The Daily Breakdown looks at semiconductor stocks, specifically Broadcom, as the group has renewed bullish momentum.

Wednesday’s TLDR

- The monthly inflation report comes out this morning…

- And so does the retail sales report.

- Broadcom shares are breaking out.

What’s happening?

The meme madness continued on Tuesday, with GameStop and AMC Entertainment opening higher by 112.9% and 128.9%, respectively. However, by the end of the day, the stocks were up “just” 60% and 32%, respectively.

The action allowed some traders to really cash in on the move using options.

The S&P 500 gained 0.5%, with the SPY ETF notching its ninth straight rally, while the Russell 2000 — a proxy for small caps — climbed 1.1%.

Will the gains hold up through today’s big reports?

That’s as the April inflation report and the retail sales report will both be released at 8:30 a.m. ET.

Inflation has been running hot so far this year and today’s CPI report will be the latest update on that front. Bulls are hoping for a report that suggests inflation is at least being held in check. Not just because it’s pinching their wallet, but because they’re hoping for rate cuts from the Fed sometime this year — something they’ll have trouble doing if inflation remains stubbornly high.

The other focus is the retail sales report.

Investors will use this report to take the pulse of the US consumer, an important temperature check considering about 70% of the US economy is driven by consumer spending.

We’ll get more — albeit different — insights on the consumer this week too, when Walmart reports earnings tomorrow morning.

Want to receive these insights straight to your inbox?

The setup — AVGO

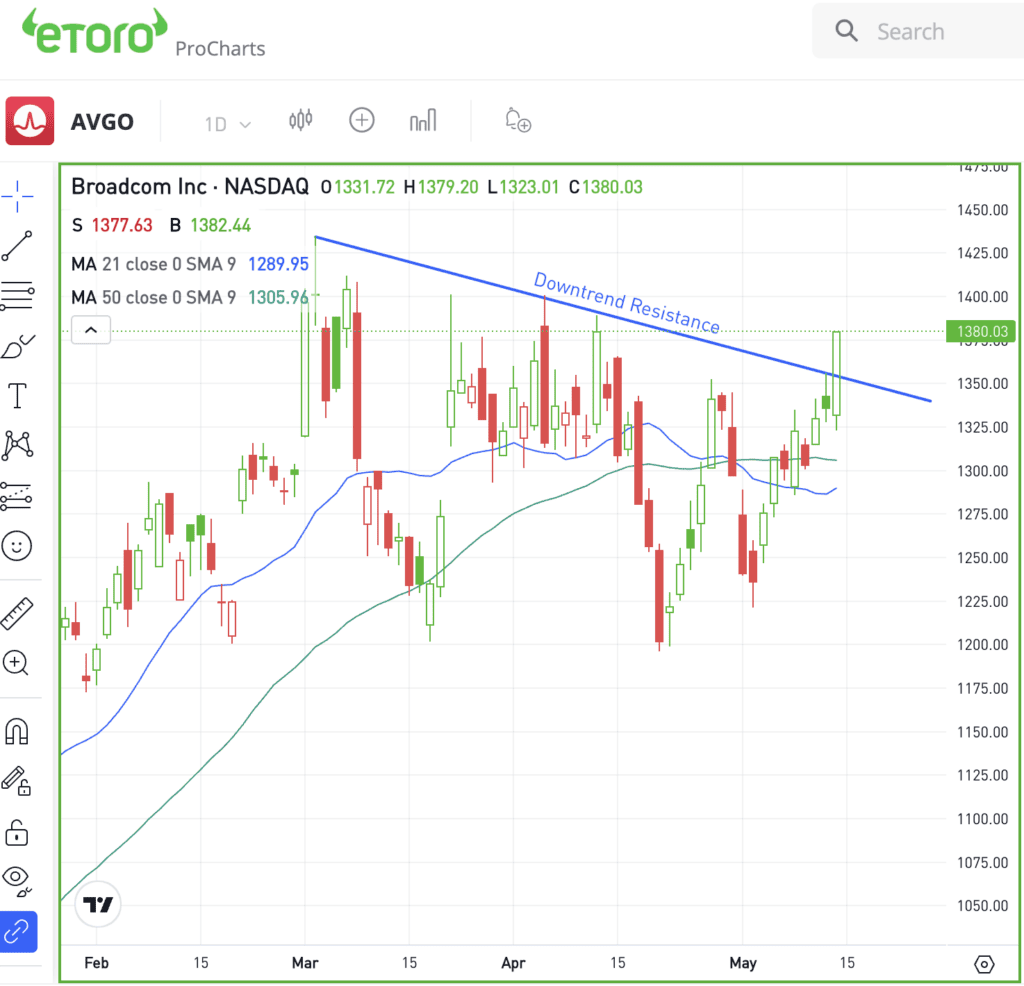

Earlier this month, I flagged a setup in the semiconductor ETF, the SMH, which just hit a multi-week high. If we zoom into this space, Broadcom has a similar chart.

After hitting an all-time high in early March, Broadcom shares pulled back. While the $1,200 area acted as support, the stock was continuously running into downtrend support.

On Tuesday, shares broke out over that measure.

Ideally for bulls, Broadcom will be able to stay above this prior downtrend resistance line while semiconductors as a whole continue to trade better. If the bullish momentum continues, perhaps the recent high near $1,438 will be in play.

If shares break below $1,325, Broadcom stock may need more time consolidating before moving higher.

Remember, Nvidia reports earnings next week and it will be a big catalyst — either good or bad — for the semi group.

What Wall Street is watching

GOOGL GOOG — On Tuesday, Google introduced a revamped search engine at its annual developers conference that increasingly prioritizes AI-generated responses over traditional website links. Starting this week, millions of users in the US will begin seeing AI-crafted conversational summaries at the top of their search results.

CMCSA — Comcast plans to unveil a streaming bundle, called “StreamSaver.” The company aims to bundle Peacock, Netflix, and Apple TV at a “vastly reduced price to anything in the market today,” according to CEO Brian Roberts. More information and its launch date are expected this month.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.