The Daily Breakdown takes as closer look at tech, as the Nasdaq continues to lag the S&P 500 and hasn’t made new highs since mid-July.

Tuesday’s TLDR

- The Dow and S&P 500 have made new highs

- But the Nasdaq and tech continue to lag

- The DoJ sues Visa

What’s happening?

BODY: Tech has been a big laggard lately and it’s got some investors scratching their heads. While the S&P 500 and Dow have gone on to make new record highs this month, the Nasdaq has not made a new high since mid-July.

As a sector, tech is up 16% so far this year, which ranks sixth out of the S&P 500’s 11 sectors. In fact, it’s even lagging the S&P 500’s return of 21%.

To be clear, tech isn’t necessarily doing bad and it’s actually a very good thing to see other sectors performing so well. This is referred to as “expanding breadth” and while most investors love groups like FAANG and the Magnificent 7, it’s healthy price action to see leadership from more than just a handful of stocks.

That said, it’s rare to see tech so far down the list of top sector performers when stocks are at all-time highs. Could that change as we shift gears into the fourth quarter?

Want to receive these insights straight to your inbox?

The setup — XLK

Last week we talked about the QQQ ETF, but I want to take a look at a different ETF focused on tech: The XLK.

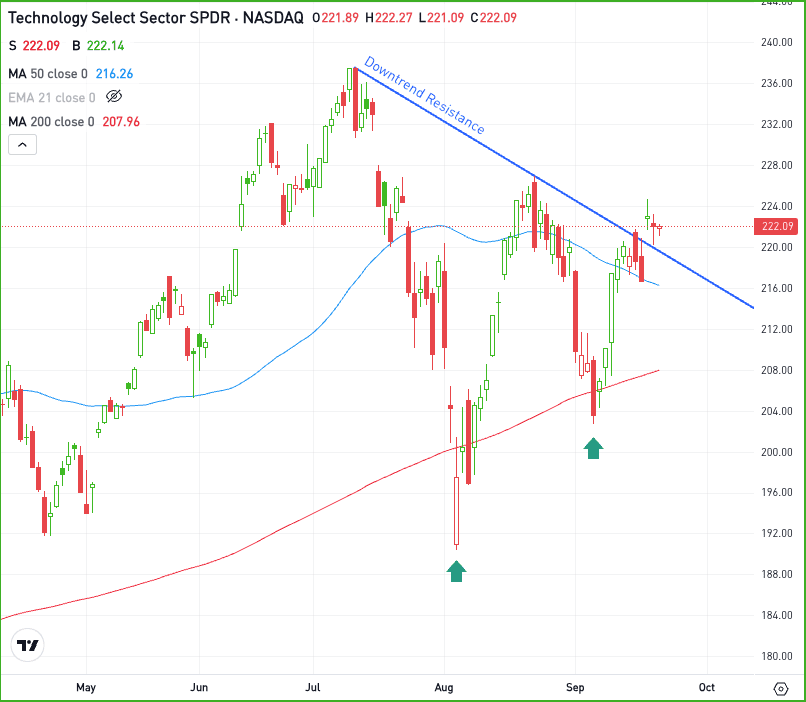

Like the Nasdaq, notice how the XLK remains notably below its all-time high. On the plus side, the ETF recently cleared downtrend resistance, as shown below:

If the XLK can stay above its recent low near $217, active bulls may look for momentum to return to tech — with an ultimate goal of seeing the sector make new highs. However, if the XLK closes below $217, it could usher in more selling pressure, potentially down to the 200-day moving average.

On a fundamental basis, the tech sector has generated double-digit earnings growth in the last four quarters and is forecast to do so again in the next six quarters, according to Bloomberg estimates. Healthcare is the only other sector currently forecasted for double-digit earnings growth through 2025.

The top holdings in the XLK include: Apple, Microsoft, Nvidia, Broadcom, and Oracle.

Options

For some investors, options could be one alternative to speculate on XLK. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and XLK rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

SNOW – Shares of Snowflake had a good session on Monday, but are down almost 4% in pre-market trading today after the firm announced a $2 billion convertible note offering.

TSLA – Tesla shares have been on a tear lately, rising almost 5% in Monday’s session. The stock is up more than 16% so far this month, and as the quarter draws to an end next week, investors will soon be looking for the automaker’s quarterly delivery results.

V – Shares of Visa are under pressure this morning following a lawsuit from the Justice Department. The DoJ is suing Visa, alleging that it “illegally monopolized the US debit card market,” according to Bloomberg.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.