Small caps continued with their recent momentum. Can they hit new highs? The Daily Breakdown digs in — and previews the Fed.

Thursday’s TLDR

- The Fed’s on deck this afternoon

- Economists expect a rate cut

- Small caps burst higher

What’s happening?

The S&P 500 and Bitcoin exploded to all-time highs on Wednesday, with euphoric price action weaving throughout capital markets. Small caps did well too, alongside sectors like financials, industrials, and energy.

On the flip side, precious metals and bonds did poorly, with the TLT ETF falling 2.7% as Treasury yields soared. Anything yield-related in the stock market also had a hard time joining yesterday’s bull party, as sectors like real estate, consumer staples, and utilities struggled.

With assets like the S&P 500 and Bitcoin making new highs, bulls will want to keep an eye on these assets’ former highs. To stay above these highs is a good sign. Further, yesterday’s price action didn’t result in a “sell the news” reaction after the strong open. That’s a good sign, but keep an eye on these names to see that they can stay above the prior high.

As for today, we’ve been mentioning it all week: The Fed’s on tap.

We’ll get the Fed’s latest interest rate decision at 2 pm ET, where it’s expected that they will lower rates by 25 basis points. At 2:30 pm, Chair Powell will read his prepared remarks and participate in a Q&A session where reporters will try to get clarity on the Fed’s current outlook.

Want to receive these insights straight to your inbox?

The setup — Small Caps

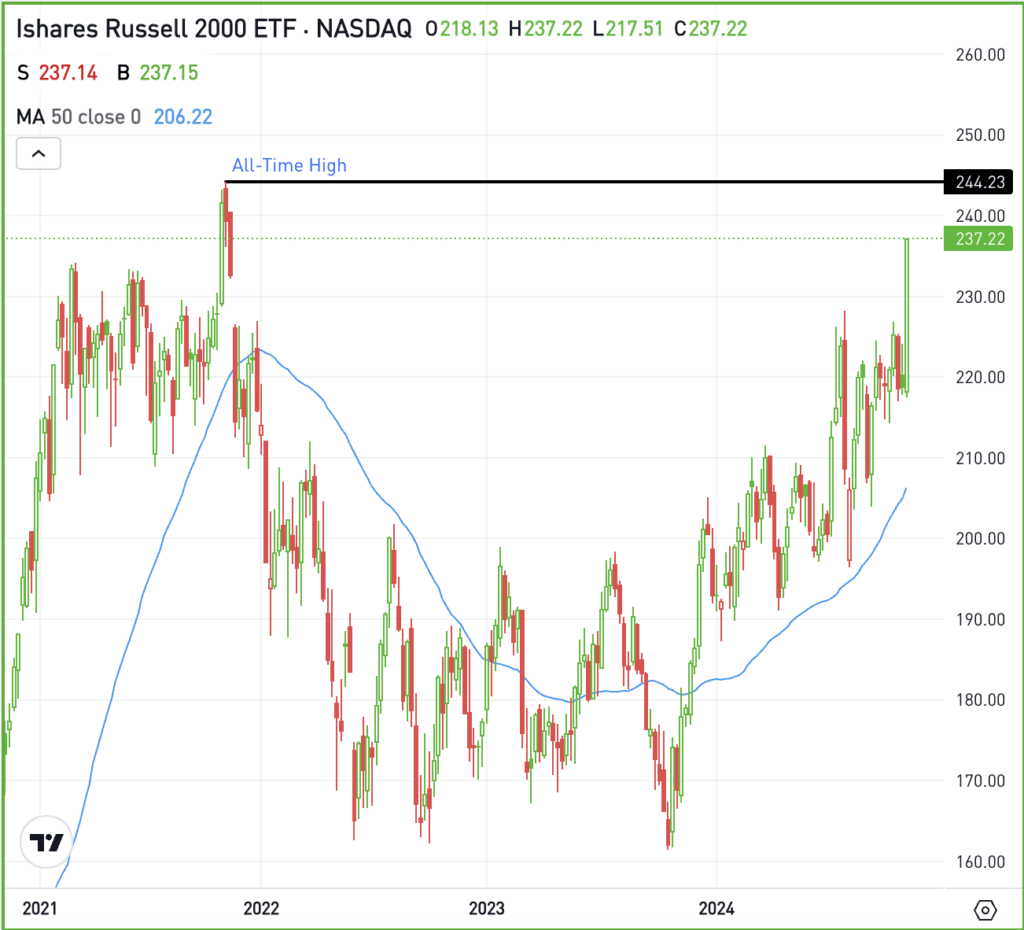

Yesterday, the IWM ETF opened higher by 5.5%, and while it dipped during the day, it closed strong, ultimately ending higher by 5.8%. This is the type of move that small-cap investors have been waiting for.

Small caps have lagged amid the two-year bull market, but showed signs of life in Q4 2023 and during the summer on hopes of the Fed shifting into a rate-cutting cycle.

Remember when the Russell 2000 — a measure of US small caps — gained more than 10% in July? As a refresh, it showed that 90% of the time the index was higher six months later.

Now bulls are wondering if and when the IWM can press to all-time highs, which haven’t been hit since 2021. If the group can maintain its recent momentum, new highs could be in store.

Small caps need a strong economy and prefer lower interest rates, which has been a slow but steady development so far in 2024. If these observations hold true into 2025 and 2026, then small cap investors may have the long-term catalyst they need for this group to finally outperform.

Options

For some investors, options could be one alternative to speculate on IWM. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and IWM rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

ARM – Shares of Arm Holdings are down this morning, trading lower by about 5% in pre-market trading after the firm reported its fiscal Q2 results. Earnings of 30 cents a share beat expectations of 26 cents a share, while revenue of $844 million beat estimates of $810 million.

MRNA – Moderna delivered a surprise profit in its Q3 results, helping send shares higher this morning. The stock is up more than 10% in pre-market trading after the report, which included a better-than-expected revenue result as well.

TSLA – Shares of Tesla zoomed to one of its best days in quite some time, with shares gaining almost 15%. The stock took out its recent highs and finally made its way to fresh one-year highs.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.