Bitcoin prices are building above the key $90,000 level, while Apple stock gains momentum. The Daily Breakdown takes a closer look.

Tuesday’s TLDR

- Bitcoin’s rally is holding up

- Apple stock in focus

- Walmart beats on earnings

What’s happening?

We’ve seen volatility in the S&P 500 and Nasdaq 100 over the past week, but Bitcoin’s action has been calmer.

Bitcoin burst higher in early November and continues to consolidate around the key $90,000 figure. This is unlike the action we saw in March, when Bitcoin pushed to new highs but then quickly faded and began to consolidate.

The way that BTC has held up is impressive to many who use technical analysis and likely adds confidence to their expectations for it to reach the key $100K mark.

Funds are flowing into the Bitcoin cryptocurrency as well as the key ETFs that were approved by the SEC earlier this year.

Now, we have another breakthrough.

That’s as options are expected to begin trading on IBIT — the iShares Bitcoin Trust ETF — which is the largest Bitcoin ETF with more than $40 billion in assets.

Options will give traders the ability to buy or sell IBIT at a pre-determined price at a future date. That allows investors who have seen large gains in IBIT a way to hedge, while it gives other investors ways to speculate on a further rise in Bitcoin.

To learn more about other options strategies, check out our Academy.

IBIT options are expected to go live on Tuesday, but we’ll see if that ends up being the case. At some point, it’s reasonable to expect other Bitcoin ETFs to have options trading as well.

Want to receive these insights straight to your inbox?

The setup — Apple

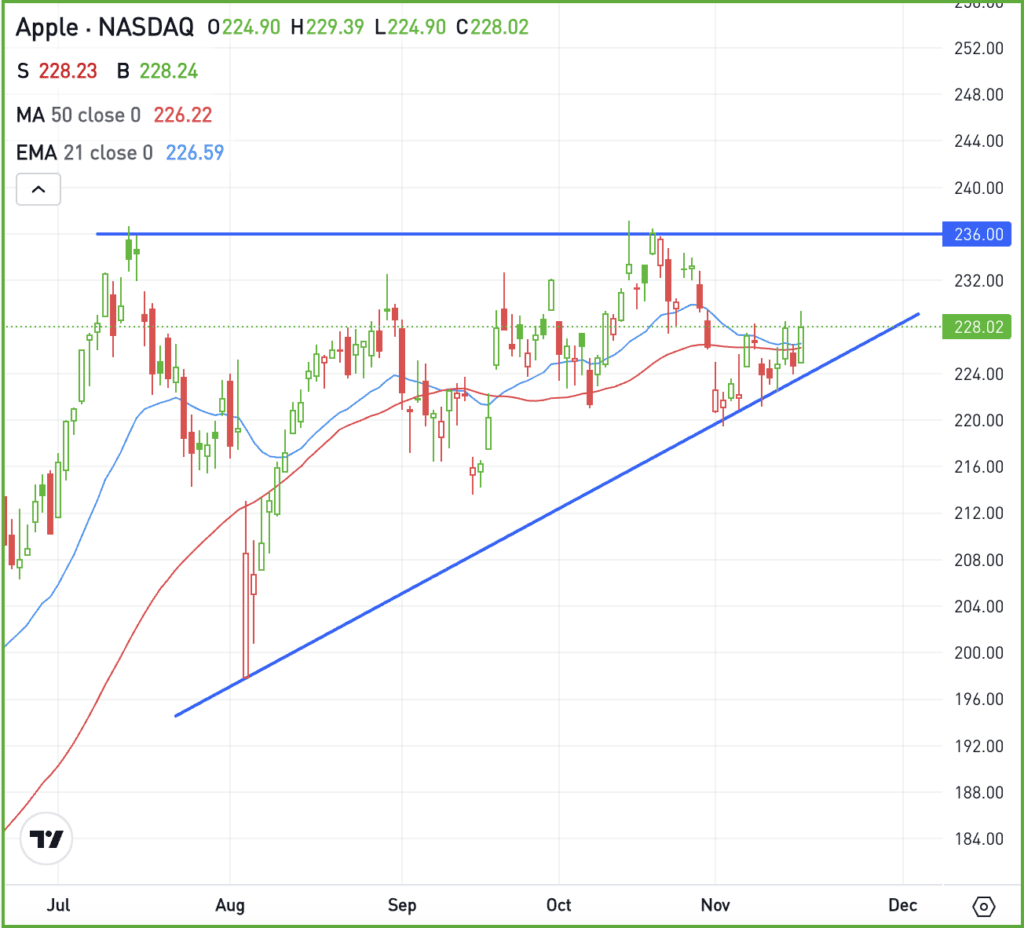

Apple is one of three Magnificent 7 stocks that still hasn’t taken out its July high. However, the price action remains constructive even though the stock has been lagging the broader market.

While shares continue to struggle with the $236 area, AAPL is back above its 50-day and 21-day moving averages. If the stock can stay above these measures in the coming days, perhaps another run at $236 could be possible:

That could bode well for short-term traders, but long-term investors are hopeful of something more — that “something” being a breakout over $236 to send shares to new highs.

On the flip side, a break back below $224 could undo some of Apple’s recent momentum, potentially putting more downside pressure on the share price.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, investors might consider using adequate time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

GOOG – According to reports, the Justice Department may seek to have Alphabet sell its Chrome Browser unit, which comes after a judge found the company to have illegally monopolized the search market. As expected, the company is pushing back against this potential possibility.

WMT – Shares of Walmart are rallying this morning after the retailer beat on earnings and revenue expectations, with sales of $169.6 billion beating expectations by nearly $3 billion. Guidance for the holiday quarter apparently impressed investors, with WMT set to open at all-time highs. Check out the chart for WMT.

XPEV – Xpeng stock is looking to rev higher on Tuesday morning, currently sporting pre-market gains after the automaker reported its quarterly results. Xpeng reported strong sales results and delivered upbeat guidance above analysts’ expectations.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.