The Daily Breakdown looks at the week ahead, with Micron and Costco reporting earnings. Apple shares may be influenced by iPhone reports.

Monday’s TLDR

- Costco, Micron headline this week’s earnings

- The Fed’s preferred inflation report is on Friday

- Qualcomm reportedly approached Intel about a takeover

Weekly Outlook

It’s the last full trading week of September and Q3, which will officially come to an end after next Monday’s session. So far, the S&P 500 is on track to eke out a gain for the month, which would snap a four-year losing streak for September. With six sessions left in the month, this week will be key on how it shakes out.

Today we have a set of manufacturing and services PMI reports due up at 9:45 a.m. ET. These are considered leading indicators on the economy and provide information on the state of current business conditions.

On Tuesday, we’ll get a consumer confidence reading, along with earnings from KB Home. Investors will be listening to management’s commentary following the Fed’s first rate cut in more than four years.

On Wednesday, we’ll get earnings from Micron.

Then on Thursday, the final revision for the Q2 GDP report will be released at 8:30 a.m. ET. Estimates call for annualized growth of 3% — which is far from being in recession territory, by the way. After the close, Costco and BlackBerry report earnings.

Friday lacks any major earnings reports, but the PCE report will be released before the open. Remember, this is the Fed’s preferred inflation gauge. Moving forward, it’s important that we don’t see any big, sustained spikes in inflation as the Fed moves forward with its rate-cut plans.

Want to receive these insights straight to your inbox?

The setup — AAPL

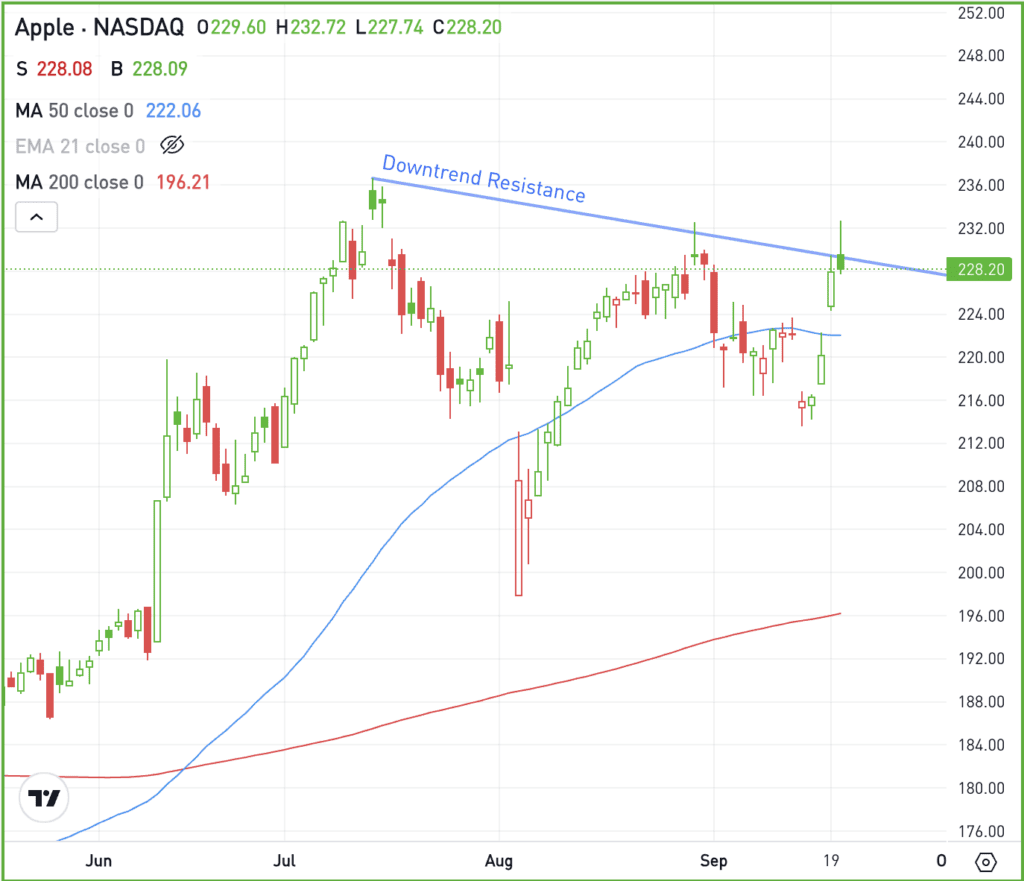

Apple is in focus as its new iPhone 16 goes on sale. It’s also one of just two Magnificent 7 holdings that are within 5% of their all-time high (the other being Meta).

AAPL continues to trade quite well, but on Friday, the stock fell over 2% in a matter of minutes going into the close. While that could be chalked up to some late-day shenanigans of a big options expiration, it also prevented the stock from breaking out.

Apple may need to consolidate in the $220s before making another breakout attempt. However, if shares clear $230, then they could keep rallying — potentially all the way back toward the all-time high near $237.

On the downside, some consolidation would make sense after last week’s big rally off the low near $214. However, if that low is challenged and fails to act as support, the selling pressure could escalate.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, make sure to use enough time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

INTC — Shares of Intel came to life on Friday afternoon after reports surfaced that Qualcomm approached the firm about a takeover. Shares of Intel popped on the news and are gaining steam again on Monday morning after Apollo Global Management has offered to make a multibillion-dollar investment in Intel.

FDX — Shares of FedEx tumbled on Friday, falling over 15% after the firm missed earnings and revenue expectations for its fiscal Q1. Earnings of $3.60 a share missed expectations of $4.77 a share, while revenue of $21.6 billion missed consensus estimates by more than $300 million.

NKE — Nike stock jumped to life on Friday, gaining almost 7% after the firm announced a leadership change. John Donahoe will step down from his role as president and Elliott Hill will take on the same roles as he looks to turn around Nike’s struggles.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.