Stocks and Bitcoin are testing all-time highs following the results of the US election. The Daily Breakdown dives in.

Thursday’s TLDR

- The election is (finally) over

- Bitcoin hits new highs

- Bank stocks are soaring

What’s happening?

The election in the US is all but decided and markets are responding with a rally as an outcome grows more certain. Remember, markets are good at pricing in new realities once they become known.

Bitcoin is hitting new all-time highs and Ethereum is one the rise. The S&P 500 looks set to open at new all-time highs, while the Russell 2000 — small caps — are set to explode higher, with the IWM ETF higher by more than 6% this morning.

It was a bull market before the election and remains a bull market today. That is true regardless of who won last night’s presidential election, and will continue so long as the bullish pillars — earnings, the economy and the Fed — remain in place.

Investors have had to endure a difficult and data-loaded two-week span of earnings, economic reports and the election. Now, we’ll wrap it up with the Fed meeting, which is scheduled for tomorrow afternoon at 2 pm ET.

While headlines are seemingly only focused on the election outcome right now, keep in mind that Wall Street will soon shift its focus to the Fed.

Want to receive these insights straight to your inbox?

The setup — BTC

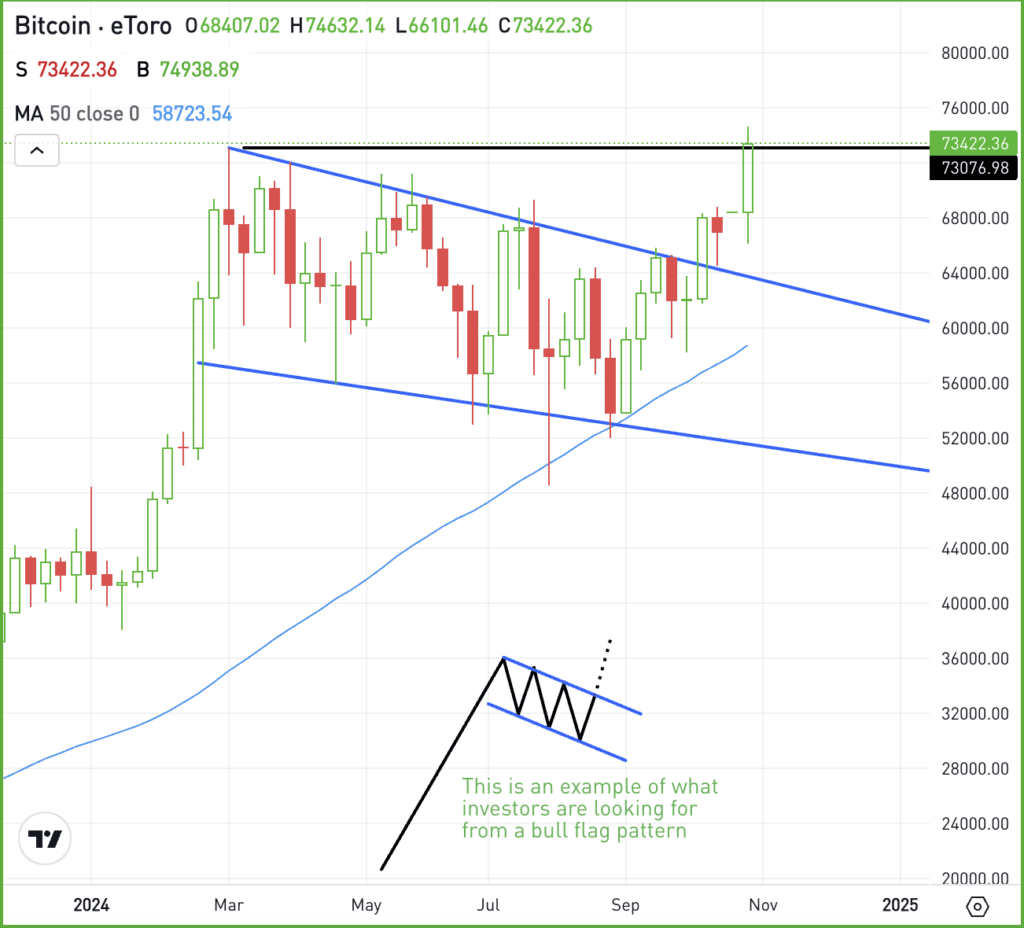

In late October, I shared a chart of Bitcoin that showed the cryptocurrency breaking out of a large consolidation pattern known as a “bull flag” pattern. The illustration at the bottom of today’s chart shows what an ideal pattern resolution looks like.

With Bitcoin now rallying, the prior all-time highs and the psychologically key $75,000 level are the main areas to watch.

If Bitcoin can clear these levels, it could very well add fuel to the recent bullish momentum we’ve seen. If BTC can’t clear $75,000 and this area acts as resistance, investors will want to see support in the $67,000 to $68,000 area.

Bitcoin bulls are hopeful that lower regulations and historical seasonality patterns will help power Bitcoin to new heights.

What Wall Street is watching

XLF – The financial sector ETF — the XLF — is ripping this morning, up more than 5% in pre-market trading. It leads all of the 11 sectors in the S&P 500 and is reminiscent of the election reaction we saw in 2016. JPMorgan, Bank of America, Morgan Stanley, and others are on the move.

CELH – Shares of Celsius Holdings are down slightly this morning after the firm reported its Q3 results. The company missed on earnings and revenue expectations, with this morning’s gains adding to the recent woes for the stock.

ARM – Arm Holdings is set to report earnings. Analysts expect the firm to earn 26 cents a share on revenue of $810 million. The stock has had a blistering start to its life as a public company after IPOing in September 2023, with shares up more than 160% in the past 12 months.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.