The Daily Breakdown sizes up Bitcoin’s recent dip, while also looking outside of tech stocks to generate strong returns in 2024.

Friday’s TLDR

- S&P 500 hits another all-time high.

- Lululemon slumps on disappointing guidance.

- Bitcoin is looking for its next direction.

What’s happening?

We made it to another Friday, which means we’ve got an expanded top section — The Bottom Line.

This section will sound a little hypocritical at first, but just bear with me. I promise it will work itself into a coherent idea.

There’s something to be said about not being overly diversified, with your investment funds tied up in seemingly every industry and asset. When we invest in the businesses, brands, and assets we know best, and they perform well, it’s both mentally and financially rewarding.

Let’s be honest: Generating big gains in Apple, Nvidia, Tesla, Bitcoin and other well-performing assets over the years feels good — both to ourselves and our portfolios.

That’s not an endorsement for chasing fads or YOLO-ing our investments into options. It’s a compliment to investors that do the work and see the payoff.

The flip side to all of this — AKA the “hypocritical” side — is that looking outside your usual investment faves can potentially yield big results, too.

Led by Meta, Netflix, and Disney, the communications sector is the best-performing sector in the S&P 500 year to date.

But the next best?

Try financials, energy, and industrial stocks.

How many investors have been busy scooping up these groups — stocks like JPMorgan, which is up in 19 of the last 20 weeks, or Valero, which is riding a huge breakout we highlighted last week?

How about industrial leaders like General Electric, Caterpillar or even Uber?

Nevermind that gold prices just hit all-time highs. So are the stock indices for Denmark, France, Germany, Japan, and others.

Okay, that’s enough — let’s unwind.

I’m not saying investors should throw money around blindly, and I’m not trying to make anyone feel badly about missing out on the rallies I just pointed out.

My point is, investors should remember to lift their head up once in a while and look around. See what sectors are doing well and look at the stocks within that group. Which ones do you know? Why are they rallying?

You might not be familiar with Caterpillar’s machines, but you’ve probably taken an Uber before.

Many investors focus on only a handful of stocks, while passively investing in US index funds — the latter of which has historically been a great investment. But remember to keep learning and expanding your knowledge.

You shouldn’t invest in businesses or sectors that you’re not comfortable with. But there are times when it pays to look outside of the same few stocks we so often find ourselves staring at.

Want to receive these insights straight to your inbox?

The setup — Bitcoin

After all that, now I look at Bitcoin. Go ahead — call me a hypocrite.

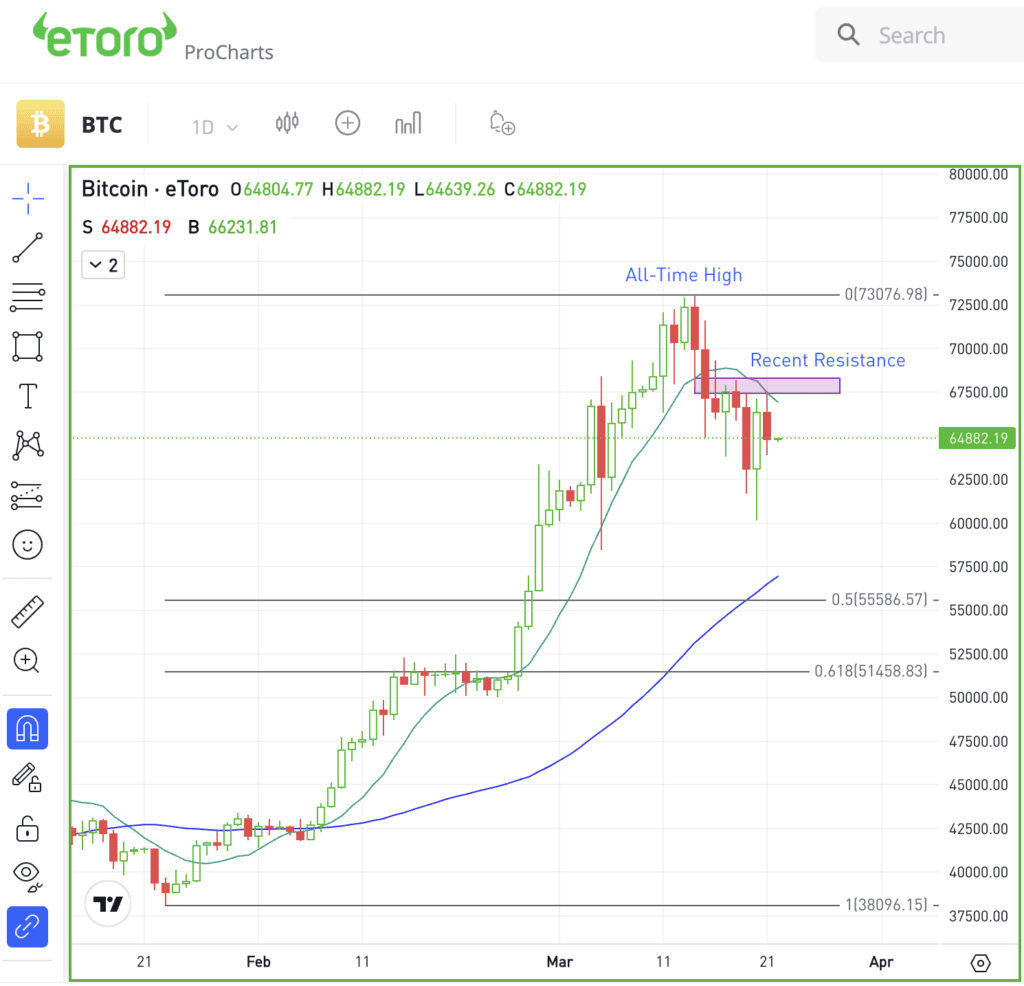

That said though, the price action doesn’t lie. Bitcoin has been running into resistance between $68,000 and $69,000.

Further, we’ve seen more volatility creeping into cryptocurrencies as of late. We’ve seen that as the recent dip in Bitcoin sent it down to almost $60,000.

I’m approaching this asset with an open mind.

On the one hand, Bitcoin has already had a powerful run and some rest would make sense. On the other hand, it hasn’t paid to bet against Bitcoin lately, while the halving event is coming up next month.

On the upside, watch that recent resistance level. If Bitcoin can get above — and more importantly, stay above — this $68,000 to $69,000 zone, it may have a shot at retesting the highs or making new highs.

On the downside, watch the recent low near $60,000.

If Bitcoin breaks below this measure and can’t get back above it, a deeper correction could be in play. That would have me watching for potential support in the low- to mid-$50,000 range.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.