are down roughly 10% in pre-market trading despite the firm beating Q2 earnings and revenue expectations. Sales of $868.8 million grew 28.9% year over year, while product revenue guidance for Q3 and the full year came in ahead of expectations. However, Q2 billings of $779 million fell well short of the consensus estimate of $831.9 million.

TOL — Shares of Toll Brothers jumped after the homebuilder reported Q3 earnings of $3.60 a share, beating expectations of $3.33 a share. Revenue of $2.73 billion beat expectations too, as management raised its full-year delivery and pricing forecast.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.