The Daily Breakdown takes a closer look at the new Ethereum ETFs, which began trading after gaining approval from the SEC.

Tuesday’s TLDR

- Earnings season heats up.

- SEC green-lights Ethereum ETFs.

- Wiz seeks IPO over Google’s $23 billion buyout.

What’s happening?

It’s the biggest day of earnings in a week that has a lot of earnings reports.

There’s United Parcel Service, Spotify, General Motors, General Electric, Coca-Cola, Comcast, and Lockheed Martin, among others. Also, that’s just the companies that reported this morning!

Tonight, we’ll hear from Tesla, Alphabet, Visa, Texas Instruments, Enphase Energy, and others.

Pivoting to crypto, Bitcoin and Ethereum are on investors’ radar this morning as the Ethereum ETFs are set to begin trading today in the US.

Bitcoin ETFs began trading in January, but the outlook wasn’t so great for Ethereum ETFs. However, in May the Securities and Exchange Commission made an unexpected move, opening the door for ETF approval later this summer.

Well, that day is today. While analysts don’t expect the Ethereum ETFs to be as popular as Bitcoin, they could see several billion dollars worth of inflows this year.

For context, Bitcoin ETFs have seen roughly $17 billion in inflows so far in 2024, garnering more than $1.25 billion last week and more than $3 billion over the last four weeks.

Regardless, it’s an important and historic day for Ethereum as it finally joins the ETF party.

Want to receive these insights straight to your inbox?

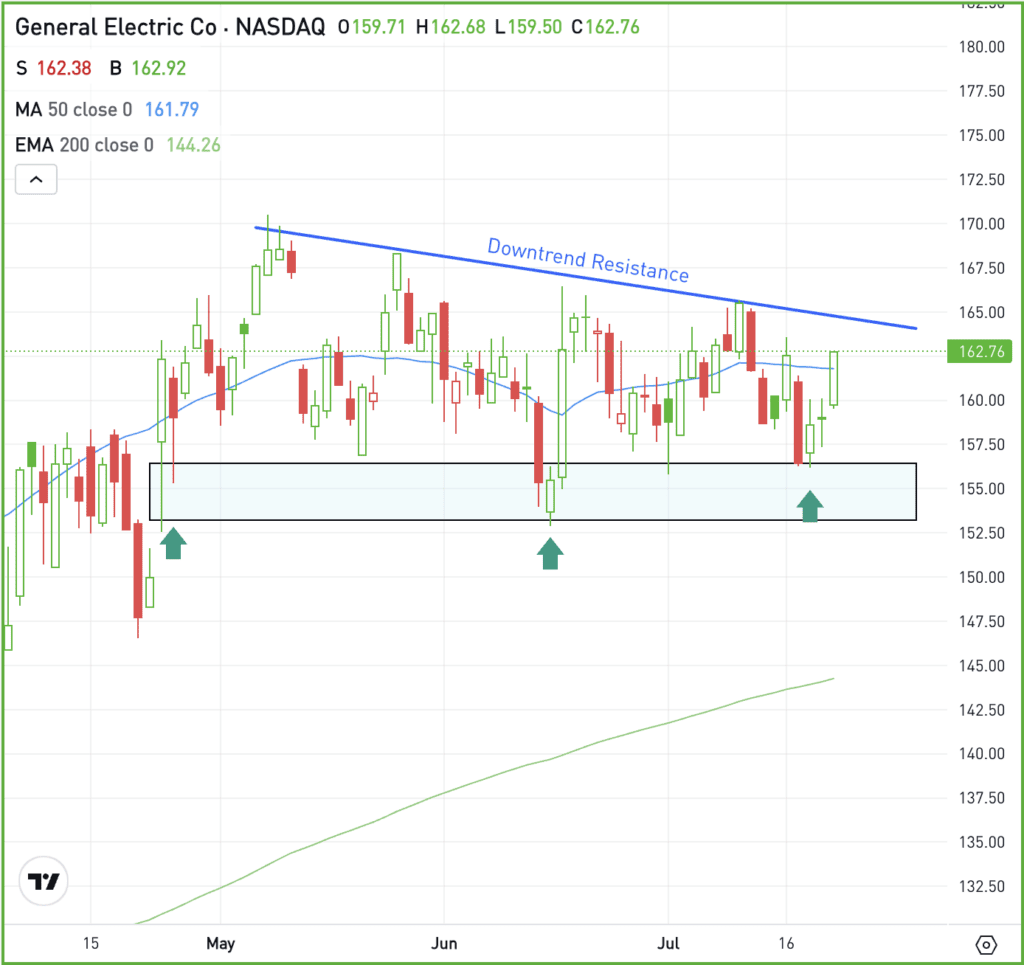

The setup — GE

I have been watching GE for a while now, waiting for the stock to break out of its range. Will today be that day?

GE reported earnings this morning, so investors will need to see how it holds up in today’s trading session. For what it’s worth, shares are trading higher in the pre-market after the firm beat earnings expectations.

The stock has been trapped in a trading range for a while now, finding support in the mid-$150s but being contained by downtrend resistance.

If GE can get above — and more importantly, stay above — downtrend resistance, it could open the door to its recent highs near $170, followed by potentially new 52-week highs.

However, if GE stock fails to break out, support in the mid-$150s could be back in play. Below that and the selling pressure could accelerate.

Options

For some investors, options could be one alternative to speculate on GE. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and GE rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

If you want to upgrade your investing knowledge this summer, make sure to join our eToro Academy Learn & Earn Challenge, where you can take courses, pass quizzes, and earn up to $18 in rewards. Terms and conditions apply.

What Wall Street is watching

MAT — Mattel jumped after reports of a takeover offer from L Catterton, while Hasbro may also make a bid. Mattel stated confidence in its standalone strategy, denying any deal talks. Hasbro rose 2.3%, while L Catterton is backed by LVMH, which is reporting earnings today.

GOOG — Talks between the privately held Wiz and Google parent Alphabet have reportedly broken down. The cloud security company has instead decided to pursue its goals of an IPO rather than come to terms on a $23 billion acquisition deal with Google — which would have marked the largest acquisition by Google to date.

VZ — Verizon was the worst-performing stock in the S&P 100 yesterday, tumbling after reporting its Q2 results. Earnings of $1.15 per share were in-line with expectations, while revenue of $32.8 billion missed consensus estimates of $33.04 billion.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.