The Daily Breakdown looks at the ECB and BoC as they cut interest rates ahead of the Fed’s meeting next week.

Friday’s TLDR

- Two central banks just cut rates.

- But the Fed is not expected to cut rates this month.

- Pinterest stock is trying to break out.

The Bottom Line + The Daily Breakdown

Today’s the first Friday of the month, which typically marks the monthly jobs report. This morning, investors will be keying in to see if the US is continuing to see softening economic data.

On the economic front, we’ve had a bit of a mixed bag lately.

Retail sales have come in lower than expectations, while at the same time, we’ve seen consumer sentiment and GDP below economists’ expectations. We’ve also seen some softness in the labor market.

That doesn’t necessarily mean it’s time to panic, but it’s certainly adding to the calls for the Federal Reserve to lower rates.

Lower rates around the world

On Wednesday, the Bank of Canada was the first from the G7 countries — which includes Canada, France, Germany, Italy, Japan, the UK, and the US — to lower interest rates.

A day later, the European Central Bank followed up with a rate cut of its own.

Both the BoC and ECB said they would be data dependent when it comes to future rate cuts — a phrase we hear regularly from Fed Chair Powell & Co.

Naturally, this has the Fed on watch. Next Wednesday June 12, we’ll get the monthly CPI report in the morning, followed by the Fed’s interest rate decision in the afternoon.

Spoiler alert: Don’t get too excited about a rate cut.

Where does the Fed stand?

Right now, the bond market is not pricing in any probability of a rate cut from the Fed this month. For the meeting on July 31, the bond market is currently pricing in just a 20% probability that the Fed will cut rates.

It’s not until September before the bond market is pricing in a rate cut.

Remember, these probabilities move constantly and are subject to change. But the expectation is that the Fed won’t cut rates for at least a few more months.

While we had two favorable inflation reports in May — the CPI and PCE reports — the Fed will likely need more than one month of roughly in-line inflation results before feeling confident enough to cut rates.

The flip side is, we are seeing softening economic data. If that continues, it could push the Fed to cut rates sooner than currently expected. Ideally though, a rate cut comes on the back of lower inflation rather than deteriorating economic conditions.

Tomorrow’s jobs report will be a key focus in this regard, as will next week’s inflation report. Then we’ll have to listen to what the Fed has to say and how that impacts expectations for July.

Want to receive these insights straight to your inbox?

The setup — PINS

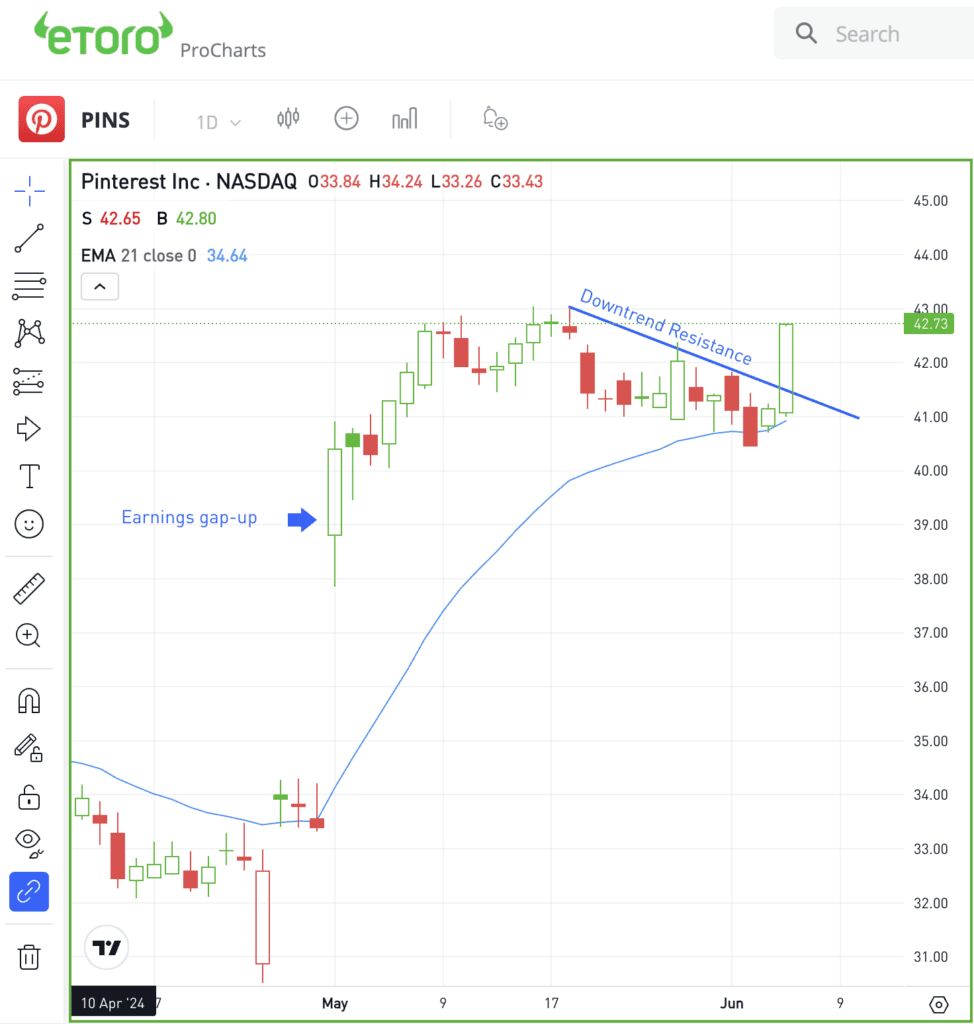

Pinterest has been trading really well lately, up 21.7% over the past three months. A bulk of those gains came after shares erupted higher on May 1 following better-than-expected earnings.

After some consolidation, the stock is now trying to resume a potential move higher.

Notice how PINS stock was able to find support on the 21-day moving average, then push through downtrend resistance. That’s got bulls eyeing a potential push up to recent highs near $43, then possibly extending higher.

If shares lose momentum and break below the $40 to $40.50 zone, then more downside selling pressure could develop in the short term.

Options

For some investors, options could be one alternative to speculate on PINS. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and Pinterest rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.