The Daily Breakdown looks at the reactions to earnings so far this quarter, as well as how well Apple stock is holding above support.

Friday’s TLDR

- Q1 earnings have shown solid growth…

- But the reactions have been disappointing.

- Apple continues to hold above key support.

What’s happening?

Another Friday, another Bottom Line breakdown.

This time it’s about lackluster earnings reactions this quarter, starting with the Magnificent Seven.

Meta and Netflix sold off earnings, while Microsoft and Amazon were muted — rallying 1.8% and 3.4%, respectively. Alphabet stood out with its one-day 10.2% rally, but that gain was chiseled down to just 4.2% a few days later.

Apple and Tesla rallied on earnings, but the stocks were pummeled into the reports and are still down so far this year.

The trend has been to punish stocks that fail to deliver good results and begrudgingly reward those that post great results.

Case in point?

Robinhood posted strong results and the stock fell on Thursday. The Trade Desk also had a good quarter and a solid outlook, yet shares hesitantly inched higher.

Uber, Coinbase, Disney, Celsius, Datadog, Shopify, Palantir, Arm Holdings, Starbucks, Etsy, Roblox and many others have had varying degrees of painful reactions.

The flip side

One could argue that there are always negative reactions during earnings season.

While the stock-specific reactions have been disappointing, the actual results have been good overall.

Entering this week, FactSet noted: “The earnings growth rate for the first quarter is now at 5.0%. That is compared to an earnings growth rate of 3.5% just last week and an earnings growth rate of 3.4% at the end of the first quarter.

If 5.0% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q2 2022 (5.8%).”

The bottom line

This is a good time to remember the mental side of investing and take a moment to know your timeframe.

Before taking a position, ask yourself: Is this a trade (short term) or is this an investment (longer term)?

If it’s a long-term investment, earnings — good and bad — are just part of the ride. But if it’s a trade that you really want to be involved in and earnings are in the not-too-distant future, one consideration is options.

Those who buy calls or puts (as well as bull call spreads and bear put spreads) pay what’s called a premium when they enter the trade. That premium is the maximum loss for the trade.

There is a caveat, though. Because volatility is elevated ahead of a known event (like earnings), options prices become more expensive. This is known as implied volatility and when a larger move is expected — i.e. implied volatility is higher — options pricing reflects that.

Earlier this year, I wrote about a really good real-world example involving trading options on Snap around earnings.

It highlights how options can be rewarding when you’re right, but help limit your losses when you’re wrong. Options take discipline and can be tricky to navigate at times, but they can also be very worthwhile to learn.

For those looking to learn more about options, consider visiting the eToro Academy.

Want to receive these insights straight to your inbox?

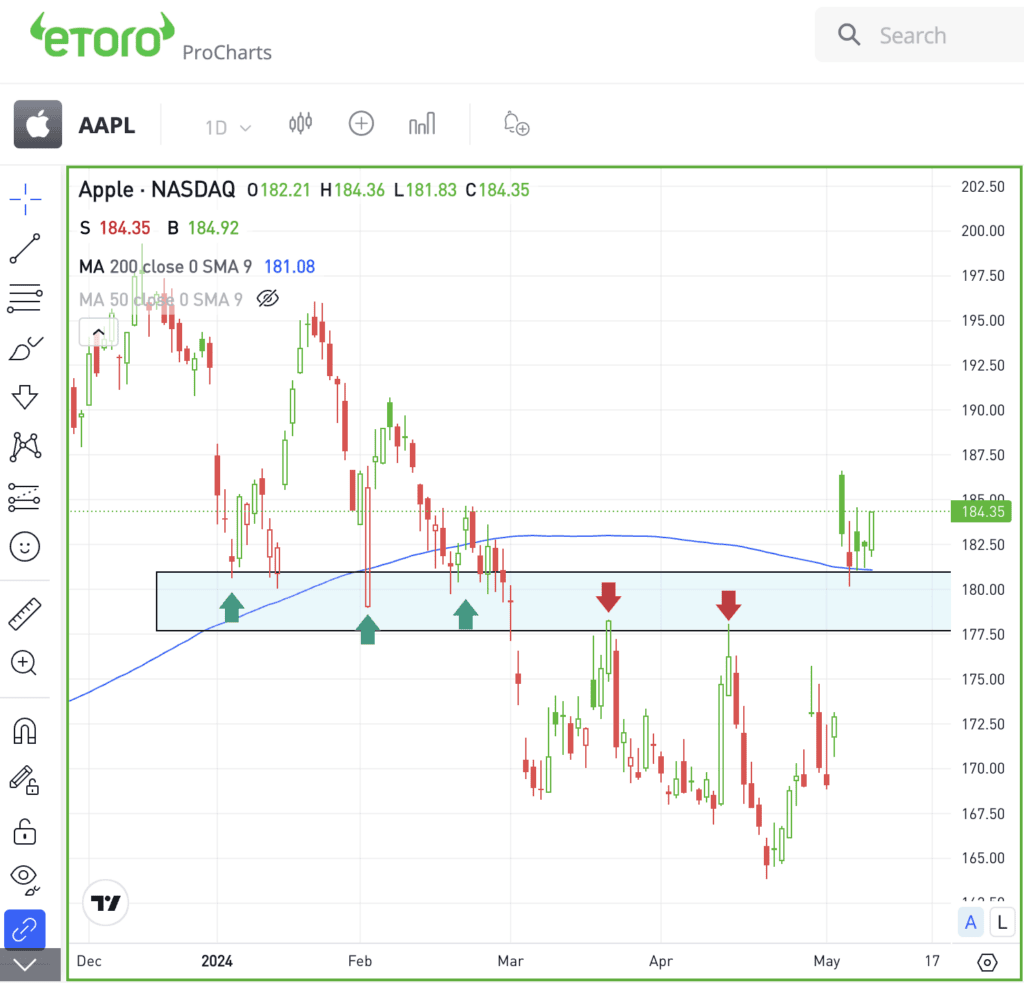

The setup — AAPL

Apple is still down a little more than 4% so far in 2024, but the charts are starting to improve?

When Apple reported earnings in early May, the stock popped back above the key $180 area — remember when we talked about this level breaking? — as well as the 200-day moving average.

Now, we’re seeing Apple hold up over this area.

Bulls would love to see more leadership from Apple, which has become a key stock to watch over the years. If it can hold up over the $177.50 to $180 area, bulls can maintain control.

In an ideal world, bulls would like to see Apple take out the post-earnings high at $187. On the flip side, if the stock breaks back below $177.50, it’s possible that Apple heads lower — potentially back below $170.

Options

For some investors, options could be one alternative to speculate on Apple.

Bulls can utilize calls or call spreads to speculate on further upside, while bears could wait to see if support fails, and if it does, puts or put spreads could be an option to speculate on lower prices.

Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.