Ethereum has lagged the rally that we’ve seen in Bitcoin. Can it start to catch up? The Daily Breakdown looks at the charts.

Monday’s TLDR

- We have a shortened trading week

- ETH is trying to build momentum

- Macy’s delays earnings

Weekly Outlook

After a whirlwind couple of months, the market finally looks ready to tap the brakes when it comes to events. Even excluding the election, we had plenty of action in the way of earnings, Fed meetings, and major economic reports.

Nvidia was the big report to watch last week, alongside several major retailers. Now traders are focused on how stocks will perform during the short week and whether Bitcoin can get to $100K this week — it rallied as high as $99,800 on Friday.

Remember, the stock markets are closed on Thursday for Thanksgiving and have an abbreviated trading session on Friday (US markets are open from 9:30 a.m. ET to 1 p.m.)

Retailers will be in focus this week for Black Friday, as well as earnings.

That’s with Abercrombie & Fitch, Kohl’s, Best Buy and Dick’s Sporting Goods reporting earnings on Tuesday morning.

Dell, Crowdstrike — who was responsible for that big cybersecurity outage earlier this year — Workday, and HP Inc will report on Tuesday after the close.

On Wednesday, we have two major economic reports to focus on: an updated GDP revision for Q3 and the PCE report. Remember, the latter is the Fed’s preferred inflation gauge.

Lastly, expect trading volumes to fall this week, as many investors take time off.

Want to receive these insights straight to your inbox?

The setup — ETH

A lot of focus has been on Bitcoin and with good reason — it’s up more than 130% so far this year. On the other hand, Ethereum is up just over 50%.

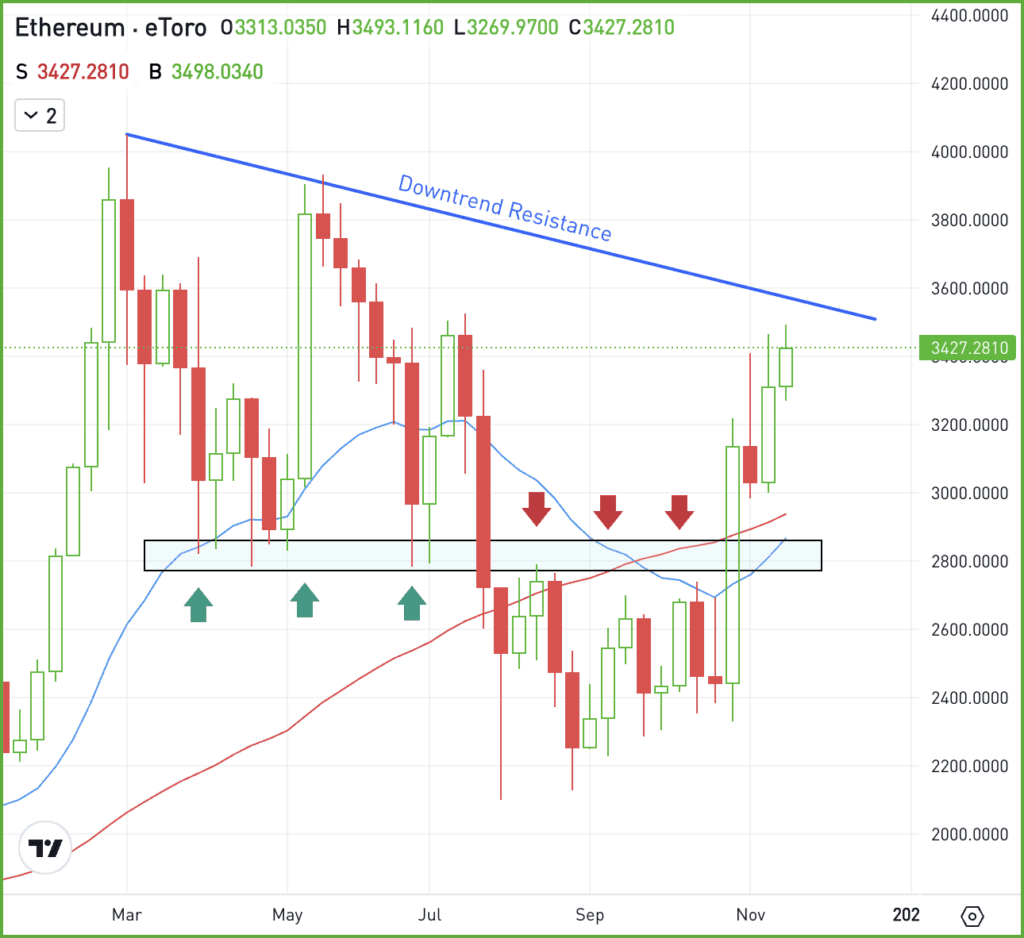

Recently, ETH was able to regain the key $2,800 level, and even held above the $3,000 range on its latest pullback. Now pushing higher again, bulls are watching downtrend resistance.

If ETH is able to clear downtrend resistance, it could put this year’s highs in play near $4,000.

However, if this level continues to act as resistance, then bulls will want to see the key $2,800 level hold as support on any pullback. It would also be encouraging if ETH is able to hold the 50-day and 200-day moving averages as support on future pullbacks.

What Wall Street is watching

M – Macy’s stock is down slightly this morning after the company said it would delay its Q3 earnings report (originally scheduled for tomorrow morning) “after an investigation revealed an employee hid more than $100 million of expenses,” according to Bloomberg.

GOOG – Alphabet shares fell 4.2% last week and are now down more than 7% in the last two weeks as investors continue to digest the headlines related to its ongoing monopoly issue with the Justice Department. The latest issue involves regulators wanting the company to sell its Chrome browser business. Check the charts.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.