The Daily Breakdown looks at the S&P 500 and its key levels with the March CPI print in focus. Intel introduces a new AI chip.

Wednesday’s TLDR

- The monthly CPI report is in focus this morning.

- The S&P 500 faces a key resistance area.

- Intel unveils a new AI chip.

What’s happening?

Another day, another mixed trading session for stocks as the S&P 500 finished higher by just 0.1%. It’s pretty easy to see what’s going on, as investors bide their time ahead of this morning’s CPI print, which was released at 8:30 a.m. ET.

But does it even matter?

For active investors, the answer is a resounding “yes.” For passive investors, it doesn’t matter quite so much.

The market could rally to new all-time highs and passive investors will keep feeding their 401k and investment accounts. The S&P 500 could dip 5% to 10% and guess what? Passive investors will keep putting money to work.

For active investors though, today’s inflation report is a biggie.

As rate-cut odds for June slide toward 50-50 — a month ago, the bond market was pricing in roughly a 75% chance for at least one rate cut — investors are eyeing today’s CPI report even more closely.

A hot report likely edges the June odds into the “no cut” camp, while an in-line or lower-than-expected report keeps the June rate cut in play. Either way, today’s report could stir up some volatility and that’s got active investors paying attention.

Want to receive these insights straight to your inbox?

The setup — S&P 500

For a week now, we’ve been talking about the potential for an increase in volatility — and that potential still exists. However, investors often forget that volatility can cut both ways, on the upside and the downside.

Generally speaking, the S&P 500 hasn’t gone anywhere in a month. It’s been up or down 1% to 2% since the close on March 1.

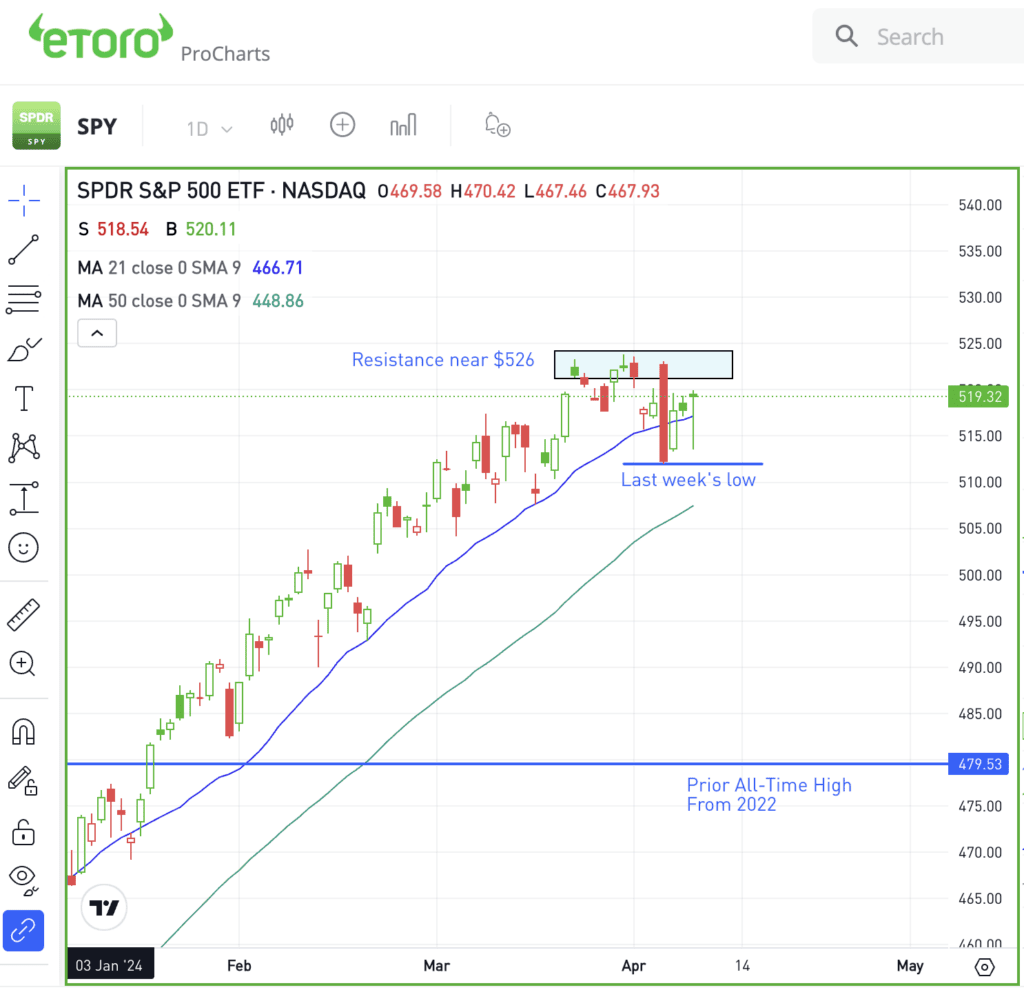

For the last three weeks, resistance has come into play at the same spot — the 5,260s. For the SPY ETF, which is shown below, that’s the $526 range. Here’s how active investors can approach this situation.

While we’re on watch for a potential dip after a powerful multi-month rally, don’t forget that we’re in a strong uptrend. Stocks have been consolidating for a month below what has become a key resistance level.

If we have an upside reaction to today’s CPI report, it could trigger a potential breakout in SPY over the $526 zone, setting up the next leg higher.

However, if the reaction is lower, keep a close eye on last week’s low near $512.75.

Below that level could fuel a deeper decline — potentially down toward the 50-day moving average. Before everyone gets too worked up, keep in mind that if SPY fell to that measure, it would only mark a decline of about 3.3% from the current high — far from the end of the world.

And remember, you don’t have to predict what the stock or ETF will do. You can wait for it to happen, then take action.

What Wall Street is watching

INTC — Intel announced the launch of its Gaudi 3 AI chip on Tuesday, challenging Nvidia’s dominance in the AI chip market. Gaudi 3 distinguishes itself with more than double the power efficiency and 1.5 times the speed of Nvidia’s H100 GPU, supporting the training and deployment of complex AI models. Gaudi 3 will be featured in systems by Dell, Hewlett Packard Enterprise, and Supermicro.

MSFT — Microsoft commits to investing $2.9 billion in Japan over the next two years, focusing on expanding its cloud computing and AI infrastructure, marking its largest investment in the country to date.

MRNA — Moderna rose by more than 6% after reports emerged of promising early-stage study results for its cancer drug developed in collaboration with Merck. The treatment targets a specific type of neck and head cancer.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.