The Daily Breakdown looks at the week ahead, including the PCE and jobs reports, as well as earnings from Apple, Amazon, Microsoft and more.

Monday’s TLDR

- GDP, jobs, and inflation on watch

- PayPal struggles with a key level

- Boeing raises cash

Weekly Outlook

Fun fact: Since 1950, October 28th currently sports the best one-day average return for the S&P 500. Of course, in reality that means absolutely nothing in terms of how the market will do today, but I thought it was a fun fact to mention.

As for this week, it’s going to be a busy one. On the economic front, we end the week with three big reports.

On Wednesday, we’ll get the first GDP report from Q3. On Thursday, we’ll get the PCE report, which is the Fed’s preferred inflation gauge. Friday marks the first trading session of November, and that’s when we’ll get the monthly jobs report and updated unemployment rate.

When it comes to earnings, more than 40% of the S&P 500’s market cap will report.

That starts with companies like Ford and Waste Management on Monday evening. SoFi, PayPal, McDonald’s and Pfizer report on Tuesday morning, while Alphabet, Advanced Micro Devices, Chipotle Mexican Grill and Visa report after the close.

On Wednesday, Eli Lilly, Microsoft, Meta, Coinbase and Robinhood report earnings. That’s followed by Uber, Apple, Amazon, and Intel on Thursday.

Finally on Friday, oil giants Exxon Mobil and Chevron — which combine for a market cap of $806 billion — will report before the open.

Want to receive these insights straight to your inbox?

The setup — PayPal

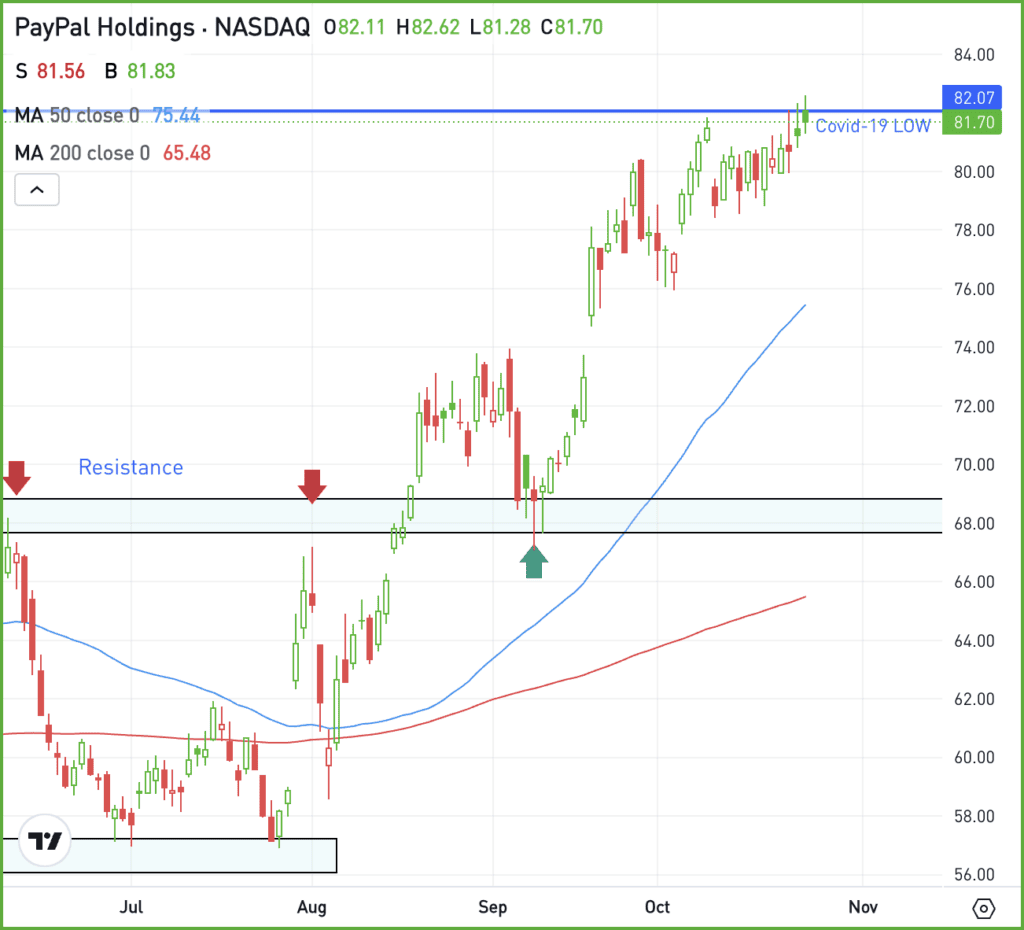

PayPal has been frustrating for long-term investors. Not only did the stock crater about 84% from its all-time high in 2021 to its low in October 2023, but the rebound hasn’t been all that impressive.

Sure, the stock is up 62.6% from its lows, but that badly lags the ~95% rally we’ve seen in the QQQ ETF. Plus, PayPal stock still hasn’t closed back above its 2020 Covid-19 low!

Despite PayPal’s awful performance over the last few years, shares have done well lately, up about 40% over the last three months. Remember, this company reports earnings on Tuesday and that has the potential to drive big moves in either direction.

If the stock can keep up its bullish momentum, look for a move back above the key $82 level. On a pullback, bulls will want to see support come into play around $75 and the 50-day moving average.

If that area isn’t support, the stock could see further selling pressure — potentially back toward the key $68 breakout level we discussed in late-August.

Options

For options traders, calls or call spreads are one way for investors to speculate on more upside, while puts or put spreads allow them to speculate on further downside or allow bulls to hedge their long positions.

Using options around big events — like earnings — tend to be more expensive. However, one advantage is that the total risk of the trade is tied to the premium paid when buying options or option spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

BA – Boeing shares are mixed this morning after the firm announced a massive effort to raise cash. The company will raise about $19 billion after selling 90 million shares of common stock and roughly $5 billion worth of depositary shares.

TSLA – Shares of Tesla soared 22% last week after the firm delivered better-than-expected Q3 earnings results. The stock hit a high of $269.49 last week, sitting just below the 52-week high of $271. Check out the chart.

SPX500 – The S&P 500 and Nasdaq 100 are set to start the week with a rally. However, with so many economic events packed into this week, along with a huge slate of earnings reports, this week could prove to be difficult for active traders. And don’t forget, the election is just eight days away.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.